Unveiling the Ripple Riddle: Will Crypto’s Darling Dive or Just Dip a Toe? 🤔💸

In the dizzy world of cryptocurrency, where fortunes are made and lost faster than you can say “blockchain,” a new drama unfolds. CoinRoutes’ chief, Dave Weisberger, decided to stir the pot—completely unprovoked—by tossing a verbal Molotov cocktail into the XRP pond during Scott Melker’s podcast. His question, laden with the subtlety of a sledgehammer, was whether Ripple Labs could bankroll a $10 to $20 billion takeover of Circle without crashing the entire crypto universe in a spectacular supply dump. Spoiler: Who, pray tell, would buy the $10 billion worth of XRP Ripple would need to sell? A rhetorical question of biblical proportions. If the market hears about a “supply surge,” it’s a safe bet panic ensues, and the price could get hammered like an extra at a pool hall. 🎱🔥

Can XRP Really Crash and Burn? The Heated Debate

Almost immediately, Fred Rispoli, a lawyer with a suspiciously optimistic outlook for XRP, responded on X (formerly Twitter). His reply was as cheeky as it was definitive: “I love @daveweisberger1, but on this point he is mcgloning so hard,”—a reference to Bloomberg’s Mike McGlone, known for his bearish bon mots. Rispoli suggested that based on secondary market offers, Ripple might not need to sell a single XRP to acquire Circle. Well, isn’t that charming? Of course, Ripple can’t just conjure $10 billion out of thin air, but Rispoli argued their strategy involves a cocktail of cash, debt, and a hefty stock swap—so, good luck trying to break their bank, Dave!

Weisberger shot back, faintly conceding that Rispoli’s math was “reasonable,” but warning that even the upper estimates could spell short-term pain for XRP holders. It’s all fun and games until someone’s portfolio gets obliterated, huh? Meanwhile, Ripple’s January 2024 valuation hovered around $11.3 billion, with a treasure chest of $1 billion in cash and a cozy $25 billion in digital assets, mostly XRP. But with 52 billion XRP in their vaults—40 percent locked in escrow—their immediate liquidity is, shall we say, less than impressive. At today’s $2.20 price, that’s a modest $35 billion, but try moving even a sliver quickly, and you’ll need to call in the cavalry. 🚓💰

Is Circle Just Playing Hard to Get? The Never-Ending Tale

Meanwhile, Circle, issuer of USDC, maintains a steadfast “not for sale” stance, even as it eyes a grand NYSE debut valued at $7.2 billion. Rumors of Ripple’s interest earlier this spring, flirting around the $5 billion mark, were politely rebuffed. Circle’s refiled S-1 extended the dance, suggesting they’re happy to stay the darling of stablecoins with no bids in sight, thank you very much. Ripple, of course, has its own dollar-pegged token RLUSD, designed by Monica Long to be “not a competitor, just a good friend.” If Ripple were to acquire USDC, it might well balloon into a behemoth worthy of Tether itself—because who needs limits in crypto, right? 🎭

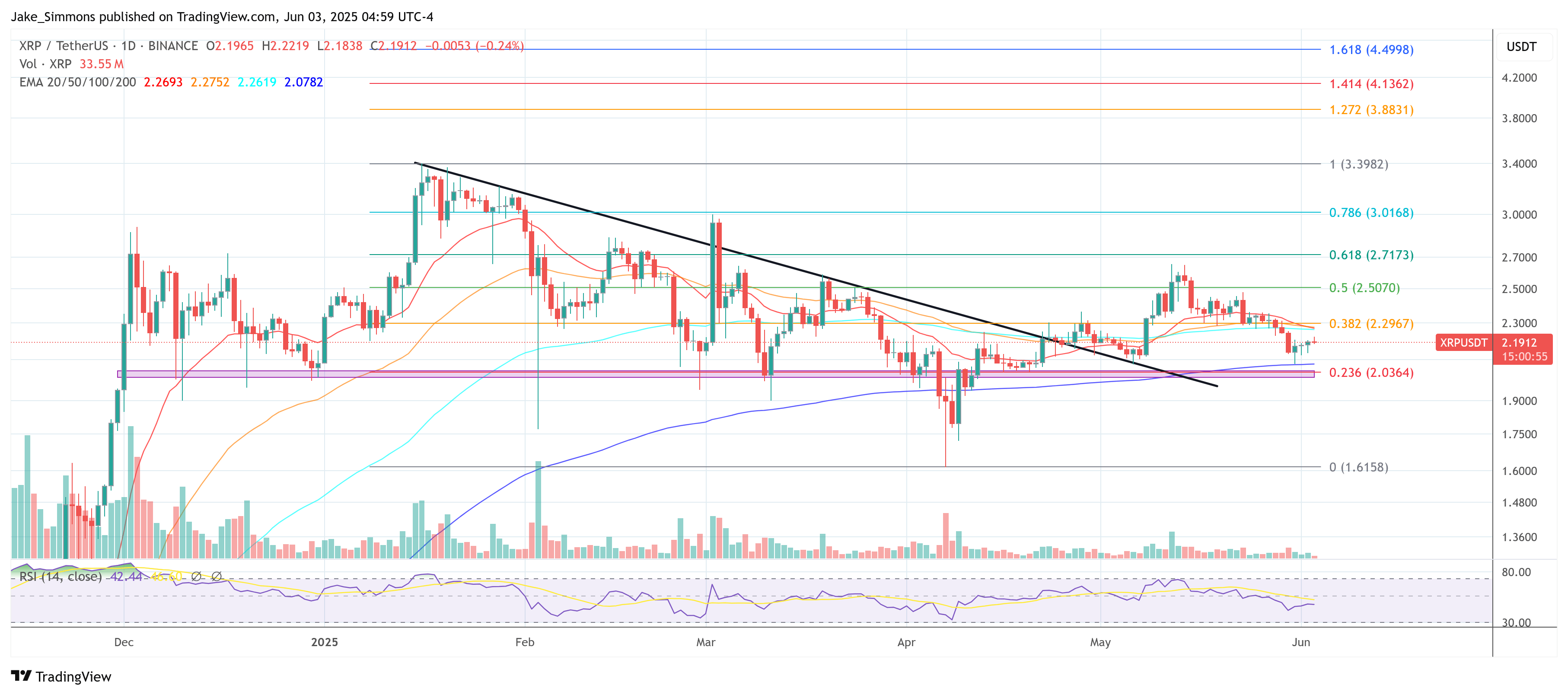

Given current volumes, unloading just 500 million XRP (roughly $1.1 billion) could cause a panic akin to a Black Friday sale—unless done in carefully staged private blocks, of course. But with XRP trading at $2.19, and the market as lively as a Monday morning in the office, this isn’t exactly a walk in the park. In short: Ripple might need to sell a few hundred million XRP just to keep the lights on—what could possibly go wrong? 🤷♂️

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-06-03 17:15