So, yesterday, US Ethereum spot ETFs hit a new high. Can you believe this? Like, I’m sitting there, minding my own business, and suddenly, Ether’s price is jumping because big and small funds are pouring in fresh money. What is this, a comedy show?

Record Inflows Break Previous Highs

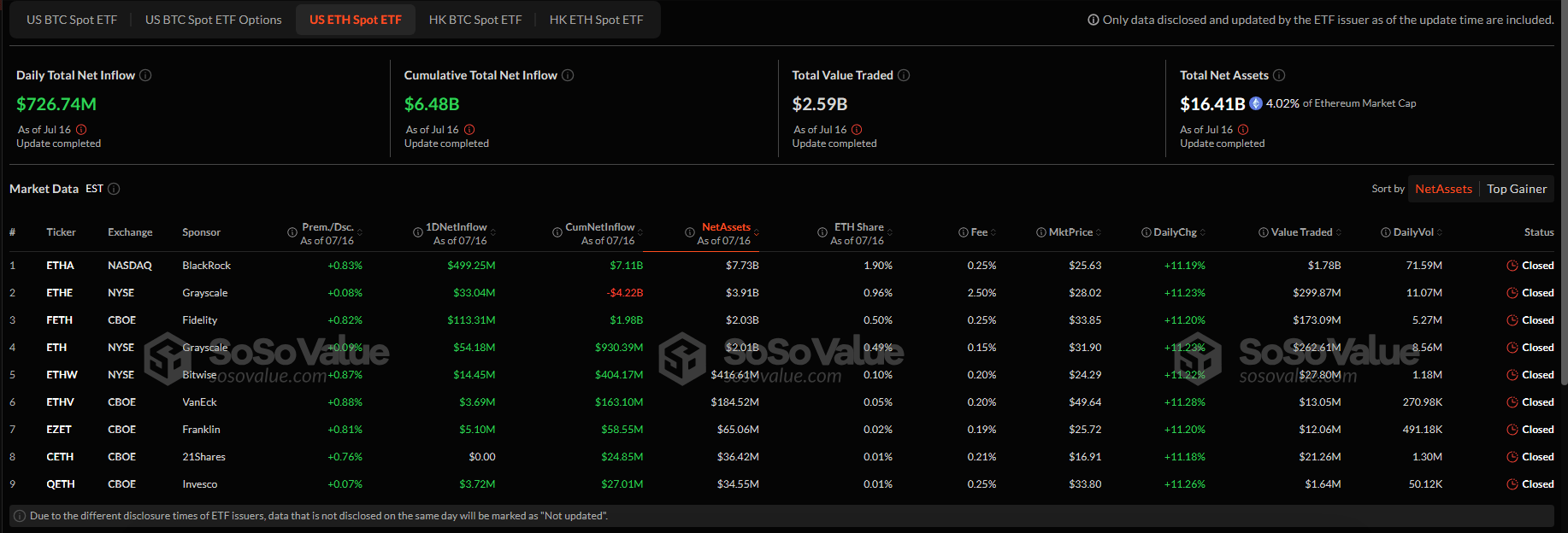

According to the latest data, US Ethereum spot ETFs saw a single-day inflow of $727 million yesterday. That’s like, more than the last record of $428 million set on December 5. I mean, what are these people thinking? Are they just throwing money at the wall to see what sticks?

The nine funds tracked have now attracted new money every day for eight straight sessions before this surge. Eight days! That’s like a week and a day. Based on reports, this eight-day streak set the stage for what became the biggest one-day haul in the ETFs’ history. Wow, just wow. 🤯

Big Names Lead The Charge

BlackRock’s iShares Ethereum Trust (ETHA) drew nearly $500 million on Wednesday, pushing its total net inflow to $7.11 billion since launch. The Fidelity Ethereum Fund (FETH) wasn’t far behind, adding $113 million and lifting its cumulative haul to almost $2 billion. I mean, these guys are like the A-list of ETFs. 🌟

Other vehicles chipped in too: Grayscale’s Ethereum Trust (ETHE) hauled in $54 million, the Grayscale Mini Trust added $33 million, and Bitwise’s ETHW ETF contributed $14.5 million. Based on those figures, it’s clear that both institutions and everyday investors are jumping on board across multiple brands. Like, it’s a party, and everyone’s invited. 🎉

ETF Leaders Dominate New Money

Nate Geraci, president of ETF Stores, noted on social media that these ETFs have gathered close to $2 billion over the past five trading days. That pace of inflows shows the growing comfort level big players have with owning Ether through a familiar wrapper. Retail investors often follow institutional moves, so these numbers could spark even more demand. It’s like a domino effect, but with money. 🪙

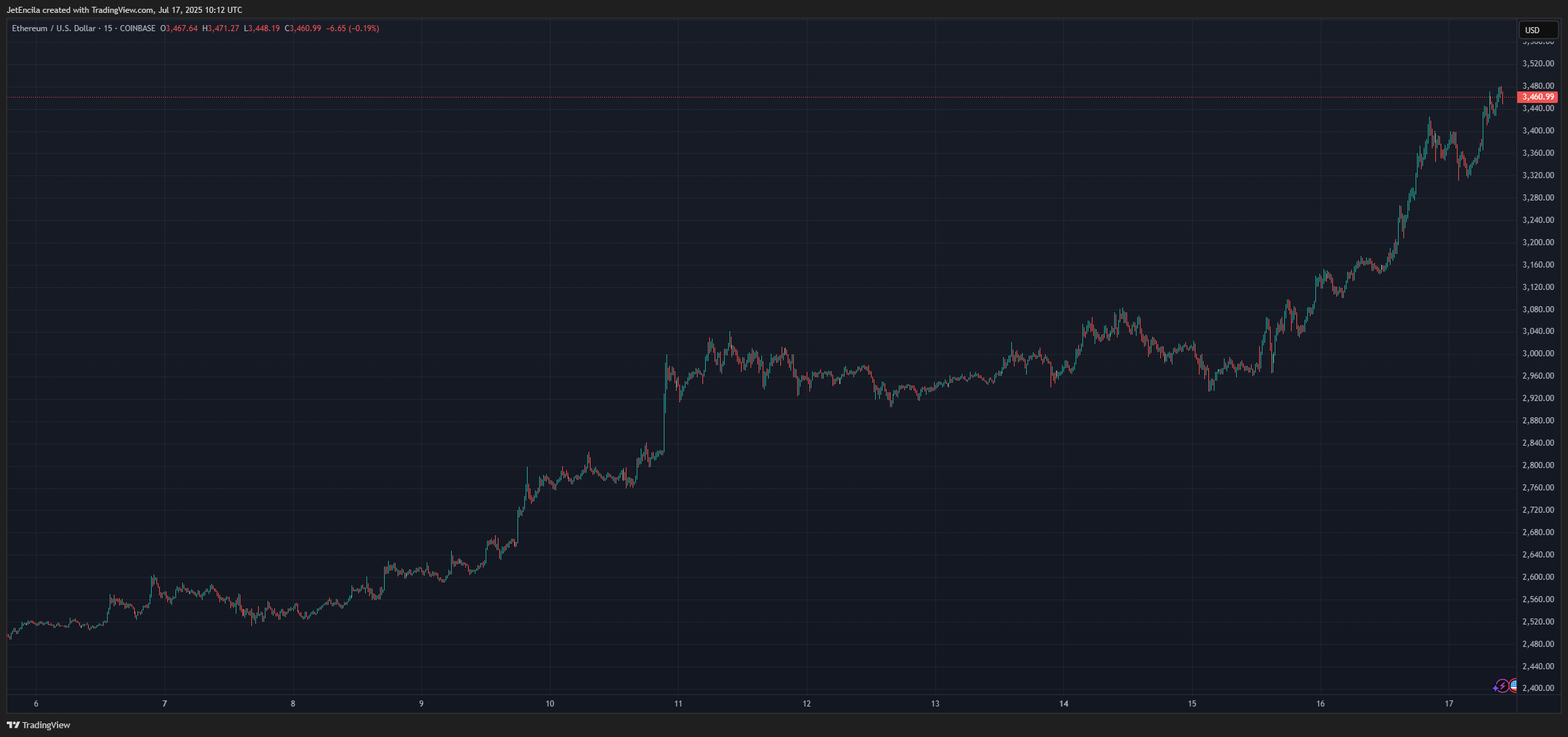

Ether’s price has climbed 9% in the last 24 hours, trading at $3,430 at the time of writing. According to market data, that level hasn’t been seen since January 31, when Ether last topped $3,370 before plunging below $1,500. The sharp rise underlines how sensitive Ether’s price can be to big capital flows into spot ETFs. It’s like a rollercoaster, but with more money. 🚀

Some analysts are now eyeing $4,000 as the next milestone for Ether. The altcoin’s renewed momentum could lift other altcoins too. If top-10 tokens follow Ether’s lead, the broader crypto market may ride this wave higher. But, you know, strong inflows alone won’t guarantee sustained gains. Big inflows can reverse quickly if sentiment shifts or if traders chase profits too aggressively. But for now, the scene is bullish. If inflows keep rolling in and the price holds above $3,300, the push toward $4,000 might not be far off. It’s like a game of chicken, but with Ethereum. 🐔

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- All Elemental Progenitors in Warframe

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- What Happened to Kyle Pitts? NFL Injury Update

- Justin Bieber ‘Anger Issues’ Confession Explained

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

2025-07-18 00:41