ETH: The Whale Whisperer’s Secret Signal 🐳

Ethereum (ETH) is currently wallowing in the depths of despair, its price stuck in the mud since late 2023. It’s like the crypto market is trying to tell us something – “Hey, we’re not done being miserable yet!” 😒 With over 57% of its value lost since December 2024, ETH is struggling to regain its footing.

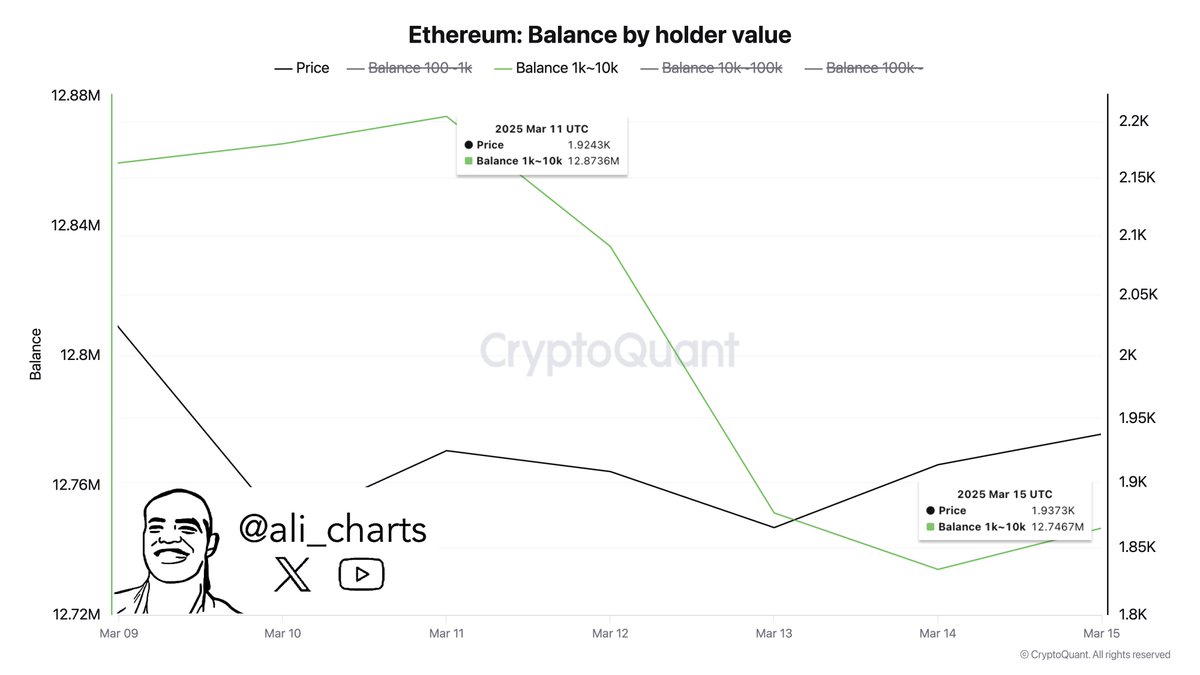

But, as the saying goes, “when life gives you lemons, make lemonade”… or in this case, when life gives you a downtrend, make a whale-sized bet on the rebound! 🐳 According to CryptoQuant, those sneaky whales have been moving over 130,000 ETH off exchanges in the past week, signaling a growing accumulation trend. It’s like they’re saying, “Hey, we’ll just take this opportunity to buy the dip and wait for the price to bounce back!” 🤑

Now, we know what you’re thinking – “But what about the bearish sentiment?” Ah, my friend, that’s like asking a chicken to give up its eggs. Sentiment is like a stubborn mule – it’ll only change when it’s good and ready. 😉 And historical data shows that large whale accumulations often precede strong rebounds once selling pressure fades. So, it’s a case of “wait for the dust to settle, and then… BAM!” 💥

However, ETH still has some major hurdles to clear. It’s like trying to climb a mountain while being chased by a pack of rabid bears. 😉 Bulls must reclaim key levels to confirm a potential trend reversal, and market uncertainty still looms large. It’s a delicate balance, really – will the whales’ accumulation efforts be enough to tip the scales in favor of a rebound, or will the bears continue to hold sway?

The Whale Whisperer’s Secret Signal 🐳

Ethereum has been under siege, struggling amidst macroeconomic uncertainty and trade war fears that have left the crypto market and the U.S. stock market looking like a pair of battered old shoes. 🤕 ETH is now trading below a multi-year support level, which could act as a strong resistance in the coming weeks. But, as the great philosopher, Dolly Parton, once said, “If you want the rainbow, you gotta put up with the rain.” 💖

And speaking of rainbows, analyst Ali Martinez has shared some insights on X that suggest whales have moved over 130,000 ETH off exchanges in the past week. It’s like they’re saying, “Hey, we’re not just here for the short-term gains – we’re in it for the long haul!” 🚀

This is significant because large investors typically move their holdings off exchanges when they plan to hold for the long term rather than selling. It’s like they’re saying, “We’re not just buying ETH – we’re buying the dream!” 🌟 When whales transfer ETH into private wallets, it often signals accumulation rather than immediate selling pressure. And historical data shows that such trends have preceded market rebounds, as reduced exchange supply can contribute to price stability and future upside potential.

So, while Ethereum still faces major hurdles, whale activity suggests that smart money is positioning itself for the next move. It’s like they’re saying, “Hey, we’re not just waiting for the market to recover – we’re making it happen!” 💪 The next few weeks will be crucial in determining whether ETH can reverse its downward trend or if further declines are ahead.

Bulls Fight to Hold Key Levels 🏔️

Ethereum is currently trading at $1,904, struggling to regain momentum after days of consolidation below the $2,000 mark. It’s like they’re stuck in a never-ending loop of ” Groundhog Day” 🌳 The ongoing selling pressure has kept ETH under key resistance, making it difficult for bulls to reverse the trend and start a recovery.

For Ethereum to regain a bullish outlook, bulls must reclaim the $2,000 level as soon as possible. A sustained push above this resistance would signal strength and could set the stage for a rally toward higher levels, potentially testing $2,250–$2,400 in the coming weeks. But, if ETH loses current levels of demand, the next major liquidity zone sits around $1,600. A breakdown below $1,750 could trigger further sell-offs, leading to an extended bearish phase that could delay any potential recovery.

With whale accumulation increasing and on-chain data suggesting reduced exchange supply, some analysts believe Ethereum could soon attempt a breakout. However, macroeconomic conditions and overall market sentiment remain critical factors in determining ETH’s short-term trajectory. Bulls will need strong buying pressure to reclaim lost ground and avoid a deeper decline.

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

2025-03-17 16:36