One can almost hear the distant sound of a gong being struck as the on-chain data reveals the number of Bitcoin loss addresses has soared, following the cryptocurrency’s rather impolite dip toward the $87,000 mark. 📉

Bitcoin, that capricious scamp, had already been striding along a bearish path this month, but it seems the little rascal has decided to accelerate its decline in the last 24 hours, dropping by a rather alarming 7%. 🤯

Below is a chart that illustrates the coin’s rather precipitous fall:

From the graph, one can see that BTC momentarily dipped below the $87,000 threshold, but it appears to have found a small measure of redemption, rebounding to $89,000. Of course, Bitcoin hasn’t been the only one to take a tumble; the rest of the digital asset sector has also found itself in a bit of a pickle, with most altcoins posting even worse returns. 🥲

The derivatives market, never one to miss a crisis, has seen severe liquidations, with a staggering $1.5 billion in liquidations over the past 24 hours, according to CoinGlass. A veritable feast for the vultures, one might say. 🦅

A natural consequence of this market maelstrom has been a significant shift in BTC’s profit-loss distribution. More than 12% of BTC addresses are now underwater, the highest level since October of last year. A rather damp squib for those hoping for a sunny spell in the crypto world. 🌦️

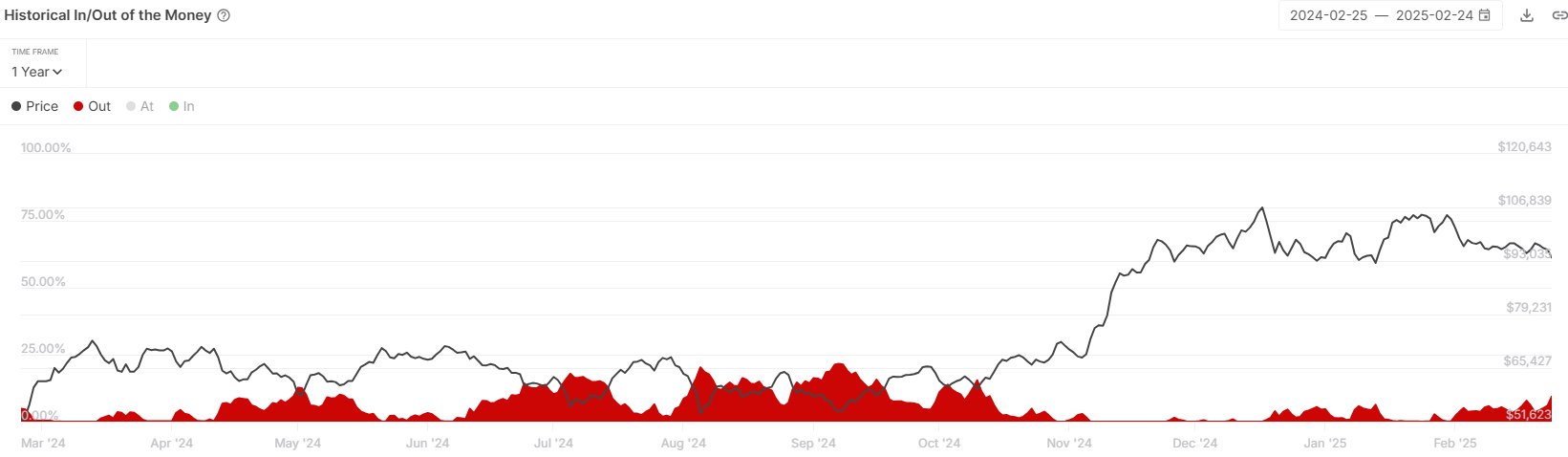

In a recent post on X, the market intelligence platform IntoTheBlock has shed some light on the latest trend in its Historical In/Out of the Money indicator. This metric, a veritable treasure trove of information, breaks down BTC addresses into profit, loss, and break-even categories.

The indicator works by delving into the transaction history of each address to determine the average price at which the coins were acquired. If this cost basis is greater than the current price, the address is deemed to be ‘out of the money,’ a rather unfortunate state of affairs. Conversely, those with a cost basis lower than the current price are ‘in the money,’ a much more desirable position. Addresses with an average acquisition price equal to the BTC spot value are, quite simply, breaking even. 🤷♂️

Here is the chart for the indicator, which shows the trend in the Out of the Money portion of the Bitcoin userbase:

As the chart clearly illustrates, the metric has risen in tandem with the latest BTC price crash, with a significant number of addresses now in the red. Over 12% of Bitcoin holders are currently underwater, a state of affairs that would make even the most stoic investor reach for the smelling salts. 💀

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-02-26 03:41