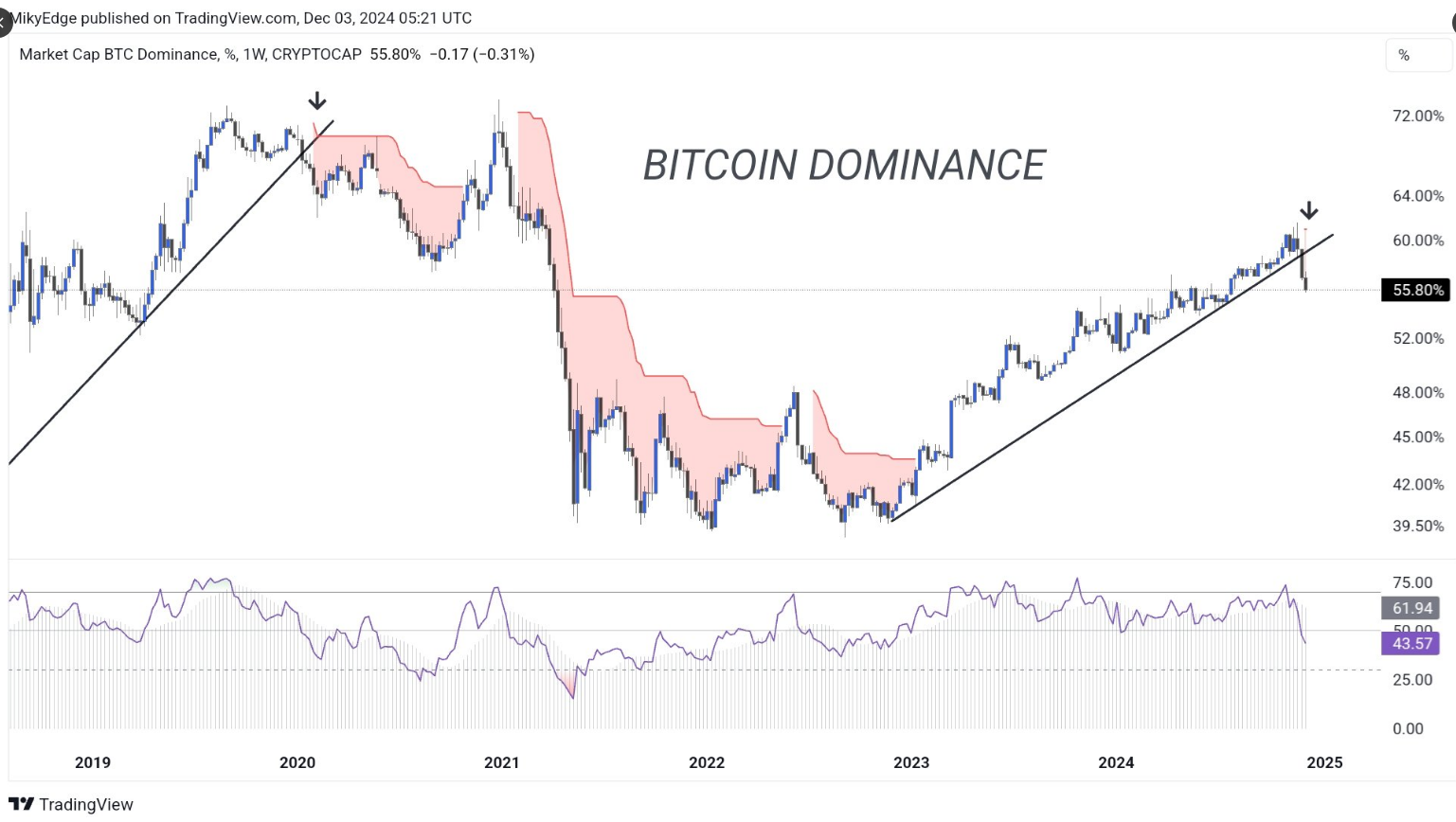

As a seasoned researcher who has navigated through multiple market cycles and witnessed the rise and fall of various assets, I find myself intrigued by the current shift in the crypto landscape, particularly with Bitcoin’s declining dominance. The flashing sell signal on the Bitcoin dominance, for the first time since 2020, is a clear indication that we might be entering an Altseason, as suggested by Mikybull Crypto.

The leading cryptocurrency, Bitcoin, is seeing a weakening grip on market dominance, causing shifts in the crypto industry. Analysts predict that other cryptocurrencies could rise in prominence as Bitcoin’s market share decreases to 55.80% and a sell signal appears for the first time since 2020. As Bitcoin struggles to maintain its price upward trend and drops below significant support lines, this pessimistic view is gaining popularity.

Bearish Signals Trigger Altseason Conjecture

In simpler terms, the RSI (Relative Strength Index) for Bitcoin’s power compared to other cryptocurrencies is currently sitting below its average value, which typically signals a bearish outlook. Historically, this kind of situation has often led to what we call “altseason,” a period when lesser-known cryptocurrencies tend to outperform Bitcoin. Financial analysts believe that investors may start moving their Bitcoin holdings into other altcoins, potentially causing volatility and creating new investment opportunities.

The sell signal has just flashed on the Bitcoin dominance for the first time since 2020

Let the real fun of #ALTSEASON begins

— Mikybull Crypto (@MikybullCrypto) December 3, 2024

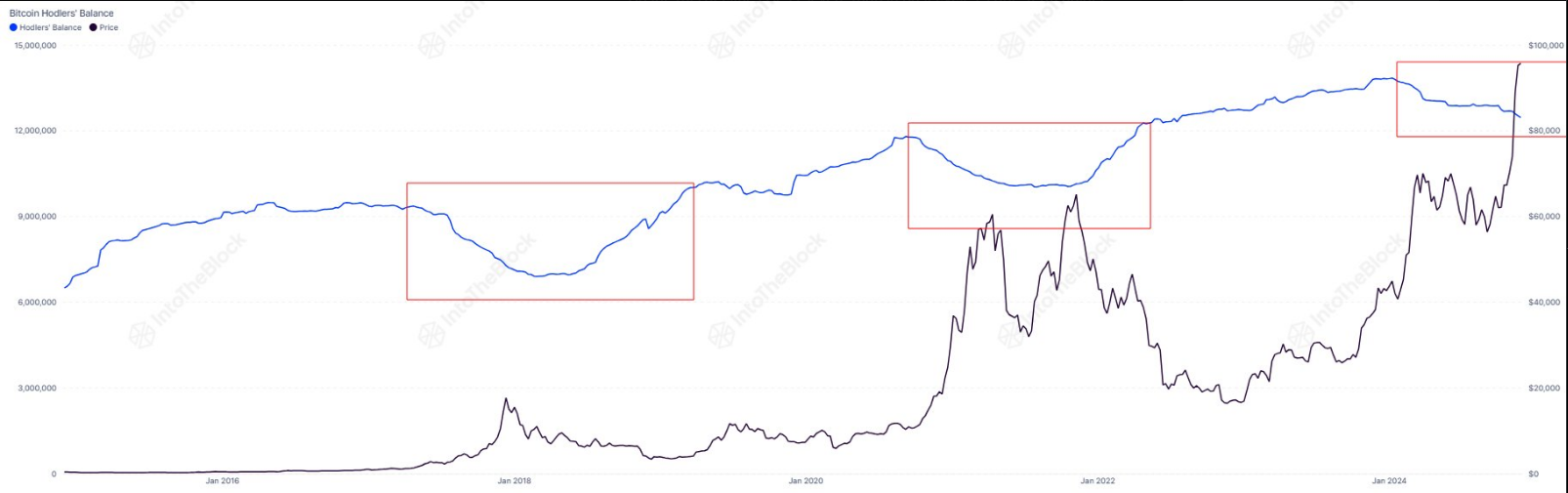

This trend matches a decrease in long-term Bitcoin holdings, indicating that it’s not just speculative. According to IntoTheBlock’s latest data, there are now approximately 12.45 million Bitcoins held in wallets for over 155 days, which is the lowest figure since mid-last year. This represents a nearly 10% drop, suggesting that some investors might be selling for profits or moving their funds to offline (cold) storage.

Bitcoin: Decline In Long-Term Holdings

As the targeted $100,000 mark for Alpha Coin approaches, Bitcoin’s price has been repeatedly thwarted by substantial resistance. Repeated attempts at $97,500 have resulted in significant declines, with Bitcoin dropping even further on Tuesday to approximately $93,940. This turbulence is mirrored by a noticeable decrease in long-term assets, making it challenging to predict market trends.

Over a period of time, individuals who have held onto Bitcoin for the long term have been progressively decreasing the amount they possess. Currently, they collectively own approximately 12.45 million Bitcoins, which is the smallest amount since July of last year.

Thus far, the current decline is less intense than previous periods. Contrasting with a drop of 15% last year and a more significant decrease of 26%, the balance held by long-term investors has fallen by 9.8%.

— IntoTheBlock (@intotheblock) December 3, 2024

Despite the current decrease in holdings being less substantial compared to drops seen in 2021 and 2017, it warrants notice for indicating a shift in investor sentiment. Some analysts suggest this behavior could be strategic realignment by seasoned investors, who are adjusting their portfolios to accommodate evolving market conditions.

Rare Bullish Signal Provides Hope Among Bearish Mood

Despite the pessimistic overtones, a seldom bullish signal offers a glimmer of optimism. Lately, the Spent Output Profit Ratio (SOPR) aligns with moving averages, suggesting that Bitcoin could surge in the upcoming one to two months. Such signs are scarce, appearing only once or twice during a bull market phase.

Despite the ongoing bearish trends, experts point out that these optimistic indicators offer potentially profitable opportunities for investors with a risk tolerance. As history suggests, following previous halving events, market analysts are also anticipating a potential downturn as we approach January 2025.

Currently, the waning influence and growing unpredictability of Bitcoin underscores the importance of a cautious yet tactical stance. Whether we’re looking at a resurgence of altcoins (Altseason) or another rise in Bitcoin, the coming months could significantly shape the future landscape of cryptocurrencies.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- How to Update PUBG Mobile on Android, iOS and PC

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-12-05 03:06