Ah, mes amis! Gather ’round, for we find ourselves in a most curious spectacle! The loyal supporters of Cardano (ADA), with their heads held high, bask in the glow of optimism, yet the weekly chart (ADA/USDT) whispers a different tale—one of caution! 🎭 While the air is thick with bullish sentiment, buoyed by recent regulatory nods, ADA’s price dances precariously beneath a critical resistance, like a jester on a tightrope, flashing cautionary signals akin to a bearish engulfing pattern. 🥴

Cardano: A Comedy of Hype and Bearish Technicals

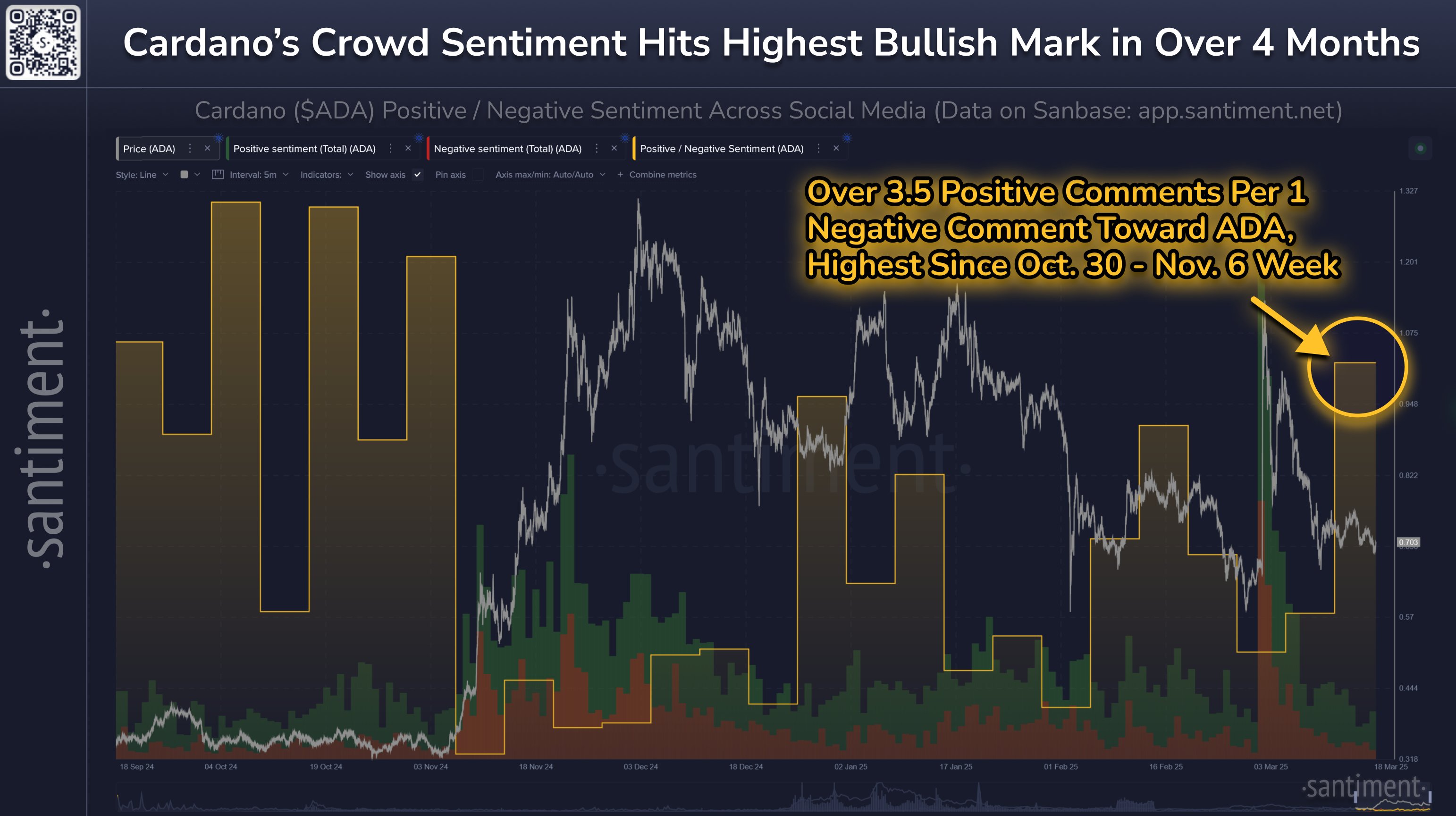

Our friends at the on-chain analytics firm, Santiment, have declared a rise in social media optimism for Cardano on the platform known as X! “Certain altcoins, like our dear Cardano, are basking in high positive sentiment,” they proclaim. Thanks to the SEC’s classification of ADA’s use case as ‘smart contracts for government services,’ the community has rallied, pushing bullishness to heights unseen in over four months! 🎉

But lo! This social media jubilation has yet to translate into a price that reflects such enthusiasm. Currently, ADA flirts with the $0.71 mark, having retreated once more after being included in the Strategic Crypto Stockpile by none other than President Donald Trump! Oh, the irony! 😅 Yet, technical traders are left wringing their hands, for a bearish engulfing candle has emerged post-announcement, signaling a potential shift in momentum back to the bears. 🐻

Since that fateful day, ADA has continued its retreat. The moving averages tell a tale of woe, as Cardano finds itself trapped beneath the 20-week EMA at $0.7883, which, like a gloomy cloud, trends downward. Below, the 50-week EMA at $0.6679, the 100-week EMA at $0.59, and the 200-week EMA at $0.5255 stand as layers of support, like a fortress against the encroaching bears. Should ADA fail to secure a foothold above $0.74-$0.78, these EMAs may become the harbingers of doom! ⚰️

As we trace the Fibonacci retracements from the all-time high of $3.0984, we uncover additional checkpoints above the current resistance. The 0.236 Fib level at $0.8990 stands as a crucial boundary, should the bulls muster the strength to clear $0.78. Beyond that, we have $1.3193 (0.382 Fib), $1.6590 (0.5 Fib), and $1.9987 (0.618 Fib)—distant objectives that seem to mock our current plight! 🎯

Yet, the bearish engulfing formation serves as a stark reminder that momentum has swung back to the sellers. Such a pattern typically suggests increased downward pressure, at least in the short to medium term, unless a swift upside move can reverse this trend. Alas, the Relative Strength Index (RSI) hovers near 48, confirming our lingering indecision. 🤔

In this grand theater of the altcoin market, we find ourselves at the mercy of declining Bitcoin dominance and the overarching macroeconomic conditions. All eyes are now fixed on today’s FOMC meeting and the updated dot plot, which may prove pivotal for risk assets. A hint of quantitative tightening easing or dovish signals could ignite a renewed strength across the altcoin sector! Let us hope for a happy ending! 🎭

Read More

2025-03-20 00:05