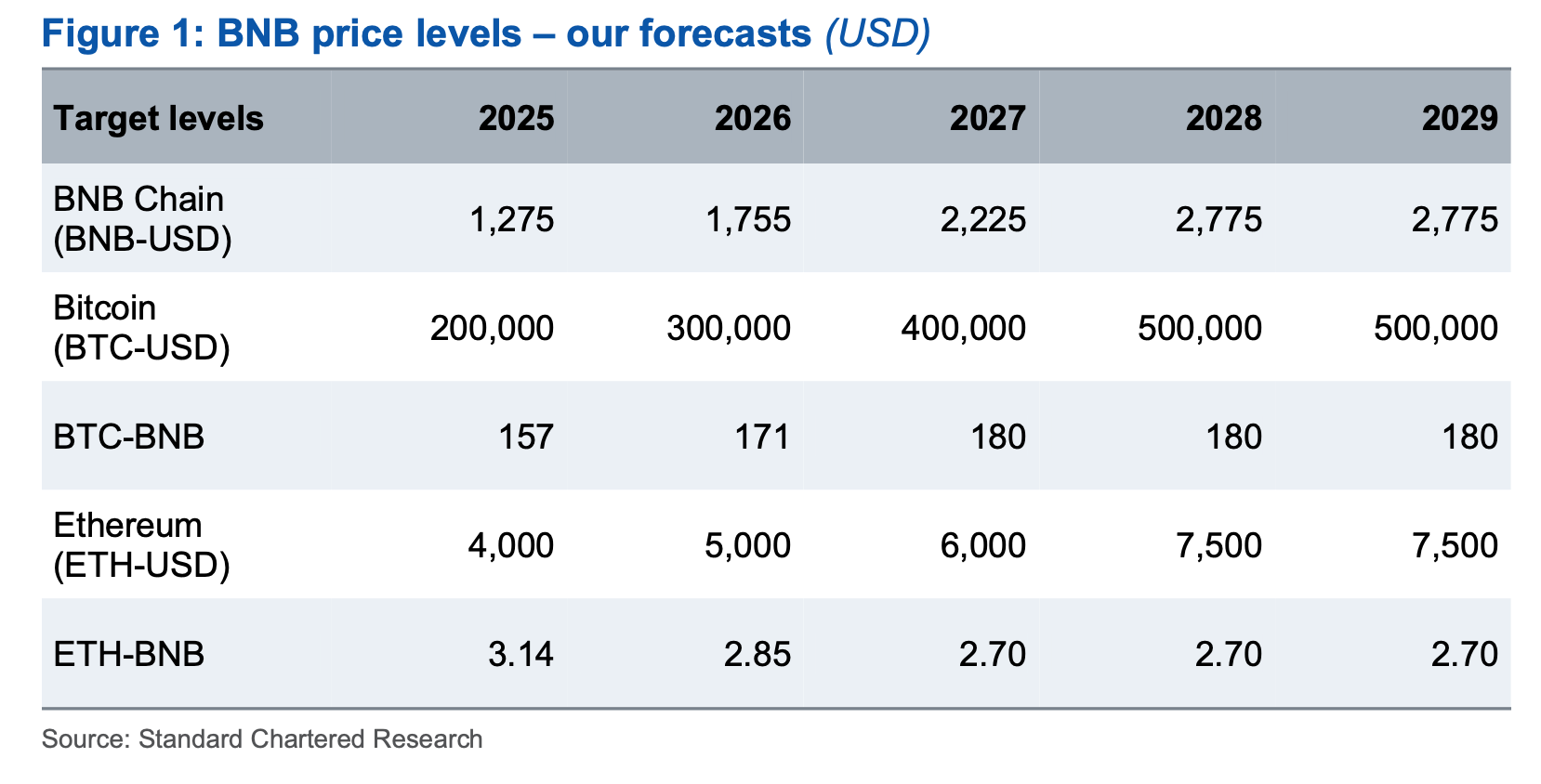

Good news, crypto fans and people who keep their savings somewhere other than inside a shoebox: Standard Chartered has finally noticed that Binance’s BNB exists, and they’re feeling bullish enough to make your favorite crypto Twitter influencer blush. According to their global head of digital-asset research (a.k.a. “guy who definitely owns at least one laser-eyed bull statue”), BNB could go from its current $600-ish price to $1,275 in 2025, and $2,775 in 2028. By 2029: apparently the price just chills out and enjoys a spa day. 🧖♀️

BNB: Because 360% Gains Are the New Black

If you’re mathy (or lucky enough to have a calculator and opposable thumbs), you’ll notice that’s a potential 360% jump. Kendrick—the bank’s designated crypto crystal-ball gazer—calls BNB “benchmark-like.” Translation: BNB moves like a third sibling who copies everything Bitcoin and Ethereum do, but with a nice haircut. Since 2021, its price chart has basically been cosplaying as a Bitcoin/Ethereum index fund that just discovered coffee.

Standard Chartered is also tossing some spice on big names: Bitcoin at $200K in 2025 (subtle flex) and $500K in 2028. Ethereum: $4,000 and $7,500 over the same time frames. Basically, if you own any crypto and it isn’t somehow lost in an abandoned laptop, Standard Chartered thinks you’re going to be insufferable at parties by 2028.

But wait! There’s some academic drama with asset ratios. The BTC-BNB ratio (fancy talk for how many BNB you can get for one Bitcoin) is expected to slide from 157 in 2025 to 180 in 2027, which means Bitcoin will leave BNB staring at its exhaust pipe. ETH-BNB’s ratio goes from 3.14 (yep, Pi!) down to 2.70, so Ethereum will outpace BNB… but only with the enthusiasm of someone running a 5K on Sunday morning.

Kendrick admits BNB “may underperform Bitcoin and Ether both in real terms and as measured by market cap,” but—wait for it—its tokenomics and role as Binance’s ride-or-die give it long-term street cred. That’s bank language for “it still slaps.” 💸

For those still awake: BNB Chain’s technical setup means just 45 validators rotate daily—compared to Ethereum’s validator army. Kendrick calls this “highly centralised”—translation: it’s a tight-knit group chat, not a public Facebook wall. Plus, developer activity has slowed; apparently, the devs preferred the DeFi summer in 2021 and now hang out more on Avalanche and Ethereum.

Still, the Binance engineers aren’t napping. The recent Pascal hard fork and the upcoming Maxwell upgrade are supposed to help lure developers back, like a Mario Kart-themed hackathon with free pizza.

And if you like discounts (who doesn’t?), BNB holders get VIP treatment on Binance, thanks to mechanical fee reductions, so long as you keep trading like your thumbs depend on it. PancakeSwap still spins the flywheel, juicing liquidity—and carbs.

Standard Chartered’s pitch? With regular token burns and a fixed supply, BNB is about as deflationary as your 2003 iPod battery life. It’s “rich” on their market-cap-to-GDP screen—finance speak for “people keep buying it even though it isn’t Bitcoin.”

At time of writing, BNB chilled at $605. Check back in 2028 to see if Geoffrey Kendrick is sipping crypto cocktails on a yacht, or doing his next research note from a windowless basement.

Read More

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2025-05-08 06:22