Ah, mesdames et messieurs! Gather ’round, for we delve into the curious case of Bitcoin, that whimsical digital coin! 🎭

Open interest, you see, is the grand oracle of our trading realm, revealing the market’s fickle heart and its capricious price whims. One might say, an increase in this open interest is akin to a bustling marketplace, where liquidity flows like fine wine! 🍷

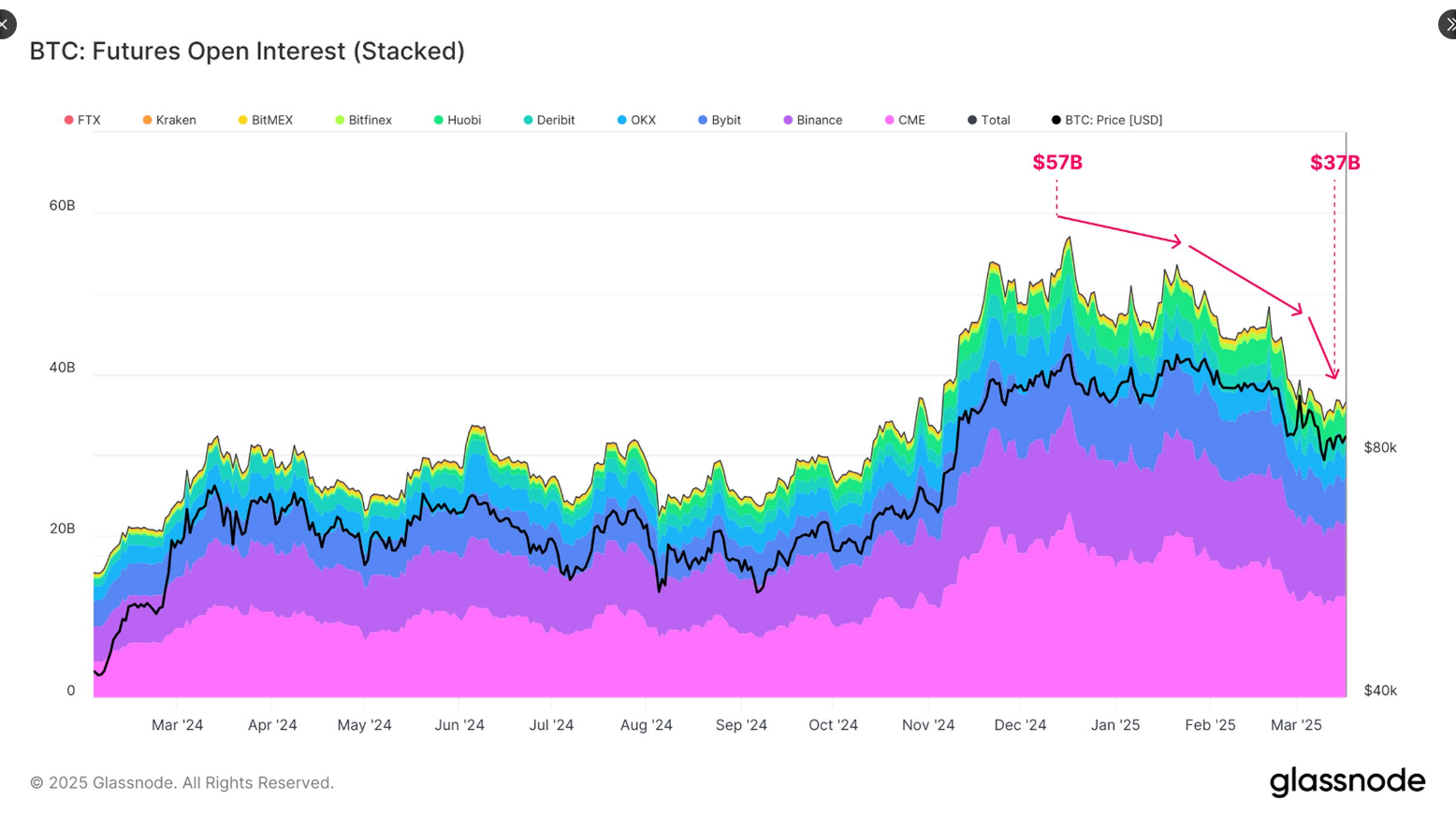

But lo! The latest tidings from the esteemed Glassnode reveal a most alarming dip: from a lofty $57 billion to a mere $37 billion! A staggering loss of 35%! It seems our dear Bitcoin has taken a tumble since it reached its celestial peak! 🌌

On a fateful day, January 20th, when the world witnessed the inauguration of a certain President, Bitcoin soared to an astonishing $108,786. Oh, the irony! 🎩

As of now, our beloved Bitcoin flounders between $83k and $86k, down more than 22% from its glorious heights. What a tragic comedy! 😂

Bitcoin’s Open Interest: A Harbinger of Price Woes?

Investors, those brave souls, wield the open interest metric like a sword, seeking to divine the market’s mood and its potential for profit. Alas! A decline in this metric suggests that traders are retreating, perhaps due to uncertainties or a lack of confidence. A most cowardly act! 🏃♂️💨

“Futures open interest has plummeted from $57B to $37B (-35%) since Bitcoin’s ATH, signaling a retreat from speculation and hedging. This decline mirrors the contraction seen in on-chain liquidity, pointing to broader risk-off behavior.”

— glassnode (@glassnode) March 20, 2025

According to the wise sages at Glassnode, this drop in open interest reflects a broader malaise, where investors seem to lack faith in our dear Bitcoin. It appears they now favor short-term trades, seeking quick riches while abandoning long-term dreams. Oh, the folly! 💰

A Shift in the Winds of Trade – Glassnode Speaks!

Glassnode proclaims that traders are now embracing the cash-and-carry trade, abandoning their long positions like a ship fleeing a storm! The closures of CME futures and ETF outflows add to the mounting pressure. What a spectacle! ⛵️

Moreover, the availability of ETFs, those fickle creatures, may further stir the pot of volatility in our alpha crypto. A recipe for chaos, indeed! 🍲

Data Highlights: The Hot Supply Dilemma

Ah, the Hot Supply metric! A most intriguing measure of Bitcoin holdings, tracking those that have been in circulation for but a week or less. Alas! The numbers have dwindled from 5.9% to a mere 2.8%, a drop of over 50% in just three moons! 🌙

This decline in hot supply suggests that fewer new Bitcoins are gracing the market, leading to a most unfortunate reduction in liquidity. A tragedy for all! 😱

Furthermore, Glassnode paints a rather gloomy portrait, revealing that exchange inflows have plummeted from 58,600 Bitcoins daily to a mere 26,900. A 54% decrease! This trend hints at a waning demand, as fewer assets make their way to the crypto exchanges. Oh, the humanity! 😩

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-03-21 23:48