In the grand theater of the cryptocurrency market, where fortunes are made and lost with the flick of a digital switch, a most unfortunate spectacle has unfolded. The past day has witnessed a veritable bloodbath in the realm of crypto derivatives, as Ethereum and its beleaguered brethren, the altcoins, have plummeted into the abyss.

Oh, the Altcoins! Liquidation Galore!

According to the oracle known as CoinGlass, the cryptocurrency futures market has been besieged by a tidal wave of liquidations. The term “liquidation,” dear reader, refers to the rather unceremonious closure of open contracts, forced upon them by the cruel hand of fate when their losses reach a certain threshold. It is a fate akin to being unceremoniously tossed out of a party you thought you were invited to.

When a multitude of liquidations occurs simultaneously, the event is whimsically dubbed a “squeeze.” The likelihood of such a squeeze is dictated by two capricious factors. The first is volatility, that fickle mistress, for a more pronounced swing in price means that a greater number of contracts find themselves in the red, much like a hapless traveler lost in a snowstorm.

The second factor is leverage, that double-edged sword wielded by traders in the derivatives market. Leverage allows one to borrow against their initial collateral, amplifying both profits and losses. It is a tempting siren’s call, but alas, when the tides turn, it is all too easy to find oneself shipwrecked on the shores of liquidation.

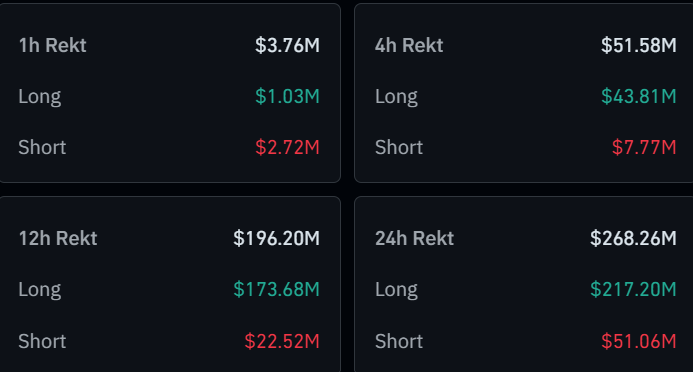

In the wild world of cryptocurrency, where assets dance to the tune of volatility and positions are often overleveraged, the specter of a squeeze looms large. And lo! In the past day, the market has once again been gripped by a surge of volatility, leading to yet another liquidation squeeze. Behold, a table that elucidates the grim statistics of this event:

As the data reveals, the cryptocurrency derivatives sector has recorded a staggering total of $268 million in liquidations over the last 24 hours. Of this, a hefty $217 million was attributed to bullish bets—oh, the irony! The long contract holders, those optimistic souls, have borne the brunt of this calamity, as the altcoins have succumbed to a price crash.

Now, let us gaze upon a heatmap that illustrates the contributions to this unfortunate squeeze from individual assets:

Typically, Bitcoin (BTC) would reign supreme in such a list, but this time, it appears to have taken a backseat, failing to even secure a spot in the top two. This is due to its relatively stable performance amidst the chaos that has engulfed the altcoins.

Ethereum (ETH), the heavyweight among altcoins, has been the chief contributor to the liquidations, with a staggering $56 million wiped out. Solana (SOL), the unfortunate soul that has faced the steepest decline among the top ten digital assets, follows closely behind with $33 million lost. Truly, a tale of woe!

The Price of ETH: A Comedy of Errors

Ethereum, having made a valiant attempt at recovery over the weekend, has already retraced its gains as the new week dawns, plummeting by 4% to a mere $2,700. Such is the capricious nature of this digital realm, where fortunes can vanish faster than a magician’s rabbit!

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-02-25 01:35