Bitcoin is having quite the week, breezing past the $105,000 mark like a limo cruising through the streets of success. The digital coin flirted with new heights, peaking just under $112,000, making even the most jaded crypto trader raise an eyebrow. And now, as if nothing happened, the market is licking its lips and eyeing what could be the next chapter in this delightful rollercoaster. 🍿

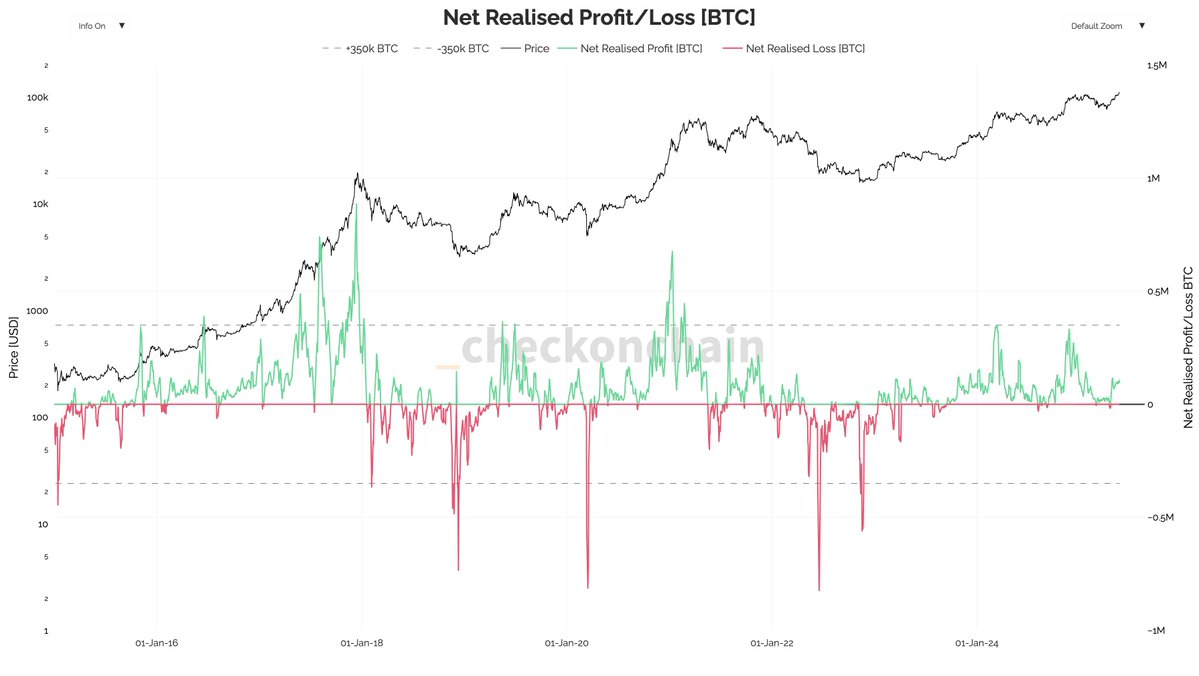

Despite its meteoric rise, the data isn’t screaming panic just yet. Darkfost, the crypto oracle of our time, assures us that profit-taking is as normal as your morning coffee during a bull run. He explained that taking profits isn’t a sign of weakness—it’s the market’s way of staying fresh. “It keeps investors from falling asleep at the wheel,” he quips, “and prevents things from going full ‘crazy train’ mode.”

Bitcoin’s price action is starting to smell like a shift in the winds, as the crypto beast emerges from its post-halving slumber. With $105K now acting like a comfy pillow of support, bulls are circling the higher numbers. If this momentum holds, that $112K rejection might just be a speed bump on the way to greatness. But remember, volatility is the spice of crypto life—this week’s close signals that the bull market is still doing just fine, thank you very much. 🐂💰

Bitcoin’s Weekly Close: More Than Just Numbers, It’s History in the Making!

Bitcoin is gearing up for a weekly close that could etch its name in history books. With $112,000 still lingering in the rearview mirror, BTC is now cruising steadily above $105,000, making its way toward the next stop on its ‘Look Ma, I’m Famous’ tour. But hold on, the road ahead isn’t without potholes—global economic conditions are still a mixed bag of high interest rates, tightening financials, and the usual market uncertainty. Sounds fun, right? 🎢

But fear not, on-chain data offers a much less panic-inducing view of the situation. Darkfost, of course, has the scoop. According to CryptoQuant, realized profits currently sit at a neat $11 billion (that’s 104,000 BTC, in case you’re counting). While it may sound like a lot, we’re still far from the danger zone of 350,000 BTC. So, no need to put your sunglasses on just yet—this isn’t the end of the world. 🏖️

Darkfost adds, “Profit-taking isn’t a red flag, folks. It’s just part of the dance that keeps things moving.” So don’t worry if people are pocketing their gains; it’s what keeps the party going. 🕺💃

The coming week will be pivotal. A confirmed close above $105K could mean that this level is the new cool kid on the block. But, if bulls stumble, the rally could face a minor existential crisis. For now, Bitcoin looks as strong as a coffee addict on a Monday morning, but the market will soon see if the hype is real or if the bubble pops. 🧐

BTC Takes a Breather After That Price Party 🚨

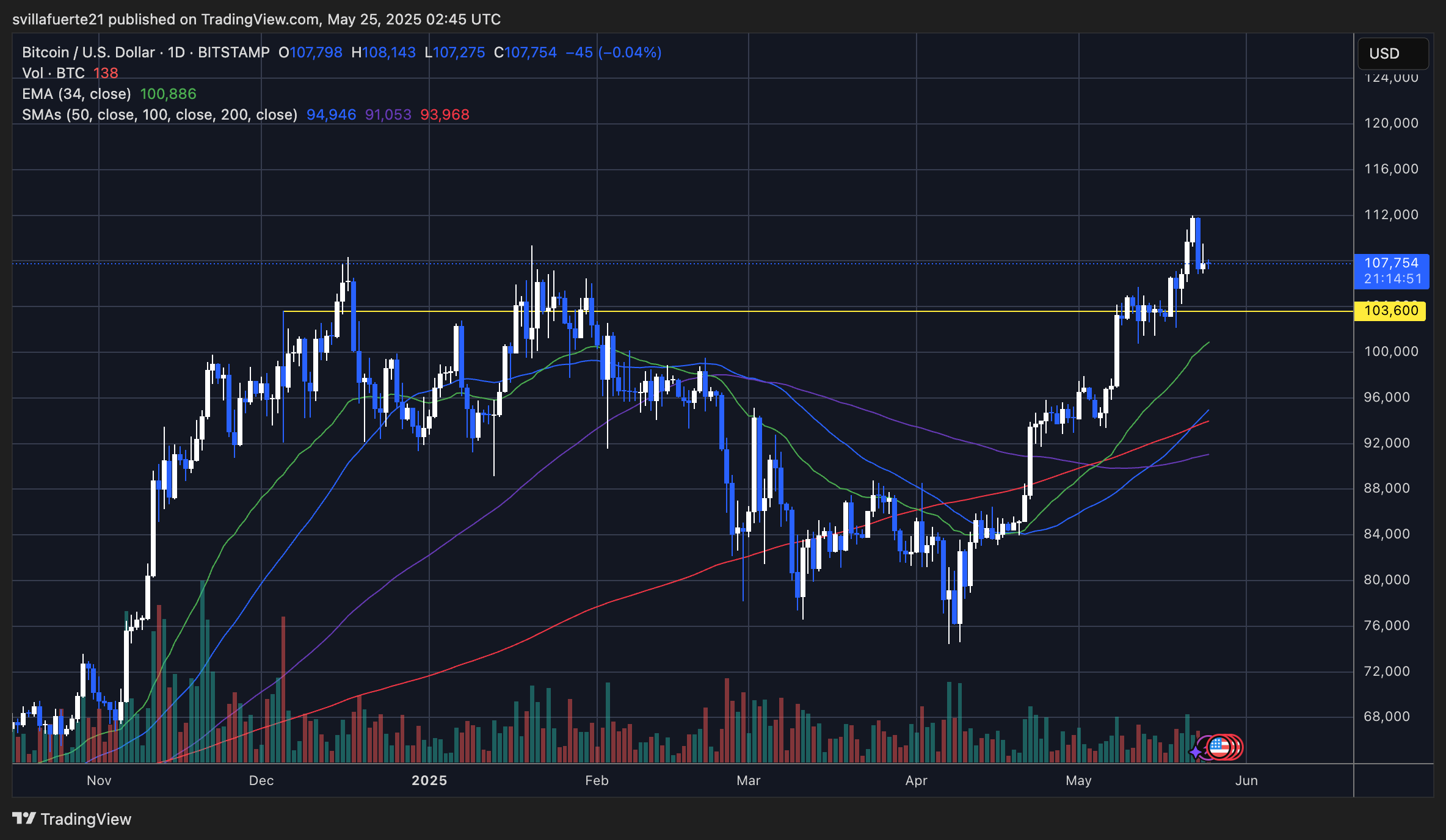

Bitcoin is taking a well-earned breather at $107,750 after hitting the crypto equivalent of a red carpet event—its all-time high of $112,000. After a brief flirtation with overbought territory, it’s now holding onto its 34-day EMA at $100,886 like a lifeline during a stormy crypto sea.

And what do we see? Bitcoin is still cruising above the 50, 100, and 200-day SMAs, confirming that bulls are still running the show. The critical horizontal support at $103,600 is now acting as the stepping stone for what could be the next leg up. Think of it like a springboard into the next phase of glory—if Bitcoin decides to bounce above it. 🏋️♂️

Sure, volume seems to be dipping a bit on the pullback, but don’t panic. This could just be the market doing its cool-down lap after the sprint. As long as Bitcoin keeps its head above the $103,600–$105,000 zone, the bulls are in the driver’s seat. A deeper correction could find support around $91,000, but that’s a story for another time.

So, is the bull run still on track? Sure, but we’ve got some speed bumps ahead. A weekly close above $105K would cement Bitcoin’s place as the hero of the hour, while a slip below $103K might suggest a minor setback. Stay tuned! 🎬

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- How to Update PUBG Mobile on Android, iOS and PC

- Brody Jenner Denies Getting Money From Kardashian Family

2025-05-25 12:07