As an analyst with a background in blockchain and crypto market analysis, I’ve closely followed Algorand’s (ALGO) performance throughout the first half of 2024. The platform showed impressive growth during Q1, with notable gains in key metrics such as revenue, transactions, and DeFi TVL. These developments aligned with the broader upward trend observed in the crypto market ecosystem.

During Q1 this year, the Algorand blockchain platform experienced significant advancements in crucial performance indicators, mirroring the broader upswing in the cryptocurrency market sector.

As an analyst, I’ve observed a noteworthy expansion in the ecosystem of the Algorand blockchain during the second quarter. However, this progression has been accompanied by a 22% decline in its native token’s price since the beginning of Q2. This downturn has put the crucial support line to the test and sparked concerns regarding the future direction of ALGO.

Algorand Revenue Skyrockets

Based on Messari’s findings, Algorand experienced a remarkable 1,747% jump in revenue from one quarter to the next. This significant growth can be attributed to several factors: a notable 288% uptick in transactions, a substantial 50% hike in the average price during the period, and the Orange memecoin project’s contribution.

In Q1 2024, the amount of ALGO tokens committed to governance on the Algorand platform dropped by nearly 61% compared to the same quarter the previous year, and decreased by about 3% from the preceding quarter. This marked the lowest point in the past year for ALGO staking at approximately 1.7 billion tokens.

According to the report, the decrease in this downturn can be partly explained by the substantial reduction in rewards given for governance during each period. For instance, governance contributors were awarded 68.2 million ALGO in Q1 of 2023, but this number dropped drastically to just 21.9 million ALGO in Q1 of 2024.

As a crypto investor following the Algorand ecosystem, I’ve noticed a 6% decrease in the total market capitalization of stablecoins from the previous quarter, now sitting at around $73 million. Particularly noteworthy is Circle’s USDC, which saw an approximate 9% decline in market cap on this platform, down to approximately $50 million.

As a crypto investor, I’ve noticed that while the market caps of many stablecoins fluctuated significantly during the given quarter, Tether’s USDT remained relatively steady with no change in market cap from the previous quarter. However, USDT managed to regain 2% of the total stablecoin market share that it had lost earlier.

As a crypto investor, I’ve noticed that USDC’s market dominance on Algorand decreased by 3 percentage points quarter over quarter, now accounting for 68% of the total stablecoin market capitalization. On the other hand, USDT gained 2 percentage points, currently holding 30% of the stablecoin market share on this platform.

Algorand’s DeFi TVL And Market Cap Lead The Pack

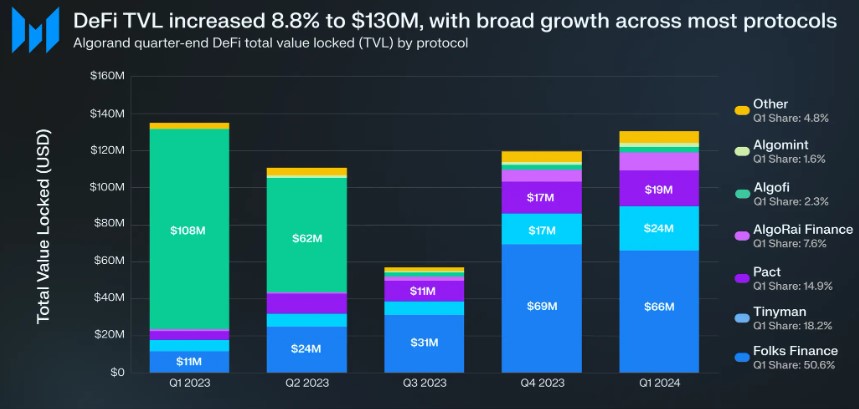

As a crypto investor, I’m thrilled to share that Algorand’s decentralized finance (DeFi) ecosystem has experienced impressive growth for the second quarter in a row. The total value locked (TVL) in this sector has increased by an impressive 9% compared to the previous quarter, reaching a significant milestone of $130 million.

Despite a decrease in TVL (Total Value Locked) for Algofi in Q3’23, the entire Decentralized Finance (DeFi) market on the Algorand platform recuperated and exceeded the values of Q2’23, approaching the heights attained in Q1’23.

In Q1, despite a 5% decrease in Total Value Locked quarter-over-quarter, Folks Finance remained the leading Decentralized Finance (DeFi) protocol on Algorand with more than half of the market share.

In the first quarter, both Pact and Tinyman made significant strides in the DeFi market, accounting for around 15% and 18% of the total value locked respectively. Amongst these, AlgoRai Finance recorded the most impressive growth, with a robust increase of over 50% in its TVL compared to the previous quarter.

In the first quarter, Algorand’s market capitalization experienced a 18% increase quarter over quarter, reaching a value of $2.1 billion. Simultaneously, the overall crypto market capitalization underwent substantial growth, approaching record highs of approximately $3 trillion – marking a 50% surge from the previous quarter.

As an analyst, I’d put it this way: In the current market scenario, Algorand saw a notable gain of 18% that added to its market capitalization. However, if we look back at the previous quarter, Algorand exhibited a remarkable surge of approximately 123%.

Testing Key Support Levels

The second quarter’s early phase has seen ALGO’s price trend predominantly downward. At present, its value is at $0.1935, and there’s a strong likelihood it may revisit the support level of $0.1904. Breaking through this support could trigger a continuation of the price drop, potentially reaching the next support at $0.1789.

As a crypto investor, I’ve noticed that the $0.1988 mark poses a formidable resistance level for ALGO coins. In the last 10 days, ALGO has made three attempts to break through this barrier, but hasn’t been successful yet.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-09 03:05