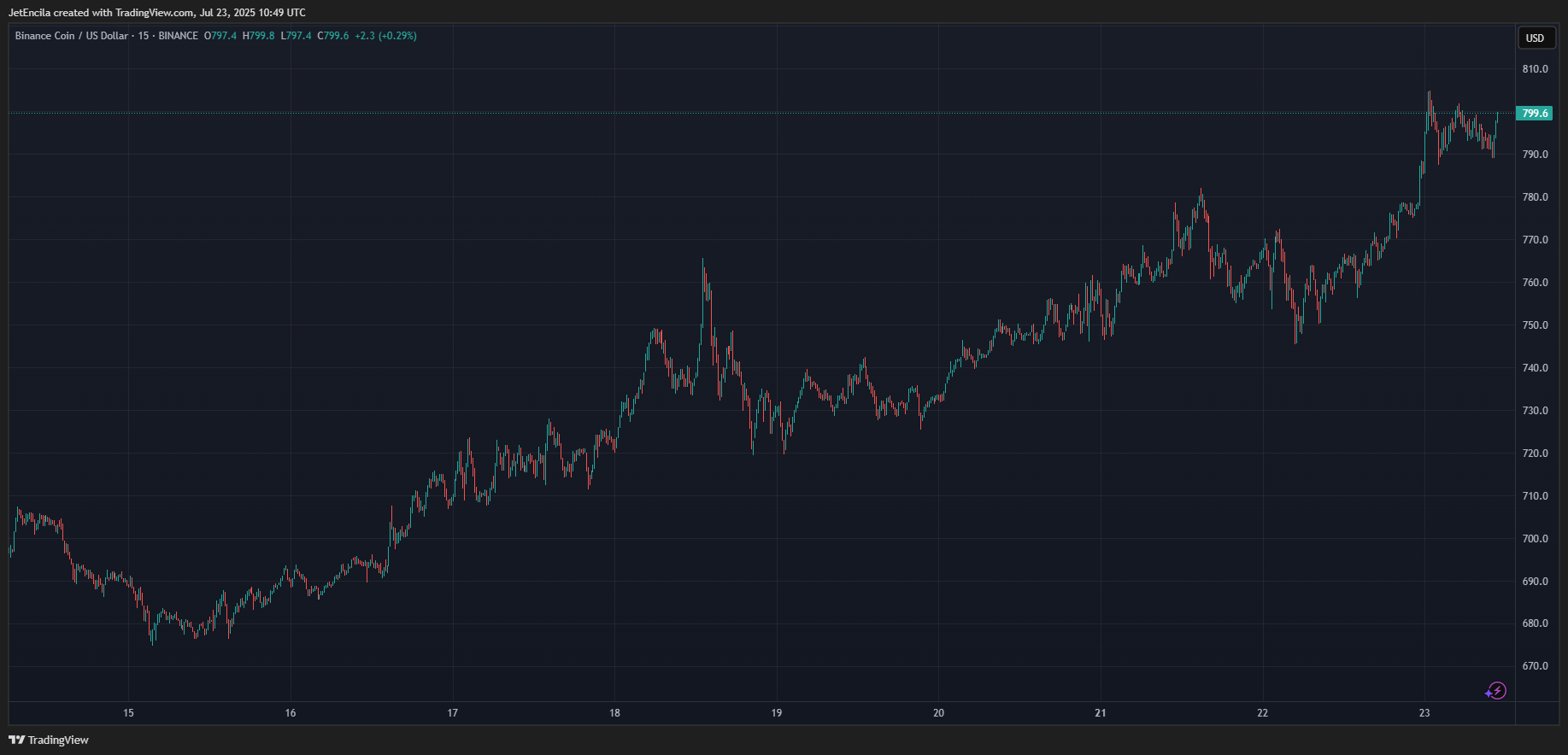

One gathers BNB, that curious digital bauble associated with the BNB Chain – a name which sounds suspiciously like a minor Balkan principality – has, in the breathless parlance of the modern age, “crossed the $800 level.” A new “all-time high” of $801, no less! The sheer vulgarity of it all. As if mere numbers could convey meaning.

Apparently, this impertinence follows a 5% uptick over the last 24 hours, and a positively vulgar 13% gain in the week preceding. This has inflated BNB’s “market capitalization” to over $110 billion, placing it fifth amongst its kind. One suspects the others are merely awaiting their turn for this preposterous dance.

A Feverish Excitement

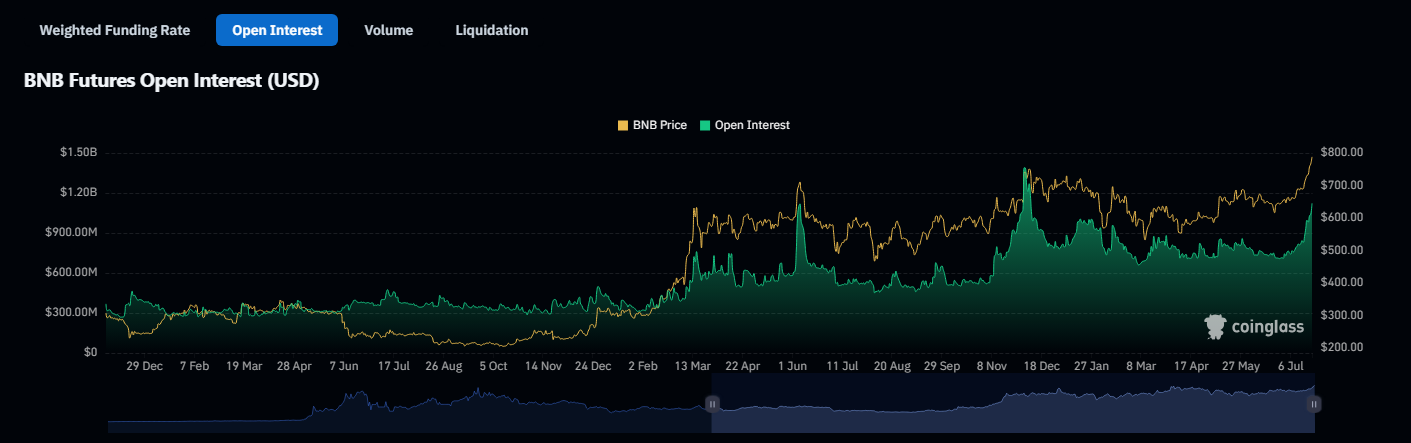

Trading volume, naturally, is “strongly increased.” One observes a rise of over 40% to a trifling $3 billion. “Derivatives volume” – a phrase that suggests a rather unsavoury complexity – has surged by 31% to $2.18 billion. And “open interest”… well, one prefers not to enquire too deeply. Suffice to say, a great deal of perfectly good money appears to be chasing this digital phantom. It’s all frightfully exciting for those with a penchant for speculation, though the rest of us might rather stick to a decent claret.

The “bullish momentum,” as they call it, is apparently rather strong. Weeks of an “uptrend” (a rather optimistic term, given the inherent instability of these things) culminating in a “breakout.” One imagines a chorus of delighted investors, oblivious to the inevitable reckoning. And, of course, the Relative Strength Index is “well into overbought conditions” at 87.50. Which, one translates, means it’s about to plummet. But why allow mere logic to intrude upon a perfectly good bubble?

Still, it remains “well above its 20-day simple moving average.” One is assured that “price is higher with good volume.” A combination, one is told, that “confirms trend strength.” One suspects the trend strength is merely that of collective delusion.

A Chinese Investor Takes an Interest

It appears a company called Nano Labs – a name that evokes images of tiny robots – has purchased $90 million worth of BNB. Founded, rather mysteriously, in China. They intend to hold it as a “strategic reserve asset.” One shudders to think what strategic purpose it might serve. Perhaps to fund further excursions into the world of digital ephemera. They are also, apparently, going to invest in companies dedicated to the BNB “ecosystem”. An ecosystem… how quaint.

This “long-term commitment” is meant to inspire “confidence” in the retail investor. One imagines the retail investor is rather more skeptical. But then, one is frequently disappointed in the common sense of the masses.

Amidst all the fuss, there are, it seems, “warning signs.” BNB is now “trading above the top Bollinger Band.” A distinctly alarming phrase, one gathers. The whole thing looks, in short, rather stretched. And therefore, almost certainly primed for a dramatic, and entirely predictable, correction. 🍷

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2025-07-23 22:35