As a seasoned cryptocurrency researcher with years of market analysis under my belt, I find myself standing at the precipice of yet another intriguing phase in Bitcoin‘s journey. The current correction looming over the market has brought back memories of past bear and bull cycles, reminding me that volatility is an inherent part of this space.

Bitcoin is navigating turbulent waters as its price continues to slide, searching for a stable support level amid growing uncertainty. The current downward momentum has sparked concerns among investors and analysts, with many questioning whether Bitcoin has reached its cycle top. Sentiment in the market has shifted dramatically, with fear replacing the once euphoric optimism that drove the cryptocurrency to recent highs.

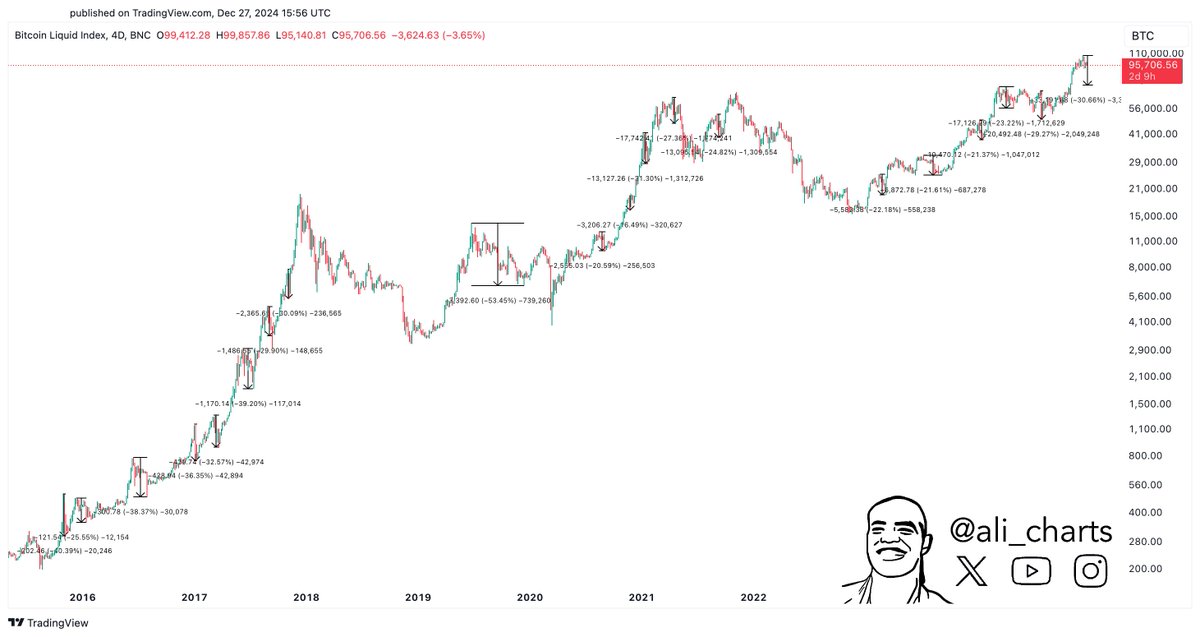

Despite the unease, crypto analyst Ali Martinez offers a more optimistic perspective on the situation. In a recent analysis shared on X, Martinez suggested that a 20% to 30% correction could actually be the most bullish outcome for Bitcoin at this stage. He highlights how such pullbacks have historically set the stage for stronger rallies by shaking out weaker hands and allowing the market to reset before resuming its upward trajectory.

In the upcoming weeks, we’ll closely watch crucial support levels as Bitcoin’s price trend seems precariously close to a possible decline. Will this dip confirm worries about a peak in its cycle, or will it lead instead to a strong rebound that sets the stage for further growth? The answer to this question could significantly influence the story of Bitcoin, the foremost cryptocurrency.

Bitcoin Correction Looms

As a researcher studying the cryptocurrency market, I find myself on the alert as Bitcoin seems poised to undergo a significant correction. The psychological barrier at $92,000 appears to be of particular importance, and there is mounting worry that if the price dips below this level—even reaching as low as $90,000—it could ignite a wave of selling that pushes Bitcoin down into the sub-$80,000 range. This apprehension has cast a somber tone over the optimistic storyline that has been associated with Bitcoin, as many are now preparing for potential unfavorable developments.

From my perspective as a researcher, while some may perceive this potential correction negatively, Martinez presents an opposing viewpoint. He proposes that a correction ranging from 20% to 30% could actually be the most optimistic scenario for Bitcoin within a broader bullish trend.

Martinez displayed an impressive graph highlighting every instance when Bitcoin’s price dropped by more than 20% in previous bull runs. His analysis suggests that these downturns functioned as market resets, pushing out less committed investors and creating a smoother path for future price increases.

Martinez underscores that adjustments are an essential and beneficial element of Bitcoin’s price fluctuations, particularly during bullish trends. These corrections help the market readjust, paving the way for continued strong growth. If Bitcoin undergoes a substantial decline, it might signal the start of a stronger and longer-lasting uptrend in the forthcoming months.

BTC Testing ‘The Last Line Of Defense’

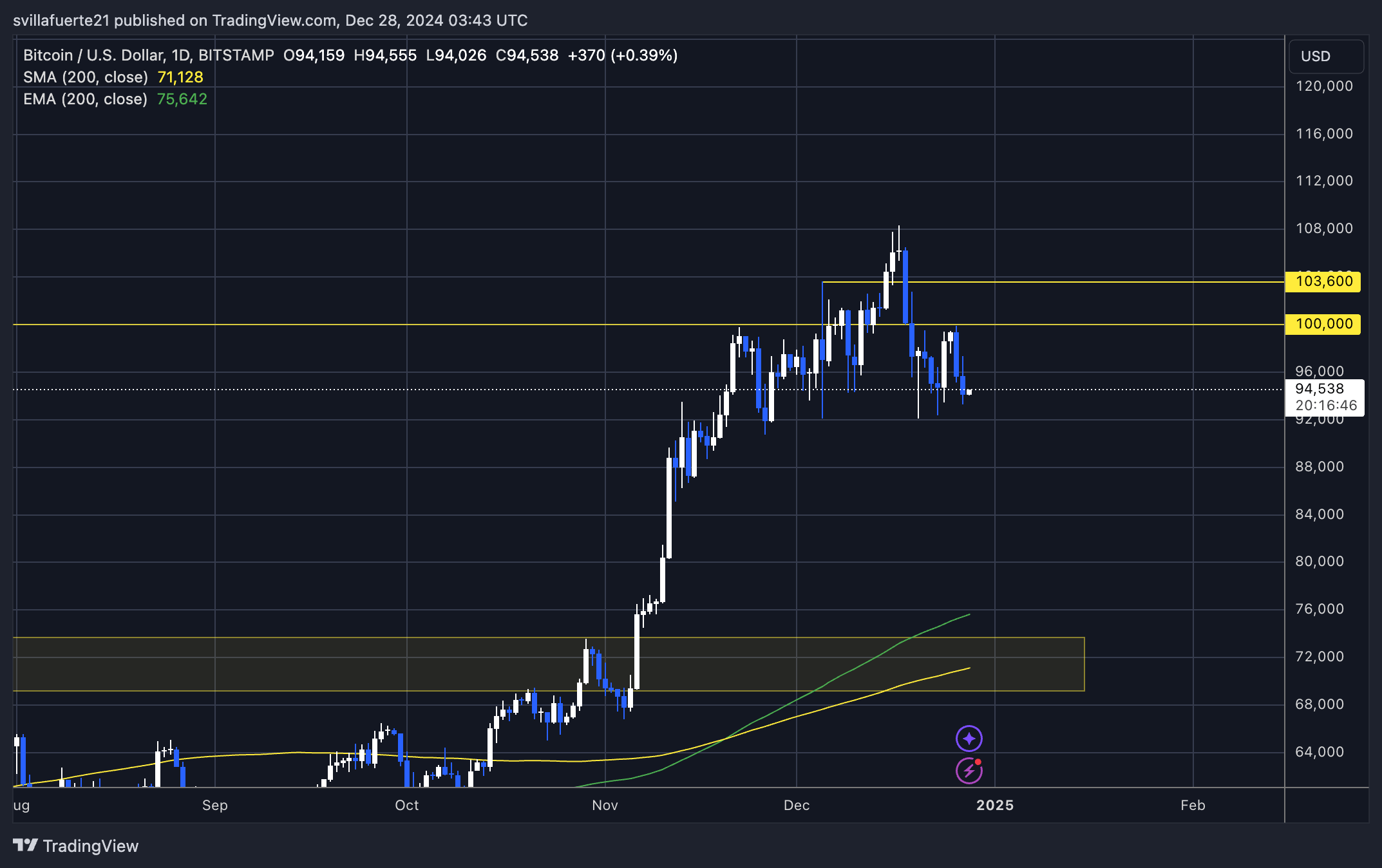

At the moment, Bitcoin is being bought and sold at approximately $94,500. It’s facing continuous selling pressure and negative price trends are prevailing. In the last few days, there has been a noticeable change in market sentiment as concerns about a more severe correction have become widespread among experts and investors. Some predict that if Bitcoin falls below the $92,000 level, it might initiate a rapid downward trend.

The crucial point for Bitcoin’s continued bullish trend seems to be around the $90,000 mark. This significant level acts as both a psychological and technical hurdle, potentially shaping its future direction over the coming weeks. Should Bitcoin successfully maintain its position above $90K, analysts predict a robust rebound that could revive bullish sentiments, propelling it towards past highs once more.

If Bitcoin drops significantly below the $90,000 point, it might trigger more sell-offs, potentially pushing the price down to around $75,000. This would represent a substantial decrease from its current peak levels.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

2024-12-28 17:10