As a seasoned crypto investor who’s been through the bull runs and bear markets, I must say that the Q2 report for Algorand (ALGO) is a mixed bag of good news and not-so-good news. The network’s rapid transaction growth, reaching 2 billion transactions in just one year after hitting the first billion in four years, is undeniably impressive. This speaks volumes about the platform’s scalability and its potential for mass adoption.

In a recent analysis of Algorand (ALGO)’s second-quarter performance, data firm Messari pointed out several significant achievements by the blockchain network, including a new high in transaction volume as one of the standout accomplishments.

Rapid Network Growth

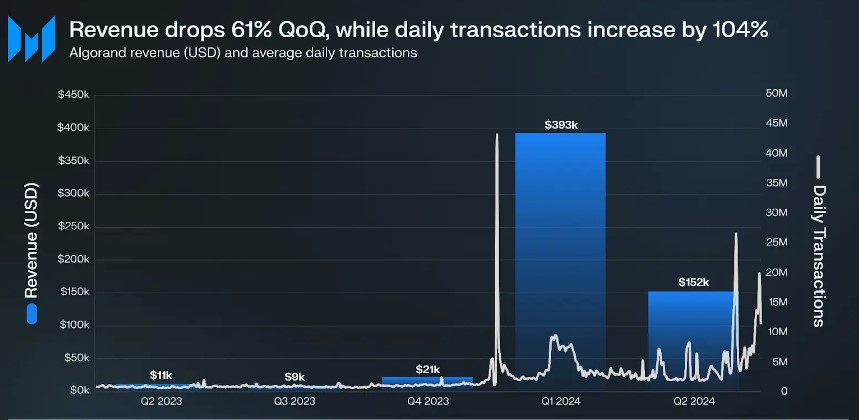

As a crypto investor, I noticed an impressive jump in Algorand’s daily average transactions, soaring by 104% to hit a staggering 4.7 million. On a more moderate scale, the total transactions saw a 6% increase quarter-over-quarter (QoQ), amounting to 425 million.

As an analyst, I’ve observed that although our transaction volume surged, Algorand’s earnings suffered a setback, plummeting by 61% to $152,000 during the recent quarter. The primary cause for this downturn, according to the report, was a substantial 46% decrease in the value of ALGO relative to the U.S. dollar compared to the previous quarter. Despite a notable 44% increase in the average transaction fee, the overall revenue in U.S. dollars still fell short.

The 61% drop in quarterly income can be attributed partly to a correction that took place after ALGO experienced an unprecedented 1,747% increase in Q1, which was primarily caused by a massive surge of 43 million transactions associated with the ORA memecoin initiative on a single day.

In comparison to the previous year, Algorand’s income experienced a significant surge of approximately 1,241%, rising from $11,000 to $152,000.

It’s worth noting that Algorand accomplished an impressive feat by processing 2 billion transactions over the course of the quarter, which underscores the expansion and acceptance of the network. Remarkably, it took the network four years to complete its first billion transactions, but the second billion was achieved in a single year.

Algorand Staking Drops To Lowest Level In A Year

In the second quarter of 2024, there was a 38% decrease in Algorand network staking compared to the same time the previous year, and a 6% drop compared to the preceding quarter. This decline reached its lowest point with approximately 1.6 billion ALGO tokens staked throughout the year. According to Messari’s analysis, this could potentially be attributed to fewer rewards being distributed during each governance period.

Over the past quarter, the amount of Algorand’s eligible supply that is being staked has dropped by approximately 4.7%, leaving it at a current level of 20.2%. Simultaneously, the circulating supply of Algorand’s ALGO token has risen by around 1.2%, reaching 8.2 billion units.

To wrap up, it’s worth noting that the quarter-over-quarter growth in the market capitalization of stablecoins on Algorand was approximately 15%, jumping from $73 million to $85 million. This significant rise can be attributed mainly to a 32% surge in Circle’s USDC stablecoin market cap, which now represents around 78% of the total stablecoin market cap on Algorand.

As a researcher, I’ve noticed an interesting shift in the stablecoin market share on Algorand. Tether’s USDT saw a significant decrease of approximately 22%, now accounting for about 21%. On the other hand, EURD’s market cap has maintained a steady 1% share within Algorand’s total stablecoin market cap.

ALGO Price Faces Make-Or-Break Moment

Over the past couple of weeks, the value of ALGO tokens has experienced substantial growth following a difficult Q2 for both its own price and the overall market. According to CoinGecko’s data, the token has witnessed a 14% price hike in just the last fortnight and an additional 12% increase within the past week.

Due to these circumstances, ALGO is now trading at $0.1357, slightly beneath its 200-day exponential moving average (EMA), denoted by the yellow line in the following ALGO/USDT daily chart. At present, this EMA serves as a barrier preventing the token from advancing.

In the upcoming days, it’s crucial to overcome this obstacle if we want the price to keep rising (uptrend) and also to set a short-term support level should there be a correction.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-23 12:05