“Bitcoin on the Brink? 😱 Why Everyone’s in a Tizzy Over This Ugly Start to the Week!”

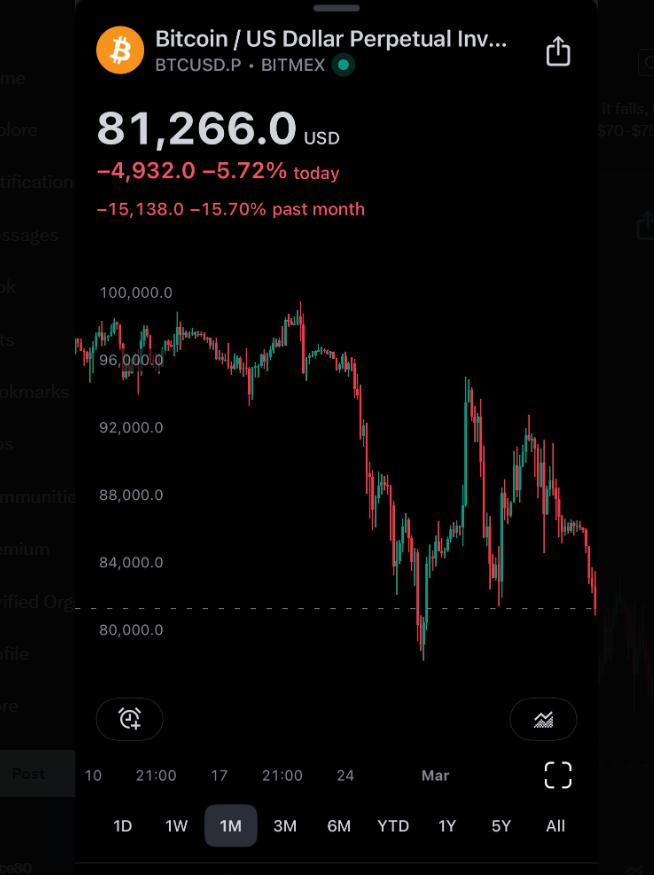

Gadzooks, dear reader! It appears our old friend Bitcoin has taken yet another swan dive, plummeting to the vicinity of $80,000 and causing the crypto crowd to clutch their pearls and order another round of espresso martinis. This latest pratfall comes hot on the heels of what had been a rather pleasing stretch of gains. Now, traders are torn between filing this under “just one of those things” or preparing to don sackcloth and ashes.

Crucial Heights and Abyssal Depths to Watch

Enter Arthur Hayes, the sage of Maelstrom and BitMEX co-founder, who’s been peering into the crystal ball and doesn’t much care for what he sees. “An ugly start,” he opines with the kind of gravity one reserves for soggy toast. Hayes reckons Bitcoin might find its knobbly knees knocking against the $78,000 mark. Should it fail to bounce back with its customary panache, $75,000 looms large as the next port of call—or perhaps, the next train wreck.

“An ugly start to the week. Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k; if we get into that range, it will be violent.”

— Arthur Hayes (@CryptoHayes) March 9, 2025

Despite the steady drumbeat of Hayes’s prophecies, it appears the greenhorns and neophytes in the crypto market are making a hash of things. Panic selling has turned into the sport of the season—an activity that 10x Research, a self-proclaimed market analysis firm (presumably operating from an undisclosed broom cupboard), has termed a “classic correction.” Jolly vintage term, “classic,” wouldn’t you say?

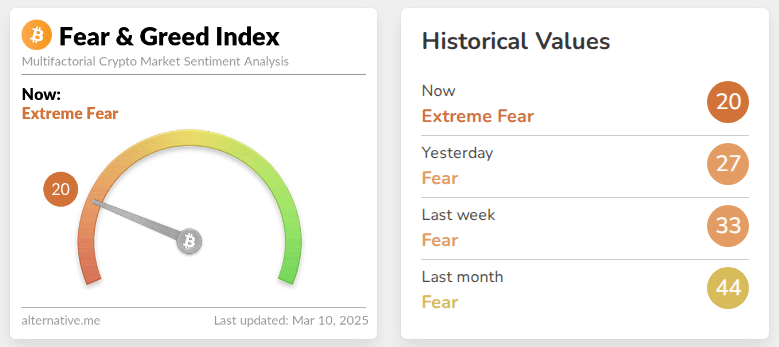

Status: Extreme Fear (Bring Smelling Salts!)

Were you feeling optimistic? Well, perish the thought! The Bitcoin Fear and Greed Index has tumbled to a positively medieval 20, marking “Extreme Fear.” One half expects villagers to descend with pitchforks and torches. Such gloomy sentiment could very well stoke volatility further—though if there’s one thing Bitcoin excels at (besides financial melodrama), it’s volatility.

The options market tells its own tale. With the bulk of positions straddling $70,000 to $75,000, the likelihood of a kerfuffle increases as Bitcoin flirts with these pivotal levels. Traders may soon find themselves juggling their positions like circus clowns handling flaming bowling pins.

Inflation: The Elephant in the Crypto Room

Meanwhile, over in the land of inflation statistics—where men in pinstriped suits sip coffee and nod solemnly—the upcoming US inflation report looms large. A higher-than-expected surge in inflation might force the Federal Reserve to sharpen its monetary daggers, sending ripples through Bitcoin and the rest of its merry band of risk assets. Conversely, if inflation decides to play nice and waft gently downward, it might soothe the markets. One lives in hope.

Finger-drumming across the globe continues as every hodler worth their salt watches that $78,000 threshold like hawks at a buffet. A rally above it could put a spring in Bitcoin’s step, while a tumble below might have it slipping on its banana peel yet again. The road is, as always, fraught with the sort of drama you’d expect in a poorly-written soap opera—bracing, isn’t it?

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-03-10 12:06