In these most curious of times, our beloved Ethereum (ETH), much like a wayward child, finds itself grappling with a most unfortunate plight, trading below the esteemed threshold of $2,000, and languishing in a state of utter disarray at approximately $1,900. Alas! The broader crypto market seems to be under some sinister spell of bearish influence, with ETH having shed a staggering 57% of its erstwhile splendid value. One might sigh, for it appears to be a most challenging endeavor for our gallant bulls to mount a recovery.

Now, lo and behold! Ethereum, having descended beneath a most venerable support level that has stood the test of time, must contend with a veritable fortress of resistance that could thwart any attempts at resurgence. The atmosphere is charged with volatility, as traders peer over their spectacles, awaiting any signs of strength—or perhaps, further woeful declines?

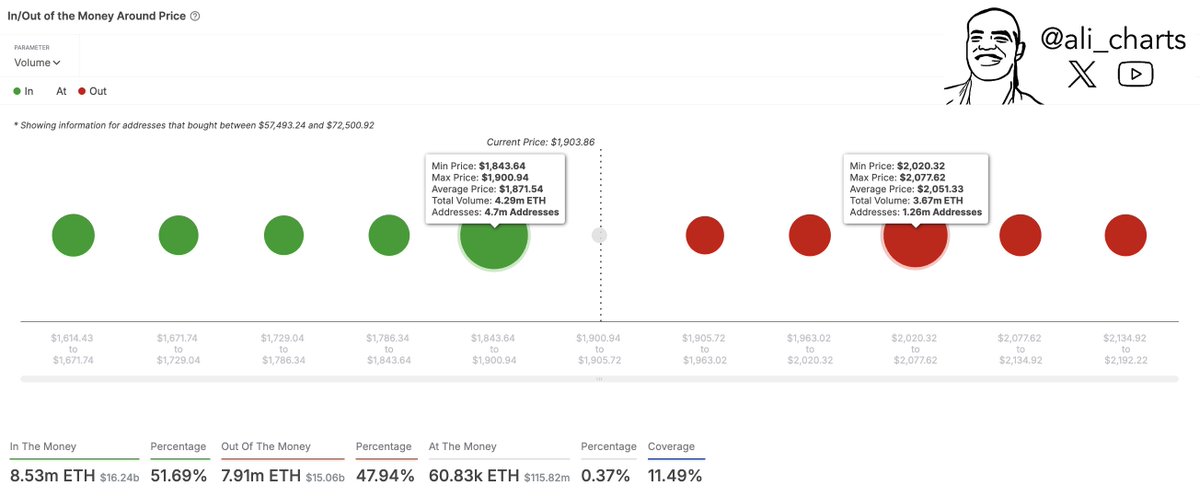

Upon consulting the learned tomes of on-chain data, one shall find a duo of pivotal price levels that dictate Ethereum’s immediate fate. The noble $1,870 is its current bastion of support, whilst the formidable $2,050 looms ahead, a seemingly insurmountable challenge that must be reclaimed to coax forth a return of optimism.

At this juncture, Ethereum remains in a state of apprehension, susceptibility reigning supreme, as uncertainty meanders through price action like a spectre of discomfort. Should our indomitable bulls fail to safeguard this crucial support, one might fear further descents; yet, a triumphant reclaiming of the elusive resistance could quite possibly reawaken the fervor of confidence within the market. The days ahead are poised to reveal whether ETH shall rise like a phoenix from the ashes or continue its soft descent into uncertainty.

Ethereum: A Test of Fortitude as Bulls Stumble to Regain Their Dignity Above $2,000

As fate would have it, Ethereum stands at a turbulent crossroads, trading at its most dismal level since the autumnal days of 2023, with the bears, resembling a band of ruffians, firmly entrenched. After a relentless barrage of selling pressure, those barreling bulls must urgently reclaim the emblematic $2,000 barrier to stave off further calamity and revive the flagging spirits of market participants.

The grand tableau of macroeconomic conditions appears precarious, with trade tensions and widespread financial instability casting an ominous shadow over both cryptocurrencies and the lofty stock markets of our land. Such factors have conspired to paint a grim picture, leaving investors fluttering with trepidation. Yet, amidst this turmoil, some optimistic sages assert that a recovery is still conceivable in the coming months, particularly should Ethereum manage to navigate its way back to vital resistance levels.

The esteemed analyst, Ali Martinez, bespeaks of the significance of $1,870 as Ethereum’s bastion of support—a most delicate position indeed! Should ETH once again breach this sanctum, further lament may be the order of the day. Upwards, the elusive $2,050 stands as a daunting barrier, challenging our bulls to rise to the occasion.

If fortune favors Ethereum and it manages to capture the much-coveted $2,050, we could witness the dawning of a significant trend reversal and perhaps a most vigorous recovery rally. With every trading session to follow holding immense weight, ETH finds itself at a critical juncture—either to maintain its ground or tempt fate with further declines, as investors remain ever-vigilant in monitoring the ebb and flow of market dynamics.

ETH Bulls Must Rally With Grace Above $1,900

Currently, Ethereum finds itself trading at a disheartening $1,920, a position borne out of days spent languishing beneath the pivotal $2,000 level. Despite spirited attempts to ascend, our intrepid bulls have met with disconcerting difficulty in reclaiming lost territory, leaving ETH in a state of unfortunate fragility.

To herald a true recovery, it would be required that ETH breaches the noble $2,000 level and ventures beyond the hallowed 200-moving average (MA) and exponential moving average (EMA) that reside around $2,400. Succeeding in this endeavor would signal a newfound vigor in buying momentum, perhaps setting the stage for a most splendid rally toward higher realms of resistance.

Conversely, should Ethereum falter in its efforts, the specter of intensified selling pressure may well loom large, escorting ETH towards lower demand territories, possibly grazing the $1,750 mark. To descend below this threshold would only serve to tighten the noose around our bulls, eliciting further melancholy and an expansion of bearish sentiment.

As the market remains delicately poised, ETH’s immediate course hangs in the balance. Our resolute bulls must act swiftly to defend key levels, lest Ethereum risk further plummeting—making a swift recovery a daunting prospect. Tensions rise as each passing day becomes crucial, as ETH traders keep a watchful eye for a breakout or the harrowing possibility of further downward movement in light of prevailing market trends.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-03-16 07:18