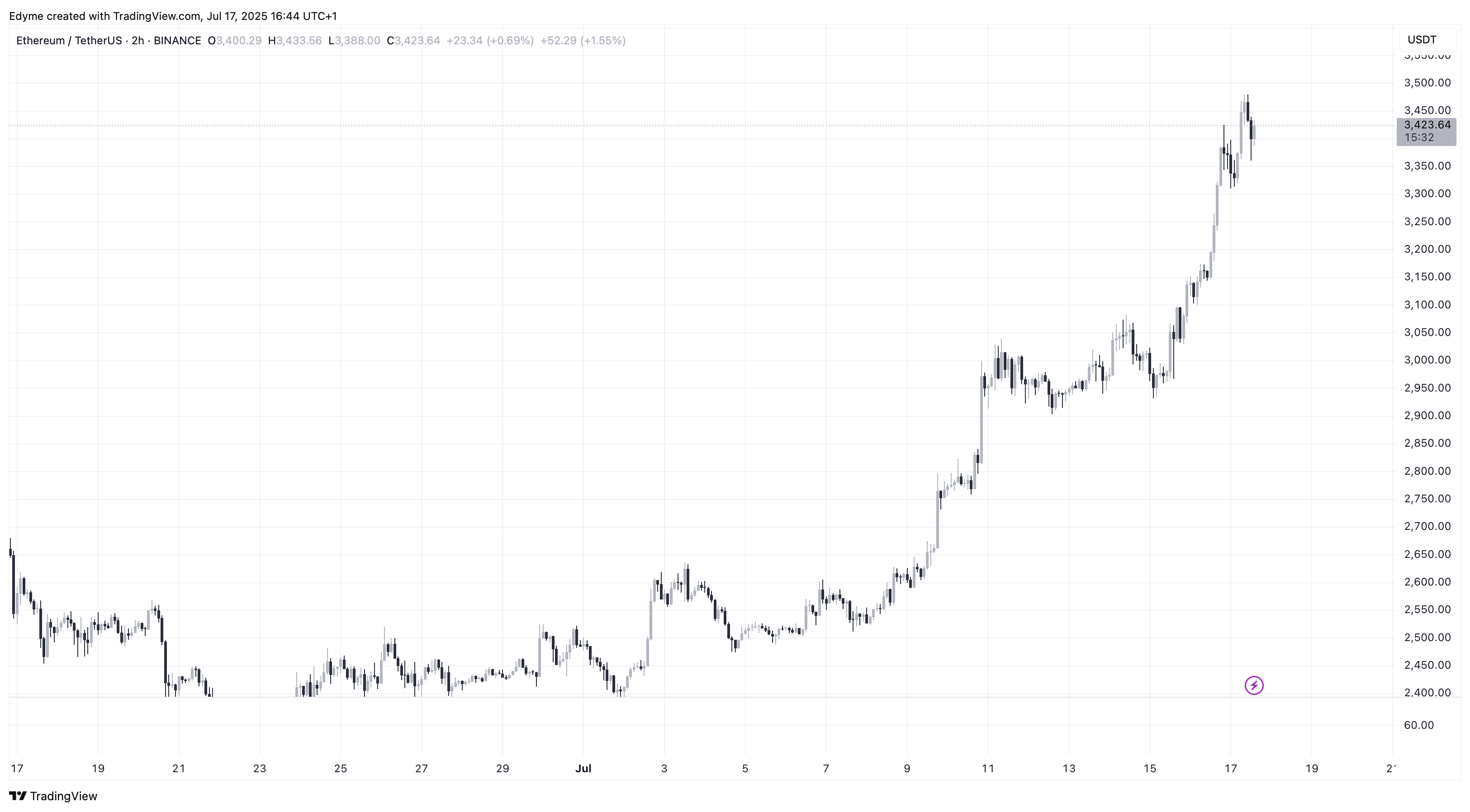

Well, well, well! Look who’s back in style—Ethereum! I mean, at this rate, it’s like the asset is strutting down the runway with a price tag of around $3,420! 💃 With a daily gain of 7.7% and a weekly surge that’s more dramatic than my last high school reunion (over 23%, if you’re keeping score), it’s safe to say that traders are feeling a little tingle of excitement, or maybe that’s just the nachos talking.

Now, after a delightful breakout above $3,000, traders everywhere are celebrating like they just found out the coffee machine is working again. This has reignited optimism faster than a double espresso on a Monday morning in the derivatives and spot markets. ☕️

Thanks to our friends over at CryptoQuant, we get to dive into the juiciness of Ethereum’s price action—spoiler alert: Binance is the shining hero (or perhaps the mischievous villain?), driving a lot of the excitement. 🔍

Short Liquidations: The Drama Unfolds!

Oh, Darkfost (not to be confused with DarkVader, though we’ve all been there), gives us the scoop about how short liquidations turned the market into a theater of the absurd. It’s the ultimate plot twist! The recent uptick in price coincides with a *major* shift in the derivatives market—like switching from popcorn to kale chips. 🍿➡️🥬

Like an amateur detective, a deeper dive into the exchange flows shows that Ethereum is positioning itself like a cat in a sunbeam, ready to reclaim its glory days. The indicators say YES, while the haters are probably furiously updating their resumes. 😎

So, after a five-month ‘let’s take a nap’ phase (that started back in December—rude, but okay), the market took care of some business and cleaned house. I guess you could say it was the “necessary chaos” that everyone raves about at trendy brunch spots.🌪️

Now that the shorts are being liquidated like they’re going out of style, Ethereum is bulking up its gains and looking like the star quarterback at prom. Darkfost believes these short liquidations are like adding extra cheese to your pizza: they just make everything better! 🍕

Liquidation data suggests pumps of $32 million and $35 million—basically, a trader’s worst nightmare. Remember, folks, when the market moves like a ‘90s boy band reunion tour, make sure you’re on the right side of it!

If this keeps up, Ethereum might just be eyeing its all-time high with the kind of determination usually reserved for a gym selfie. Plus, with fancy new spot Ethereum ETFs and institutions hopping on the ETH love train, we could be headed for quite the breakout. 🚀

Taker Volume Turns Up the Heat on Binance

Now, Crazzyblockk (not a typo) brings us the deets on taker-side activity, and let me tell you—it’s sending some serious signals! The ETH Taker Buy/Sell Ratio just crossed the magical 1.00 mark. Can we get a round of applause for stronger buy-side pressure? 👏

With a lovely spike in price volatility hitting 261.5, Ethereum is reminding us all why it’s everyone’s favorite roller coaster. 🎢

Historically, this little dance between rising buy-side volume and volatility means more exciting price rallies. It’s like a party you didn’t plan for, but everyone shows up anyway. And let’s just say, that divergence between long and short volumes is the exciting subplot we didn’t even know we needed!

So grab your popcorn and keep those eyes peeled on Binance; it looks like Ethereum is ready for its next dramatic episode! 📈💥

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Capcom Spotlight livestream announced for next week

2025-07-18 09:11