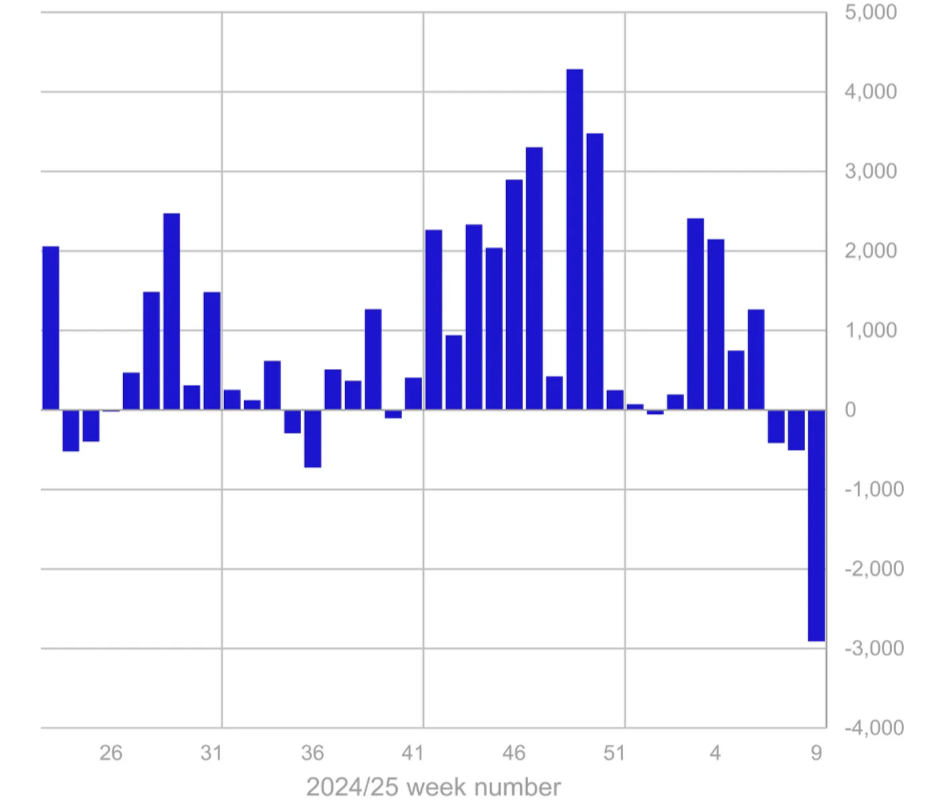

In the wake of last week’s savage rout of the crypto marketplace, where Bitcoin audaciously flirted with the sub-$80,000 brink, cryptocurrency exchange-traded products (ETPs) found themselves in a no-man’s land, suffering a grotesque $2.9 billion exodus. Few could have predicted that we’d witness three consecutive weeks of such melodrama, culminating in the remarkable evaporation of over $3.8 billion, as chronicled by none other than the insightful scribes at CoinShares. One can only assume this is what they mean by “blood in the water.”

Among the torrents of calamity that sparked this financial bloodbath were the ever-persistent specter of the $1.5 billion Bybit hack and the rather scathing pronouncements from the US Federal Reserve. “These delightful revelations have likely prompted a cocktail of profit-taking and a general malaise regarding the asset class,” quipped James Butterfill, the so-called oracle of CoinShares. Because when do cautious whispers ever lead to happy tidings?

Source: CoinShares

Over the past week, Bitcoin has firmly established its position as the head honcho of outflows from these ETPs, with a staggering $2.6 billion flying the coop. To add insult to injury, its month-to-date (MTD) outflows reached a rather grim $3.2 billion. Contrast this with the smattering of interest in short Bitcoin ETPs, which managed to entice a feeble $2.3 million, merely indicating that perhaps not everyone is entirely disenchanted with bearish positions.

The Ethereum Exodus

Not to be outdone, Ethereum ETPs also joined the outflow parade, with a respectable $300 million departing last week. Yet, like a bad penny, Ethereum has a way of returning, boasting positive month-to-date inflows totaling $490.3 million. It’s as if the market has decided that a little doom is just what the doctor ordered.

On the fringes, some altcoins have managed to maintain a modicum of grace. For instance, Sui (SUI) has made a bold showing, basking in $15.5 million of fresh inflows, a curious juxtaposition to Bitcoin’s funeral procession. Similarly, the XRP-based ETPs have serenely garnered $5 million in investor affection, demonstrating that not all hope is lost within this quagmire of despair.

The sell-off has also been mercilessly unkind to the total assets under management (AUM) for crypto ETPs, which have seen a plummet to $138.8 billion. This is a considerable descent from the dizzying heights of $173 billion recorded earlier this year—one can almost hear the collective gasps of the investment community!

Spot Bitcoin ETFs: An Outflow Fable

In a dramatic twist, the outflows from spot Bitcoin ETFs surged mercilessly until they astonishingly reclaimed positivity on February 28. One must applaud BlackRock’s iShares Bitcoin Trust (IBIT) for achieving an impressive milestone: its largest weekly outflows since its inception, totalling $1.3 billion. Nevertheless, they had barely caught their breath from the previous week’s outflows of $22 million.

Despite this remarkable exodus, BlackRock’s IBIT remains somewhat buoyant with $3.2 billion in net inflows year-to-date, totaling a jaw-dropping $51 billion in assets under management. Meanwhile, Grayscale Investments’ ETFs wallowed in modest outflows of $421 million—the kind of figures that make one question their life choices.

In stark contrast, ProShares ETFs emerged as the lone beacon of optimism, basking in $76 million of inflows during this tumultuous period. Now hailed as the second-largest ETF issuer after BlackRock, ProShares has accumulated a total of $349 million in year-to-date inflows. A splendid performance indeed, considering the circus of chaos unfolding all around!

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-03-03 17:17