Ah, Ethereum – the eternal struggler. Once a star on the crypto stage, now caught in a cruel dance with resistance, unable to break above the $1,874 mark from May 1st. It’s like a hamster trying to escape its tiny cage, but alas, that barbed wire of resistance keeps it trapped. While the broader crypto world is stirring, Ethereum remains in its cozy little range, clinging to life just above $1,800, hoping some brave bulls might come to the rescue and push it higher. But will they? Who knows.

Oh, the drama of it all. Despite countless efforts, Ethereum has yet to find its true north, and the market’s nerves are starting to fray. After all, it’s still sitting comfortably (uncomfortably?) over 55% below its December highs, trailing behind its crypto counterparts. A solid push past resistance is looking more and more like a dream, a distant hope, a passing fancy. If it doesn’t break out soon, we might just see Ethereum spiral further into oblivion.

Enter Michael Van de Poppe, a top crypto investor, with his crystal ball of technical analysis. He sees Ethereum in an accumulation phase – or maybe just in denial. According to him, Ethereum shows some glimmers of hope, accumulating strength against BTC in the background. But here’s the kicker: it needs confirmation, a grand breakout to prove it’s not all talk. Until that happens, Ethereum is stuck in this stagnant mess, vulnerable to market swings and emotional roller coasters. It’s a tense waiting game, and the next few days could be the turning point – for better or for worse.

The ETH/BTC Chart: A Potential Glimmer of Hope, Or Just More Smoke and Mirrors?

Oh, look at that – Ethereum’s struggling to reclaim the $2,000 threshold, despite the wider crypto market heating up like a summer day in the desert. It’s still stuck below those key resistance levels, as if it’s afraid to make a move. But wait – don’t get too disheartened yet. Take a closer look at the ETH/BTC chart. What’s this? A possible miracle? Van de Poppe has been digging into the details and claims there’s a clear accumulation pattern unfolding, like a story building to its climax. Ethereum has escaped from a falling wedge, consolidating just below critical resistance at 0.0195 BTC. Will it finally break free, or will it be another tragic failure?

For those who dare to dream, this could be the classic setup for an Ethereum breakout. The chart suggests that ETH might just be preparing for an epic battle against Bitcoin. But let’s not get carried away, dear reader. There’s a key demand zone around 0.0184 BTC where ETH has shown some resilience, but it’s not over until it’s over. As long as Ethereum holds above that level, the possibility of a breakout remains alive – albeit in a comatose state.

Yet, there are shadows lurking. The market is still hostage to macroeconomic uncertainties, like the grand drama of US-China tensions. So, Ethereum’s fate depends on two things: holding support and breaking through the 0.0195 BTC resistance. If it can manage that, we might finally see the rally we’ve been promised – but don’t hold your breath.

Ethereum’s Price: Stuck in a Tight Range – Like a Bad Relationship

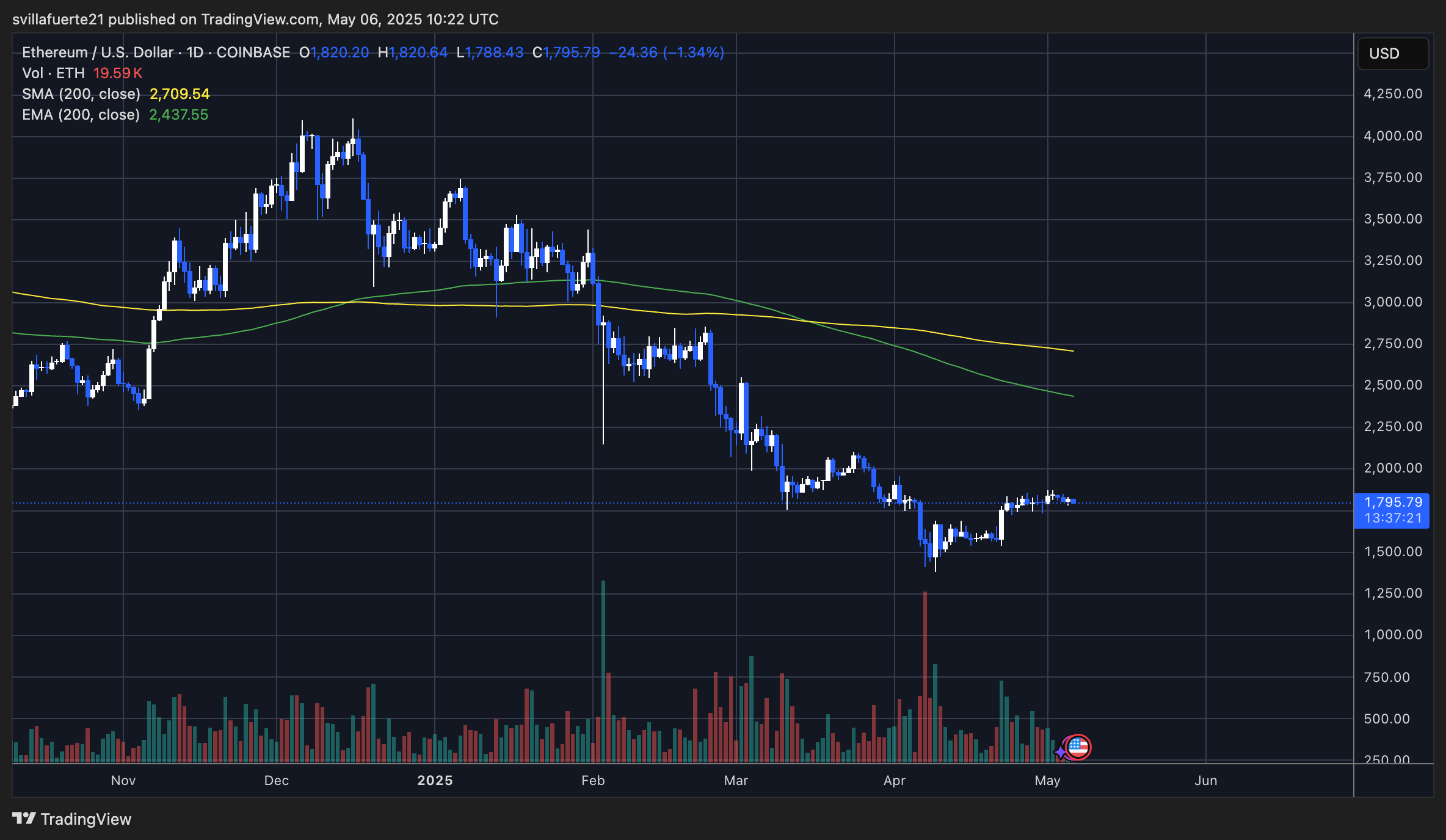

At this very moment, Ethereum is trading at $1,795.79, having been gently rejected from its $1,874 high on May 1st. It’s consolidating in a tight range, like a hamster wheel that refuses to stop turning. But here’s the thing: Ethereum’s still languishing well below the 200-day simple moving average (SMA) at $2,709.54 and the 200-day exponential moving average (EMA) at $2,437.55. This, my friends, is not the sign of a bullish breakout – it’s the weary sigh of a market stuck in limbo.

Sure, the bulls have managed to prevent further downward spirals, but Ethereum is still far from escaping its long-term downtrend. The failure to reclaim $2,000 as support is a cruel reminder that bullish momentum is nowhere to be found. Even the volume is weak, as if the market can’t decide whether to cry or cheer. It’s a pity, really.

The structure currently points to accumulation, but unless Ethereum can decisively break through the $1,875–$2,000 resistance zone, sentiment won’t change. If it fails to clear these levels, the risk of another pullback toward the $1,650–$1,700 support zone becomes all too real. How thrilling.

So here we are, at a crossroads. Ethereum is consolidating below major moving averages, with market participants growing ever more wary. A breakout above $2,000 could ignite some hope, or it could be another fleeting moment in Ethereum’s long, tortured history.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-05-07 01:47