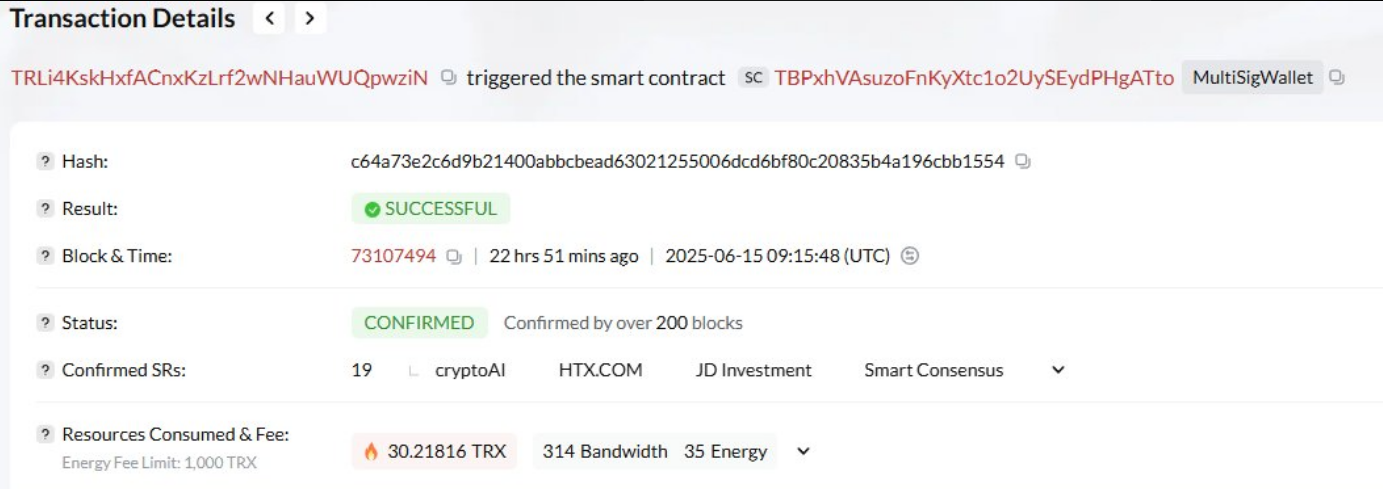

Ah, the swift hand of Tether! On a rather unremarkable Sunday, they decided to freeze a staggering $12.3 million worth of USDT on the Tron blockchain. Reports from Tronscan suggest that this bold move targets wallets that are allegedly involved in the delightful world of money laundering and sanctions evasion. Curiously, Tether has yet to grace us with a public statement, but the on-chain data speaks volumes—like a gossipy neighbor at a tea party.

The T3 Financial Crime Unit Flexes Its Muscles 💪

According to Tether, their T3 Financial Crime Unit (FCU) has partnered with Tron and TRM Labs to track suspect transactions in real time. Since late 2024, this unit has frozen over $126 million in assets that raise more eyebrows than a bad haircut. In the last quarter of that year alone, a whopping $100 million was blocked, suggesting that enforcement efforts are ramping up just as regulators worldwide tighten their belts—perhaps a little too tightly.

LATEST: Tether freezes $12.3M in $USDT tied to suspicious TRON addresses.

— MrRebel.eth (@rebelethpromos) June 16, 2025

Targeting High-Risk Entities on the Sanctions List 🎯

In a delightful synchronization with the US Treasury’s Office of Foreign Assets Control (OFAC), Tether has taken to regularly blacklisting wallets associated with sanctioned entities. Those on the Specially Designated Nationals (SDN) list are, of course, the prime targets—like fish in a barrel, if the barrel were filled with regulatory scrutiny.

For instance, in March 2025, Tether froze $27 million worth of USDT on the Russian-linked exchange Garantex, following the EU’s 16th package of sanctions. Garantex, in a fit of irony, later claimed that over 2.5 billion rubles of user funds were held up. Ah, the sweet taste of justice!

The Lazarus Group Faces a $374K Blacklist 🚫

Reports indicate that North Korea’s Lazarus Group has been quite the busy bees, moving over $3 billion in stolen crypto since 2009. In November 2023, Tether blacklisted $374,000 in USDT tied to addresses associated with this notorious group. Other stablecoin companies joined the fray, locking up $3.4 million in identical wallets. It seems that even state-sponsored hackers can’t escape the long arm of the law!

Diversifying with Gold Royalties 💰

On June 12, 2025, Tether decided to diversify beyond the digital currency realm by acquiring a 32% equity stake in Elemental Altus Royalties. This deal involved the purchase of over 78 million shares at CAD1.55 per share, valued at around $89 million. A bold move, indeed! It shows Tether’s commitment to backing its stablecoin with real assets, while also trying to appease those pesky risk-averse regulators demanding strong reserves.

A Dual Approach to Stablecoin Governance ⚖️

According to Tether executives, this delightful combination of tough enforcement and asset diversification could set a new benchmark. By freezing criminal funds and backing USDT with real-world value, Tether aims to bolster confidence in its stablecoin. After all, who wouldn’t want to invest in a currency that’s as solid as a rock—or at least as solid as a well-placed joke?

Read More

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Gold Rate Forecast

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

2025-06-18 07:24