In the winter of the world’s discontent—where fortunes are as fleeting as the Russian summer—two scholars, possessing the dual power of wisdom and unchecked optimism, set about to divine the future of a new, mysterious currency: Bitcoin.

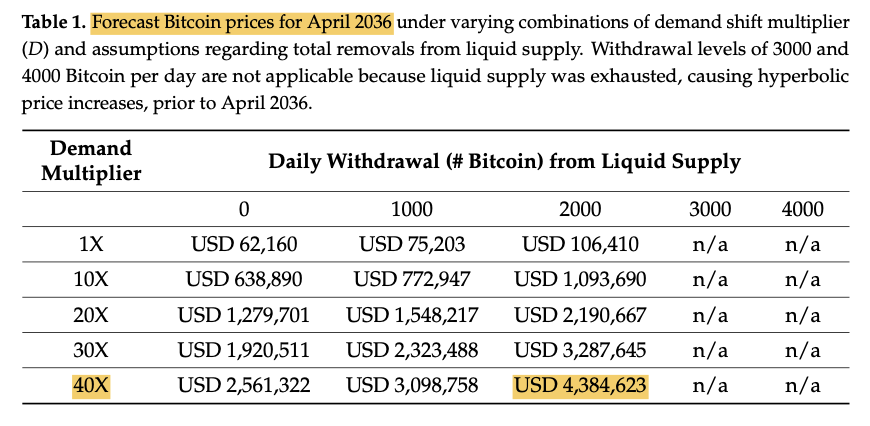

Murray Rudd and Dennis Porter, as if Tolstoyan characters seeking meaning lest their souls wither like stale bread, pronounced that by the year 2036, the price of Bitcoin would soar to $4.3 million. Yes, dear reader, this is not the punchline to a peasant joke, but rather the culmination of much mathematical modeling and, doubtless, several sleepless nights.

Giovanni Incasa, donned in the intellectual garb of the “market expert”, announced the findings with the same gravitas Tolstoy’s nobles reserved for ballroom dances. With exquisite passion, he declared the rigorous science—nay, the “economic physics”!—behind it all.

Supply Shock: As Shocking as Tolstoy’s Final Chapters

Rudd and Porter, much like engineers attempting to repair a leaky Russian dam, have peered deep into Bitcoin’s cryptic soul via mathematics. Their prophecy? A forthcoming supply shock, so tumultuous and wild, it promises swings in fortune more dramatic than a dinner with Anna Karenina and a train schedule.

Wealth, they claim, shall be redistributed with the subtlety of a Cossack taxman, leaving the digital landscape buffeted and rearranged in ways that would make both Pierre Bezukhov and digital asset investors sweat through their waistcoats.

Even their most restrained assessment sees Bitcoin climbing to $2.2 million per coin. (Liberals, conservatives, and Russian realist novelists alike may blanch at the notion.)

They note, perhaps with a hint of despair, that out of the supposed bounty of Bitcoin—21 million coins in total—only about 11.2 million are within human grasp. The rest are lost, scattered by fate and poor key management, like ducats misplaced at the bottom of the Neva.

And so, of those that remain, only half are truly liquid. Even the faintest institutional sniff sends prices fluttering like Tolstoy’s leaves in an autumn orchard.

Just observe, say the researchers, the behavior of US ETFs—average daily buyers of 285 coins—and the Bitcoin treasuries, snatching coins from the stream with the subtlety of a czar gobbling land from peasants. Debt financing? Of course. For in high finance, as in old Moscow, one always feasts on promises.

Even the honorable Senator Cynthia Lummis (a name perhaps better suited to tragic correspondence) has bubbles in her samovar: a strategic hoard of a million Bitcoin, hoarded at a pace of 550 coins a day for five years. Shall the ballet never end?

The researchers’ abacus concludes that at a mere 2,000 Bitcoin removed daily, prices would reach $106,000—already suspiciously close to today’s price, suggesting their calculations may indeed have more integrity than a State auditor’s ledger.

The fundamental mischief, say Rudd and Porter, is this: Bitcoin is inelastic, like the patience of a Russian mother. Demand rises, but new supply cannot be persuaded. Those institutions dawdling in grand halls, waiting for “a better moment”, may one day discover themselves cast into the winter without a single Bitcoin to warm their soup.

Three Futures: Pick Your Melodrama

The researchers, blessed with an abundance of imagination (and possibly strong tea), propose three scenarios:

- In the “restrained optimism” scenario—where demand grows twentyfold and daily 2,000-coin withdrawals persist— Bitcoin achieves $2.2 million by 2036. Modest, yes?

- If the world’s greed grows more robust, a 30-fold increase may result in $5 million by 2031, surely enough wealth to buy all the cabbage soup in St. Petersburg.

- And, for those whose favorite Dostoyevsky is the one with the most suffering—a 40-fold demand, 4,000 daily coins gone forever, and Bitcoin at $4.3 million by 2036. Even the ghost of Tolstoy’s banker would blush at such profligacy.

Rudd and Porter’s tale is not merely a fantasy or idle speculation from idle men; it is a vast panorama of human avarice, technological destiny, and the timeless urge to buy high and sell in tears. The lesson, if there is one: he who hesitates in the digital winter may soon find himself shoveling snow and regretting he had not purchased just one more Bitcoin (or, at the very least, remembered his wallet password). 😅💰

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2025-06-18 16:37