As a seasoned analyst with a decade-long career in the financial markets, I must say that the current Bitcoin trend is indeed fascinating. Having witnessed the ebb and flow of various market cycles, I can confidently say that we are currently standing at a pivotal juncture.

Bitcoin is currently surging and staying above $60,000, marking an increase similar to that of September 13. Looking at the daily chart, it seems that buyers have re-entered the market. This optimism stems from the U.S. Federal Reserve’s (Fed) move to lower interest rates by 0.5% on September 18.

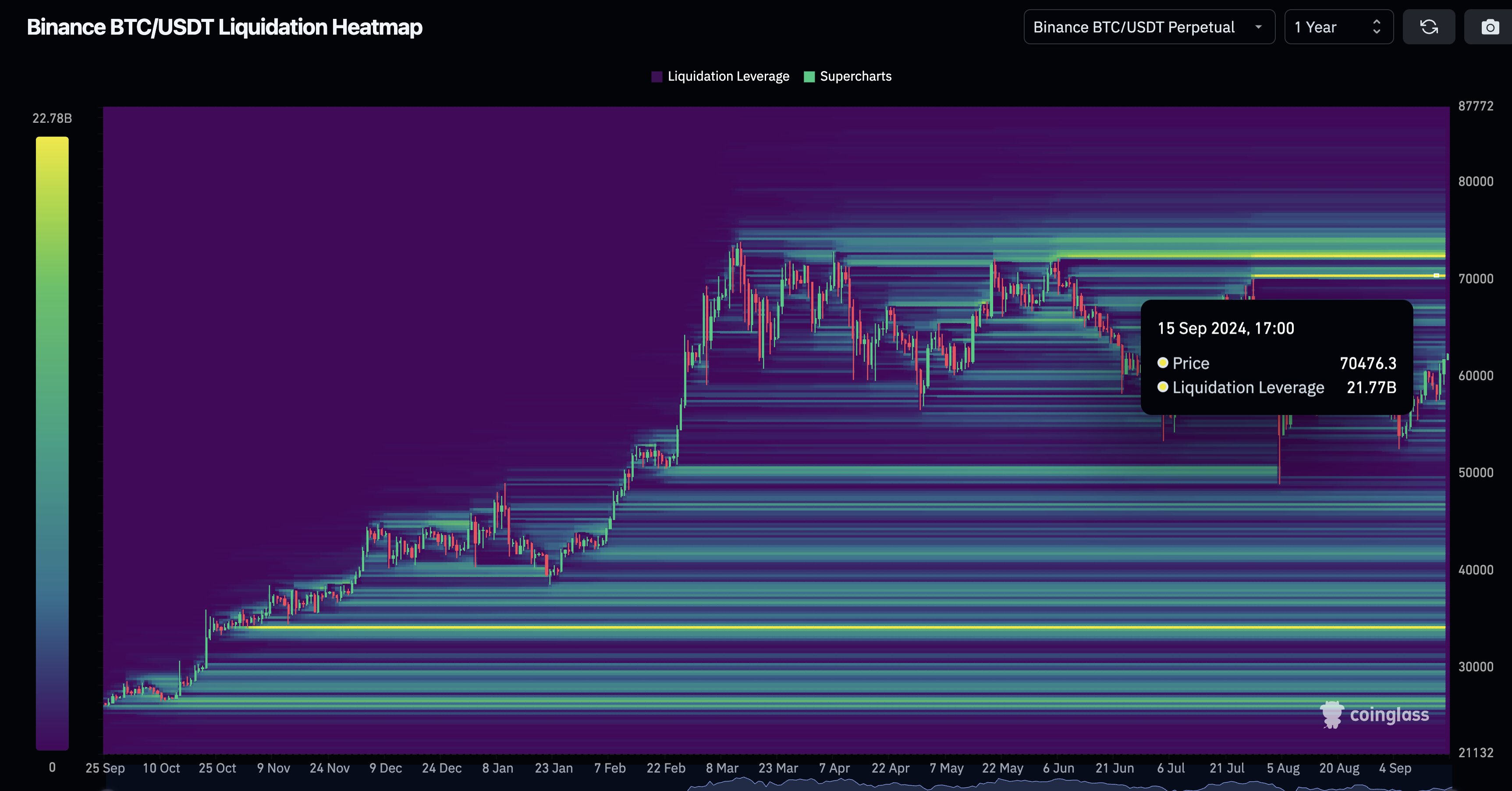

Over $21 Billion Of Shorts To Be Liquidated If Bitcoin Breaks $70,500

As more investors jump back into Bitcoin, noticing a significant increase in trading activity over the last day, an analyst at X has made an intriguing prediction: If the bulls maintain their momentum, a potential occurrence if Bitcoin surpasses $70,500, it could lead to the liquidation of approximately $21 billion worth of short positions on Binance perpetuals.

In the perpetual market, traders use leverage to capitalize on market fluctuations by either profiting from price increases (long positions) or decreases (short positions). Traders who anticipate rising prices are called longs, while those who bet on falling prices are referred to as shorts.

In both situations, these positions rely on borrowing money from the exchange. Here, the collateral or margin is used as a form of protection for the exchange. If the market moves unfavorably for the trader, they may be forced to sell this collateral.

To reach approximately a 11% growth from its current price of $70,500, Bitcoin must climb up to about $78,000. A significant resistance point lies near the $66,000 level, which corresponds to the highest points reached in August.

If the current level gets damaged, and there’s an increasing trade activity suggesting an uptrend, it’s plausible that this upward movement could serve as a strong foundation for bulls to counteract the heavy sell-off pressure around $70,000 and $72,000.

The $70,000 And $72,000 Resistance Zone Is Crucial For BTC Traders

Bitcoin enthusiasts have been finding it tough to push the price beyond $72,000 since the recent reevaluation in June. However, a robust and clear closing above the $70,000 mark could potentially initiate a ‘short squeeze’. Consequently, there’s a strong possibility that Bitcoin might challenge its previous peak at around $73,800 again, and even set new record highs.

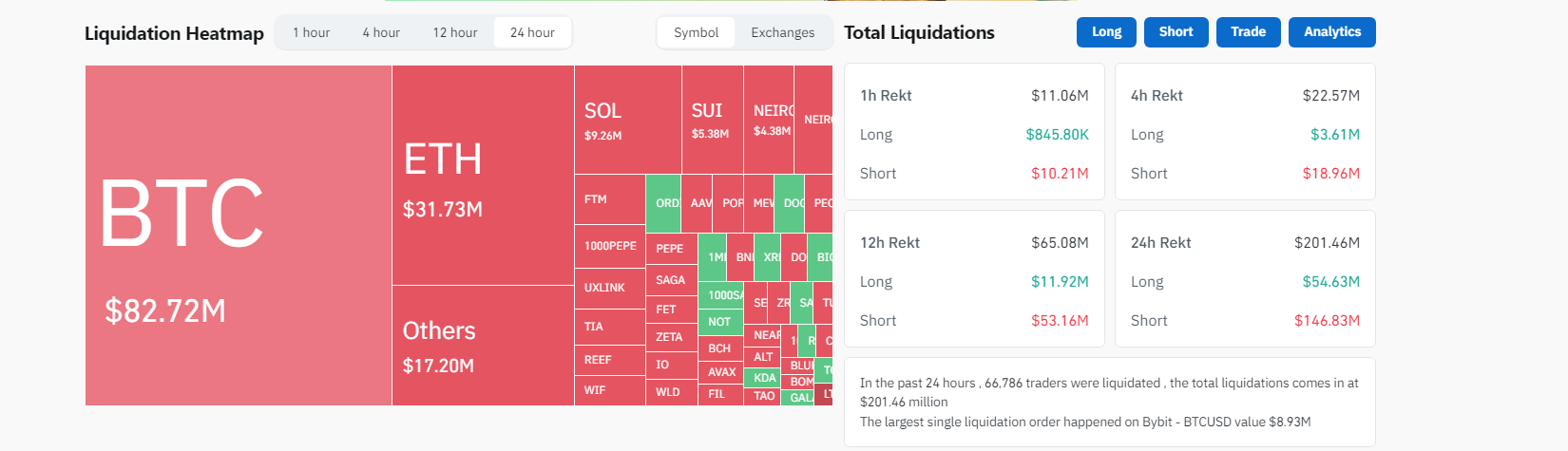

Yesterday’s crypto market was quite a rollercoaster ride for me as an investor. According to Coinglass data, a staggering $69 million in leveraged short positions were liquidated within the last 24 hours. That’s not all; $13 million worth of long positions also got squeezed out due to the market’s volatility. It just goes to show how quickly things can change in this dynamic world of crypto trading!

Approximately 66,000 individuals who trade cryptocurrencies had their positions terminated (liquidated) within the last day, and the largest Bitcoin-US Dollar (BTCUSD) leveraged position, valued at over $8.9 million, was shut down on Bybit – a platform for perpetual trading, during this timeframe.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-19 20:46