Ah, the illustrious President Trump, with his penchant for dramatic proclamations, has decided that a little economic hardship is just what the doctor ordered. Yes, dear reader, while we clutch our Bitcoin (BTC) and Ethereum (ETH) like a child clings to a teddy bear during a thunderstorm, our beloved crypto market finds itself under the weight of his “short-term pain” strategy. Who knew that a mere $9 trillion in US debt could cause such a ruckus?

As the stock market takes a nosedive, shedding an estimated $5 trillion this year, our digital assets are not far behind. Bitcoin has plummeted by a staggering 23% since the grand inauguration day, while Ethereum has taken a more dramatic tumble of 43%. It seems that even the most volatile of assets are not immune to the whims of macroeconomic forces. Who would have thought?

In a twist of fate, The Kobeissi Letter, that oracle of financial wisdom, claims that Trump had this grand plan in mind even before he took office. But it wasn’t until March 6 that he decided to share his epiphany with the world. “The stock market is not driving outcomes for this administration,” he declared, as if the stock market were a wayward child needing discipline. And let’s not forget the Treasury Secretary’s nonchalant remark about volatility—because who doesn’t love a little chaos in their financial life?

As we navigate this “period of transition,” one can’t help but wonder if the administration’s focus on 2025 is merely a clever ruse to distract us from the impending doom of $9.2 trillion in maturing debt. Ah, the sweet scent of recession wafting through the air! It’s almost poetic, really.

And what of oil prices, you ask? They’ve plummeted by over 20% since Trump took the reins. It’s almost as if he’s orchestrating a symphony of economic decline, with each note played in perfect harmony with his desire to lower inflation. “What would lower oil prices?” you ponder. Why, a recession, of course! It’s the gift that keeps on giving.

Meanwhile, the administration’s love affair with tariffs is chipping away at GDP growth estimates, as if they were sculptors carving a masterpiece of economic slowdown. And let’s not forget the curious case of DOGE and its leader, Elon Musk, who seems to have accepted the short-term declines with a shrug and a promise that “it will be fine long-term.” Ah, the optimism of the rich!

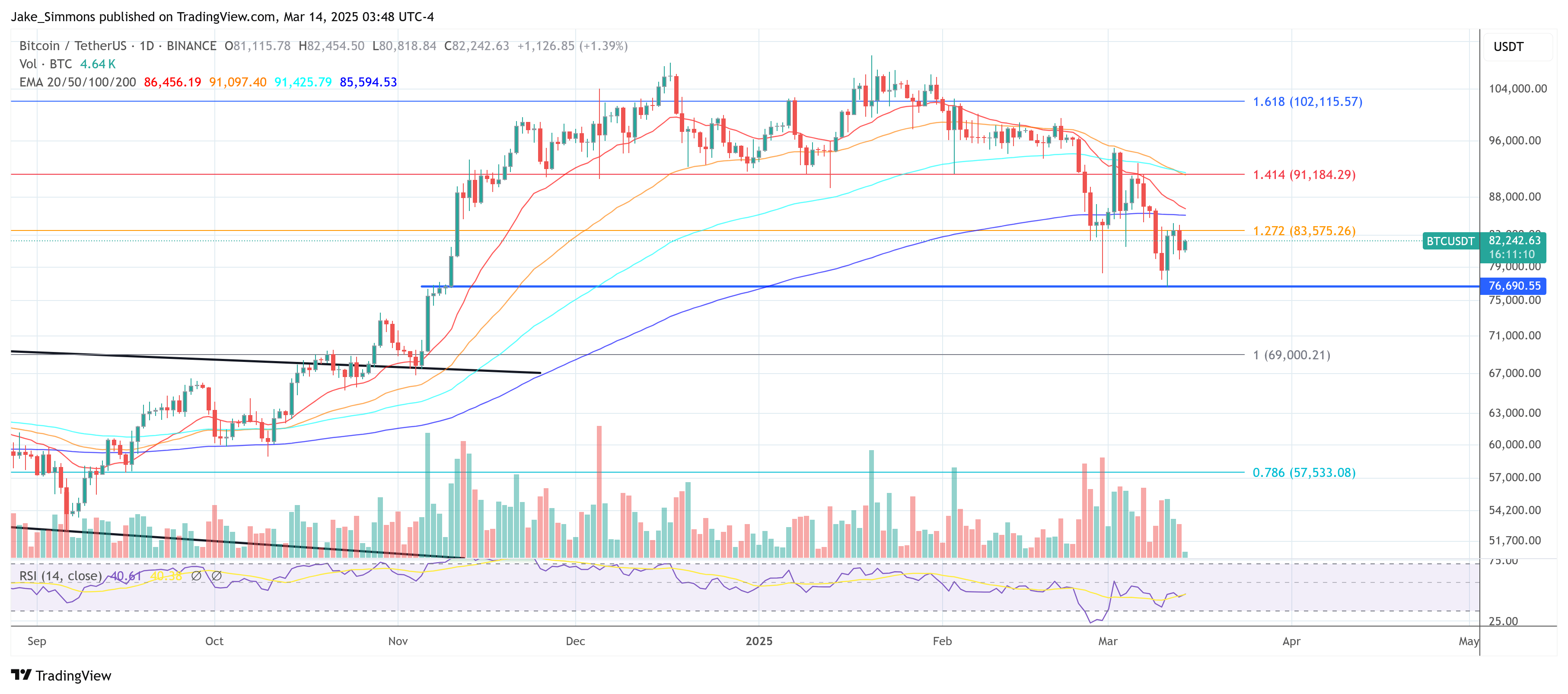

For those brave souls trading in this tumultuous market, the question remains: will Trump’s “short-term pain” lead to a long-term gain? Or will we find ourselves in a never-ending cycle of economic despair? As the price of BTC hovers around $82,000, one can only hope that laughter will be our saving grace in these trying times.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2025-03-14 20:15