In a series of essays, cleverly titled “The Ugly” (oh, how very dramatic!), the former CEO of BitMEX, Mr. Arthur Hayes, ventures into the depths of crypto markets, offering insights as sharp as a diamond and as insightful as a Jane Austen novel (but with fewer balls and a bit more blockchain).

Imagine, if you will, a perilous climb up a mountain, where an unexpected avalanche at 1600 meters forces a swift change of course. Just as our intrepid climber must adapt to the treacherous terrain, Mr. Hayes warns of a looming storm in the financial world, fueled by central bank machinations, shrinking liquidity, and the most mischievous of all—the unpredictable meme coin craze. 🤫

While initially bullish on Bitcoin (you know, the digital gold everyone’s talking about), Mr. Hayes now predicts a rather unladylike pullback to $70,000 – $75,000 before a potential surge to $250,000 by year’s end. His revised outlook, like a fashionable new bonnet, is influenced by the shifting tides of central bank balance sheets, erratic banking credit rates, and the mischievous $TRUMP meme coin. (Oh, how the times do change!)

“History doesn’t repeat itself, but it does rhyme,” muses Mr. Hayes, channeling the wisdom of the ages (and perhaps a bit of the poet Robert Frost). “I don’t believe this bull cycle is over, but I think we are more likely to go down to $70,000 to $75,000 Bitcoin and then rise to $250k by the end of the year.”

Exploding Debt, Rising Yields: A Recipe for Disaster?

The US Treasury debt, a colossal figure that rivals the size of a whale, has ballooned to $36.22 trillion, doubling from $16.70 trillion in 2019. Mr. Hayes, ever the concerned chaperone, warns of a potential financial crisis should the 10-year treasury yield reach 5-6%. Such an increase could throw the delicate balance of the financial world into disarray, unsettling institutions that have become overly reliant on treasuries. Imagine, if you will, a grand ball where the very foundation of the ballroom floor begins to crumble!

To add to the chaos, traditional buyers of treasuries, including the Federal Reserve and major banks, have retreated, leaving the market in the hands of relative value hedge funds (sounds rather risky, don’t you think?). But with rising repo yields and stricter margin requirements, even their future is uncertain, threatening the very stability of the treasury market.

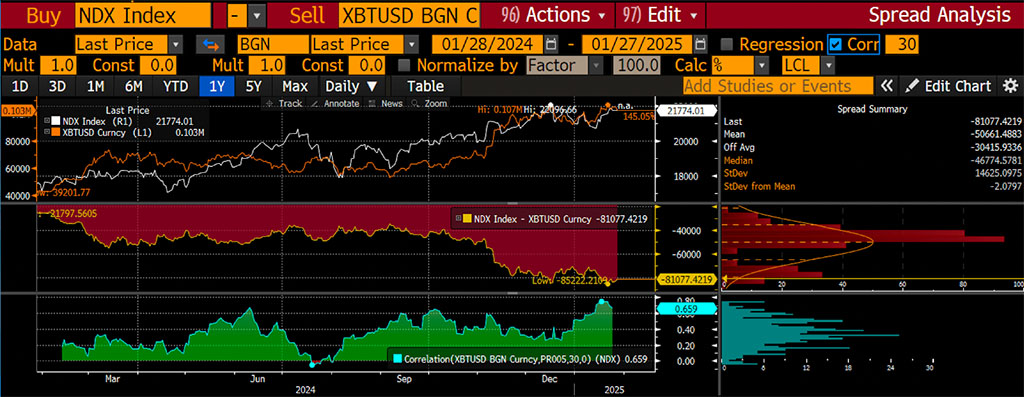

Bitcoin, which once seemed independent of the fickle whims of traditional markets, is now showing a rather embarrassing connection to the Nasdaq 100. The surge in 10-year treasury yields and the ever-present spectre of inflation have pushed the correlation between Bitcoin and the Nasdaq to a startlingly high level. It seems Bitcoin is behaving like a high-duration bond, a most unusual dance partner indeed! As interest rates rise, Mr. Hayes predicts further declines in Bitcoin’s price, a prospect that would surely cause a flurry of whispers among the crypto crowd.

“In the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term,” Mr. Hayes explains. “This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield.”

In the face of this market turmoil, Mr. Hayes suggests a more conservative approach, a strategy perhaps best described as “hunkering down.” He recommends reducing exposure to cryptocurrencies while holding staked $USDe with yields of 10-20%, a tactic that offers a glimmer of hope in these uncertain times.

Source: Cryptohayes/Substack

A Global Liquidity Crisis: A Financial Symphony of

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-01-28 17:26