As a seasoned analyst with over a decade of experience navigating the ever-evolving cryptocurrency landscape, I’ve seen my fair share of market trends and shifts. And let me tell you, Aave (AAVE) has consistently caught my eye as a standout performer in the decentralized finance sector.

As an analyst, I find myself drawn to the captivating rise of Aave (AAVE), the leading player in the decentralized finance (DeFi) lending sector. Since November 5, this standout contender has experienced a breathtaking surge of more than 200%, outperforming the broader market. Reaching its peak since 2021, Aave’s remarkable recovery serves as a testament to its resilience and unwavering influence within the DeFi ecosystem, reaffirming its position atop the decentralized finance landscape.

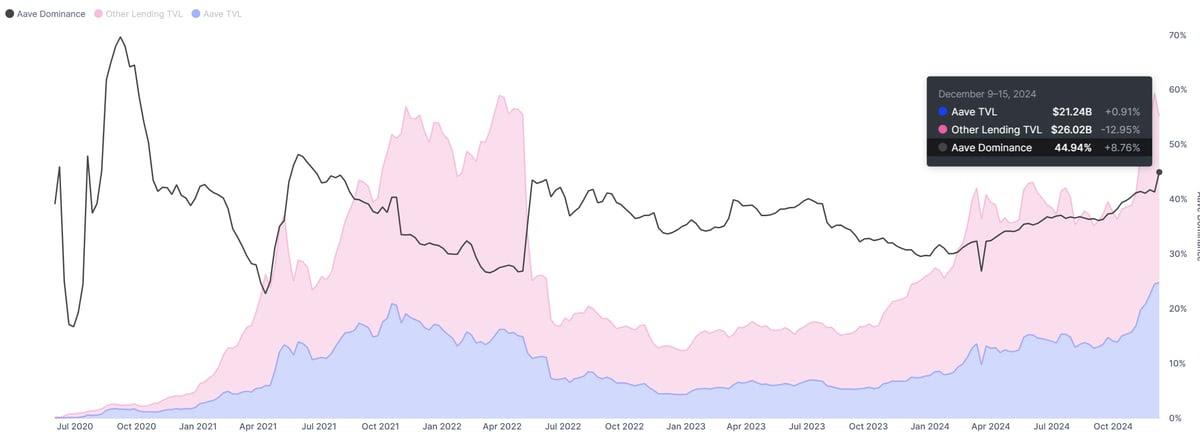

According to IntoTheBlock’s data, AAVE stands out as a leader in the lending sector, boasting a remarkable 45% market dominance. This makes it the preferred option for users looking for decentralized lending and borrowing platforms.

In informal language: Given that AAVE’s trading price is at record highs over several years and the on-chain data indicates intense activity, everyone – from investors to analysts – is watching its path closely. The real question is if this momentum will continue and push the price to never-before-seen peaks in the near future.

AAVE Keeps Growing

Over the past year, Aave (AAVE) has steadily expanded its influence, firmly establishing itself as a leading player in the Decentralized Finance (DeFi) lending market. Recognized for its forward-thinking strategy in building non-custodial liquidity pools, Aave empowers users to generate returns on both deposited and borrowed assets through adjustable interest rates. This flexible method has made it a preferred choice for decentralized lending and borrowing activities.

For a considerable amount of time, Aave has been leading the charge in DeFi innovation, consistently improving its platform and user experience. The proof of its achievement is clear in its dominance within the market. Data from IntoTheBlock underscores Aave’s unparalleled leadership, with an impressive 45% control over the DeFi lending sector.

This superiority is underscored even more by the immense Total Value Locked (TVL) of Aave, currently standing at approximately $21.2 billion. In fact, this figure is nearly as large as the combined TVL of all other lending platforms together.

These figures highlight Aave’s essential function within the Decentralized Finance (DeFi) landscape. With its well-established presence and strong infrastructure, it stands as a pivotal figure in the event of a potential DeFi revival. If the sector experiences renewed activity in the near future, Aave is expected to garner considerable interest from investors and traders alike.

Price Targets Fresh Supply Levels

Right now, Aave (AAVE) is being exchanged at $366, after hitting a high not seen in years at $396 mere hours ago. The cryptocurrency maintains its upward trend as it nears the crucial $420 barrier, a point that was last significant in September 2021. This level is considered a key area for Aave’s future price movements, with numerous analysts predicting a substantial response once it’s reached.

Should AAVE maintain its present position and continue its bullish trend, the likely next objective would be the $420 resistance area. Overcoming this barrier might suggest a prolongation of its multi-month surge, paving the way for additional ambitious price objectives as investor trust grows.

If the price doesn’t hold steady above the $320-$340 area, we might witness a more significant drop. Dropping below this region could cause the price to fall further, undoing some of its recent progress and temporarily reducing optimism among bullish investors.

At the moment, AAVE is holding firm, but traders are keeping a close eye on its movements around these crucial points. Whether it continues its climb or experiences a downturn hinges on its capacity to surpass and maintain itself above substantial barriers of resistance.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-15 15:04