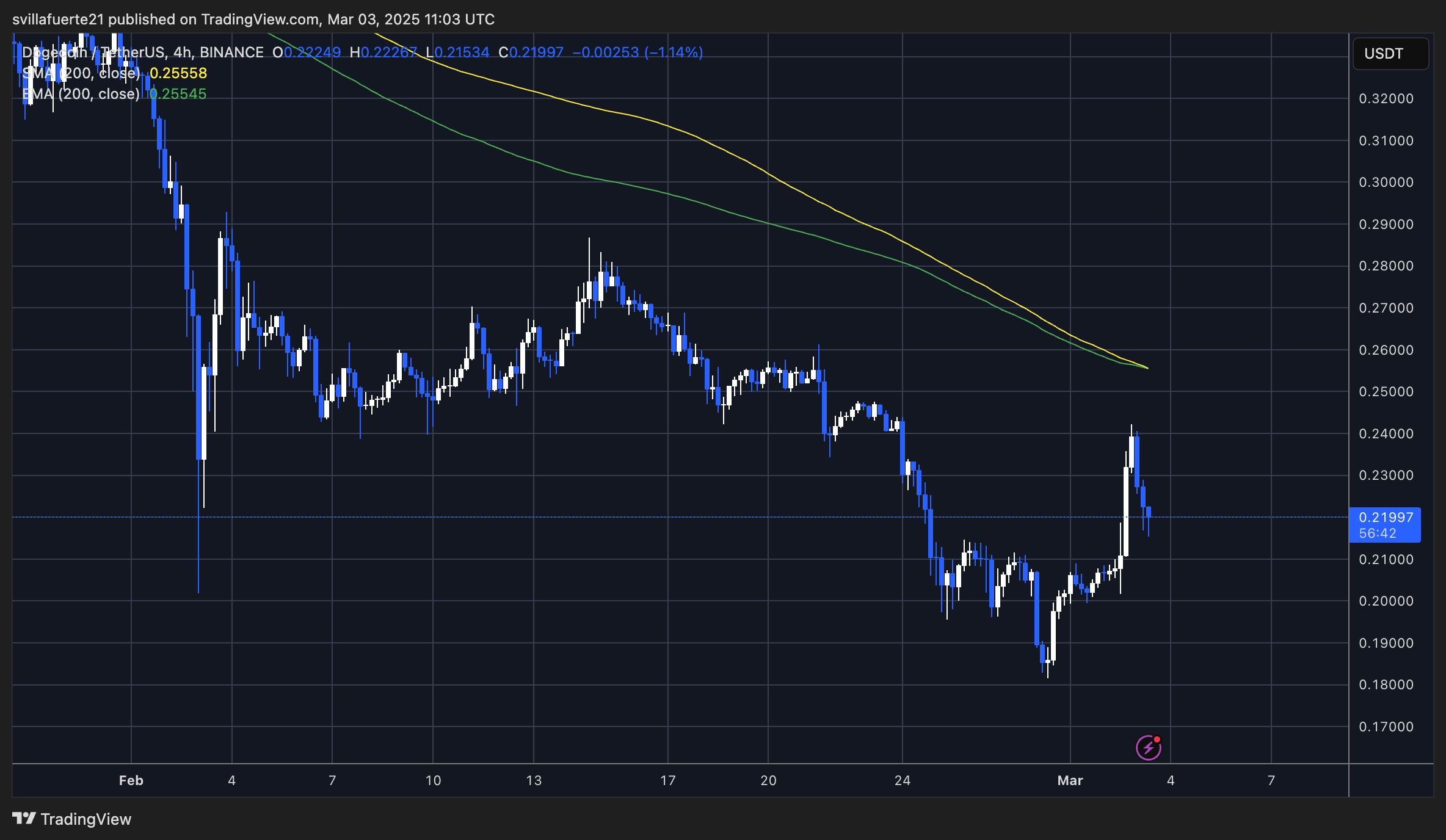

Ah, Dogecoin! The cryptocurrency that started as a joke and somehow became the punchline of a very expensive joke. Currently, it’s trading below key levels, having taken a nosedive of over 10% after last night’s bullish price action. It’s like watching a dog chase its tail—entertaining, but ultimately going nowhere. Since late January, our beloved DOGE has been on a downward spiral, consistently setting lower prices each week. Investors are now as cautious as a cat near a dog park, with selling pressure keeping any meaningful recovery at bay.

But wait! Not all hope is lost! Some analysts, bless their optimistic hearts, are still waving the Dogecoin flag. Top analyst Carl Runefelt recently shared a technical analysis on X (formerly known as Twitter, because why not?) showing that DOGE has broken out of a long-term falling wedge pattern. Yes, a wedge! Not the kind you find in a sandwich, but a technical one that historically leads to significant upward movements—if, of course, the breakout is confirmed. Fingers crossed, everyone!

If Dogecoin can hold its ground above this key level and confirm the breakout, we might just witness a price move that could make even the most stoic investor shed a tear of joy. However, if it fails to hold this level, we could be looking at further declines, pushing DOGE into the dreaded lower demand zones. The next few days are crucial, like the final moments of a reality show where everyone is waiting to see who gets voted off the island.

Investors Keep Selling Dogecoin: Can This Change?

Dogecoin is facing a crucial test, much like a student cramming for finals. It’s trying to break above key resistance without falling below critical demand levels. The bulls are working hard to reclaim lost territory, hoping to ignite a significant rally, but the price action remains as uncertain as a cat’s loyalty.

The meme coin market is under intense selling pressure, and Dogecoin is struggling to establish strong demand, despite multiple breakout attempts. Investors are watching for signs of strength, but so far, the bulls have been about as effective as a chocolate teapot in generating momentum for a sustained recovery.

Runefelt’s technical analysis reveals that DOGE has recently broken out of that long-term falling wedge pattern and is now retesting it. If it holds, Runefelt has set a price target of $0.434 in the coming weeks. That’s right, folks, we’re talking about a potential price that could make your morning coffee seem cheap!

However, let’s not get too carried away. The broader crypto market is still as directionless as a lost tourist, especially with Bitcoin hanging around below the $100K level. Since BTC is the big boss of the crypto world, meme coins like Dogecoin are likely to follow its lead. If Bitcoin manages to reclaim key levels, DOGE could experience a price surge faster than you can say “to the moon!” But if uncertainty continues to reign, well, let’s just say the upside potential might be limited—like a dog with a short leash.

DOGE Testing Short-Term Liquidity

Currently, Dogecoin is trading at $0.21 after a strong 33% rally over the past few days. The bulls have gained a slight advantage, pushing the price above key resistance levels. But for DOGE to maintain this momentum, it must hold above the critical $0.20 mark, which now serves as short-term support. It’s like trying to balance on a seesaw—one wrong move and it’s all over!

If the bulls can successfully reclaim $0.255 in the coming days, Dogecoin could see a significant breakout, leading to a massive recovery phase. A move above this level would confirm a bullish reversal and potentially trigger further buying pressure, sending DOGE toward higher resistance zones. It’s like watching a dog finally catch that elusive squirrel!

However, the market remains as volatile as a toddler on a sugar high, and losing the $0.20 level could quickly reverse recent gains. If DOGE fails to hold this support, a 15% drop could follow, bringing the price back into lower demand zones. Traders are watching Bitcoin’s movements closely, as any major BTC sell

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2025-03-03 18:41