Alright, gather ’round, folks! This week, Stellar Lumens (that’s XLM to you insiders) hit $0.20—a “critical support” level. In Brooklyn, we’d call this a shanda! Thirty percent—thirty!—below the peak in May and down 60% for the year. If this was the stock market, my uncle Murray would be hiding in his bathroom with a brisket for comfort. Oy vey!

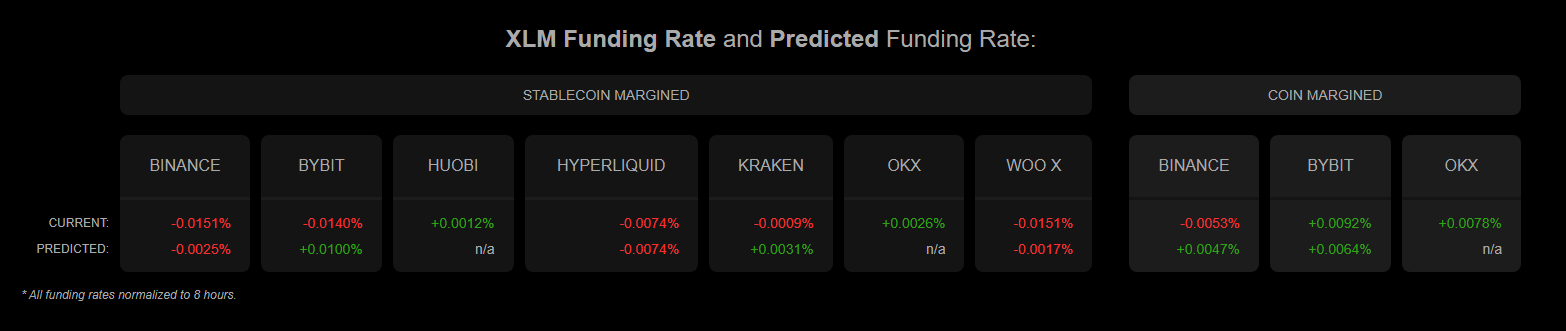

Market bears are swarming like a nosy mother-in-law: reports say funding rates have nosedived into negative territory since June. If support breaks, the rumors are XLM could tumble down to $0.15. That’s a 35% drop—or as they call it in crypto, “Tuesday.”

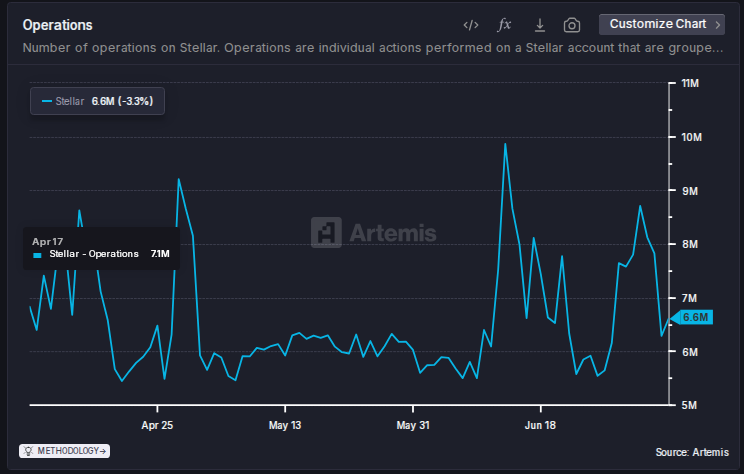

Network Activity is Up! (But Price, Not So Much…)

Meanwhile, over on the Stellar network, business is booming: Artemis says 197 million operations happened in June. That’s more activity than my cousin’s wedding buffet. Stablecoin supply is at a record $667 million. Mazel tov to them!

More good news nobody cares about: tokenized real-world assets hit $487 million, thanks to wild new innovations like the Franklin OnChain US Government Money Market Fund. The ecosystem is hot—like a pastrami sandwich straight from Katz’s. But the market? As cold as my Aunt Ruth’s stare when you’re late for dinner.

Funding Rates: Down, Down, Even Lower!

If you’re holding onto XLM futures—first of all, why?—the funding rates have been negative almost every day since May. Short traders are paying long traders just to stay in the game. The last time I paid for something that pointless was my gym membership.

Funding rates hit the lowest since June 30. In crypto speak, that’s like your landlord knocking while you’re already behind on rent. Data from Coinalyze shows this misery is hitting all the major exchanges, mostly for stablecoin-margined pairs. The shorts are laughing, the longs are schvitzing.

Nansen reports a spike in transactions to 182 million in a week and active addresses up 10% to 146,700. Look at Stellar work those numbers harder than a Borscht Belt comedian!

Sadly, the price refuses to laugh. XLM fell under its 50-day and 100-day Exponential Moving Averages—don’t worry, nobody at my high school reunion knows what those are either. Momentum is on the side of the short sellers and my chiropractor (from all this neck craning at red charts).

Some optimists whisper, “Maybe a short squeeze will save us!” Hey—if my Uncle Saul can win at bingo, anything’s possible, right?

The daily chart is flashing a descending triangle pattern—translation: a big, fat warning sign. $0.21 is the support line, like April’s lows when every altcoin had a panic attack. Now we’re below the big, tough 60% Fibonacci retracement zone, where supposedly things “bounce.” Sure. My mattress bounces too, but I don’t sleep any better.

If this triangle breaks, the trading bots hit the button and poof—off to $0.15 quicker than you can say, “Oy gevalt!” Fundamentals may be strong, but the technicals look nervous. Watch that $0.21 level—if it holds, maybe XLM survives another day. If not? Well, it’s gonna be a bumpy ride. Buckle up, buttercup! 🥯🚀

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2025-07-07 16:23