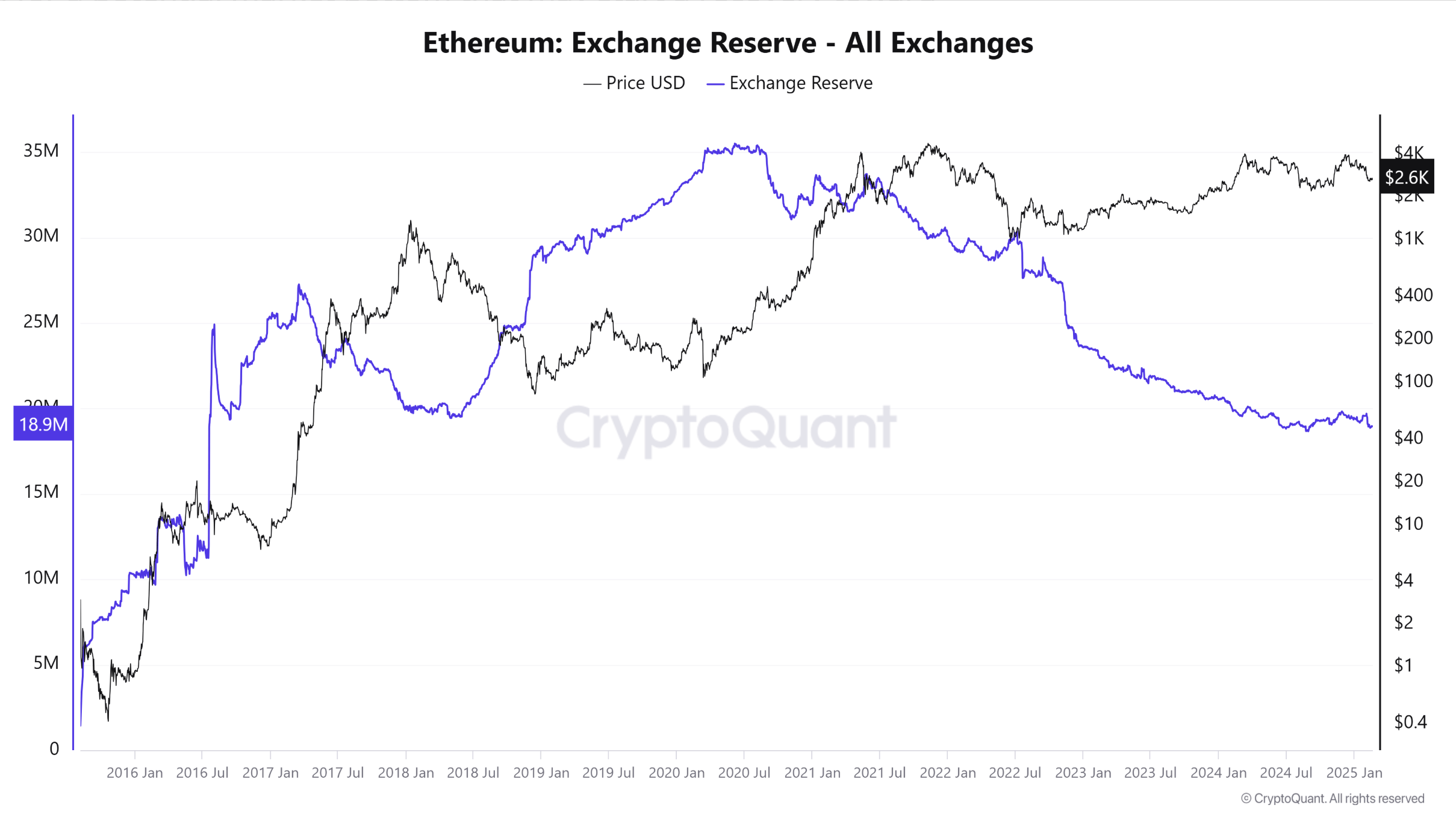

Ah, Ethereum—the digital coin equivalent of that one introverted poet at a party of extroverts. According to the soothsayers over at CryptoQuant, Ethereum (ETH) reserves on centralized exchanges have now plummeted to a 9-year low. And no, that’s not because someone misplaced the keys to the crypto vault. Apparently, this shortage might trigger a so-called “supply shock.” Sounds serious, doesn’t it? Well, it isn’t unless you’re allergic to money falling from the skies. 💸

Ethereum Reserves: Lower Than Your Wi-Fi at a Conference

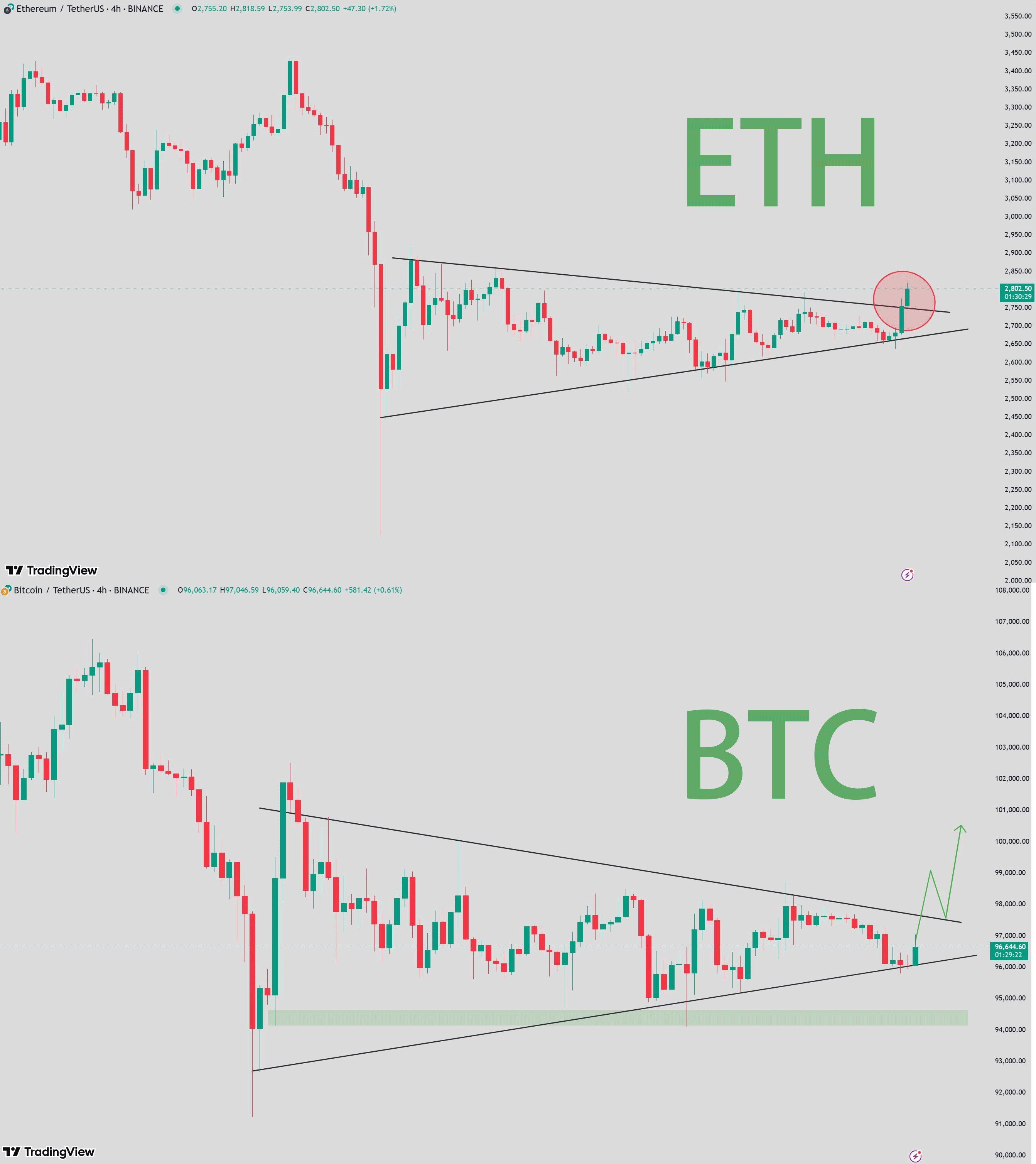

Currently marketed as the world’s second-favorite cryptocurrency (sorry, Doge fans), Ethereum remains stuck in the mid-$2,000s, trading at a very poetic $2,721. While its older sibling Bitcoin keeps stealing the headlines, ETH is apparently having a quiet 2024. “Quiet” here is crypto-speak for “failing to break out of the $3,000 dungeon.” 🏰

Investor confidence, unsurprisingly, is about as strong as wet tissue paper. However, ETH has managed to cling to its $2,380-$2,460 safety pillow, teasing hopefuls into believing it might actually do something interesting, someday. Maybe even in our lifetimes. Meanwhile, ETH on exchanges keeps vanishing faster than snacks at a goblin party—a scenario analysts lovingly call a “supply shock.” Imagine running out of coffee during an all-nighter; it’s like that, but with money.

Let’s face it, nobody likes a sudden shortage, unless you’re in the diamond business or cornering the market on Beanie Babies. With only 18.95 million ETH left on centralized exchanges, the last time we saw such low reserves, dinosaurs were trading pogs and ETH was priced at a hilarious $14. Perspective, folks.

The legendary Crypto Buddha (no, not an actual Buddha) claims ETH might be gearing up for a “major price move.” Oh, the suspense. Analysts point to diagonal resistance levels, breakout patterns, and other things that sound suspiciously like a fortune teller reading tea leaves. 🍵

ETH Investors: The Eternal Diners at the Hope Buffet

Comparatively, competitors like Solana (SOL), Sui, and XRP have been throwing market parties while ETH sulks in a corner. Bullish momentum? What’s that? Who’s she? Now, ETH holders are desperately clinging to optimistic predictions of “the most hated rally.” A phrase that sounds more like a rejected movie title.

Yet, concerns persist. Rumors of the Ethereum Foundation offloading truckloads of ETH onto the market are doing the rounds. But, let’s be honest, at least they aren’t throwing wild yacht parties with it. Probably. As of now, ETH is sitting comfortably uncomfortable at $2,721, down 4.7% in the last 24 hours. Who doesn’t love a sale, right? 📉

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2025-02-19 05:47