Ah, Bitcoin, that elusive digital currency that seems to have more ups and downs than a particularly indecisive kangaroo. Just when you thought it was safe to venture into the crypto waters, it plummets below the $95,000 mark, leaving analysts scratching their heads and wondering if they should have taken up knitting instead. 🧶

Bitcoin’s Monday Meltdown

In a plot twist worthy of a soap opera, Bitcoin has decided to take a nosedive, dropping a staggering 5.7% from its Friday highs. It was all sunshine and rainbows when the US Securities and Exchange Commission decided to withdraw its crypto case against Coinbase, allowing Bitcoin to flirt with the $99,000 mark for the first time in a fortnight. But alas, the joy was short-lived! 😱

Just as the crypto community was ready to pop the champagne, Bybit, one of the largest crypto exchanges, was hit by a $1.5 billion hack, making off with a staggering 401,347 ETH. Talk about a party crasher! 🎉 As a result, Bitcoin and its crypto pals lost their momentary gains faster than you can say “blockchain.”

Now, Bitcoin is stuck in a limbo between $95,000 and $96,000, with a brief flirtation with the $97,000 resistance on Saturday. But come Monday, it decided to take a trip down memory lane, hitting a one-week low of $93,800. How nostalgic! 🕰️

According to our resident analyst, Jelle, Bitcoin has developed a rather unfortunate habit of dumping just as the New York markets open. It’s like clockwork! Every week, it retraces its early Monday recoveries, leading to a red Monday close that has become as predictable as a cat knocking over a glass of water. 🐱💦

Despite these dramatic twists and turns, Bitcoin has managed to stay within its post-election range since November, showing about as much volatility as a sloth on a lazy day. It’s been hovering between the $96,000-$102,000 mid-zone, which is about as exciting as watching paint dry. 🎨

In the midst of this rollercoaster, Altcoin Sherpa pointed out that, aside from February 18, Bitcoin hasn’t closed below its daily support zone in over a month. It’s like a stubborn toddler refusing to go to bed! To keep the peace, BTC needs to close above $95,700. 🛏️

BTC’s Bullish Flag Fiasco

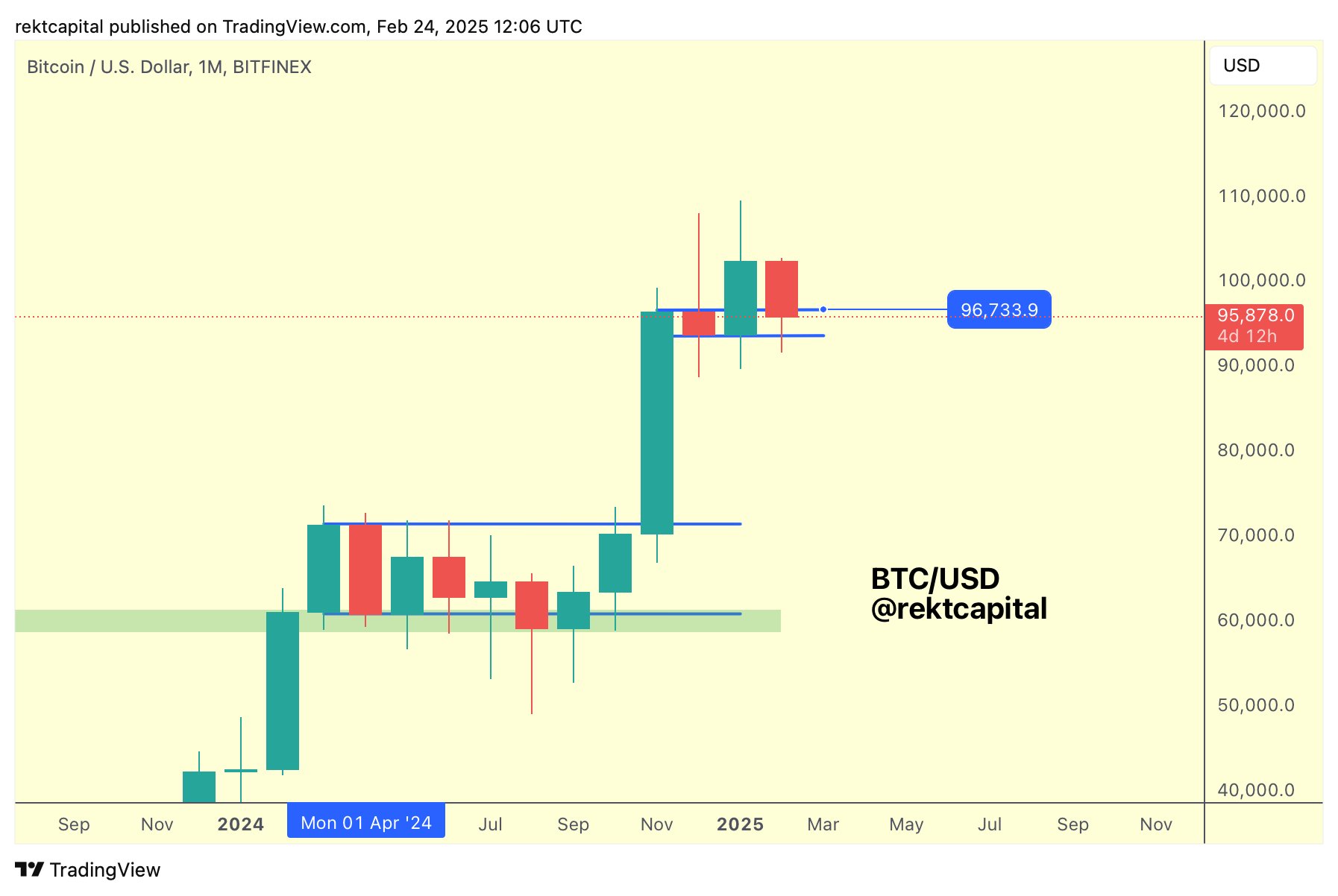

Meanwhile, Rekt Capital has chimed in, declaring that BTC needs a monthly close above $96,000 to keep its bullish long-term trend alive. In January, Bitcoin had a moment of glory, closing above the $100,000 mark for the first time, which was celebrated like a national holiday. 🎊

This glorious close confirmed Bitcoin’s breakout from its post-election monthly bull flag. But now, it seems Bitcoin is having a bit of an identity crisis, retesting its breakout level and momentarily losing it. It’s like a teenager trying to find their style—one minute it’s punk, the next it’s preppy! 👖👔

According to our analyst, for Bitcoin to confirm its breakout and set itself up for trend continuation, it needs to reclaim and close February above $96,700. It’s like trying to convince a cat to take a bath—good luck with that! 🐾

Rekt Capital concluded that while BTC’s daily close is important, it’s not the end of the world. The higher timeframe signal is what really matters, as the bull flag bottom continues to hold as support. It’s like a safety net for our dear Bitcoin! 🎪

As of this very moment, Bitcoin is trading at $94,165, a 2.1% decrease in the daily timeframe. So, grab your popcorn, folks; this crypto drama is far from over! 🍿

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County secret bunker location – DayZ

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2025-02-25 09:05