Ethereum, that darling of the digital realm, has experienced a rather dramatic revival, soaring to heights hitherto unseen. Reaching the dizzying altitude of $2,750, the crypto darling is now flirtatiously eyeing a rendezvous with the coveted $3,000 mark. Oh, the audacity! 🤑

One might think such a performance would be accompanied by a symphony of triumphant trumpets, but alas, dear reader, the reality is far more prosaic. This ethereal rise comes amid the broader crypto market’s general convalescence. Even the grand pronouncements of Donald Trump’s DeFi venture, the rather grandly named World Liberty Financial, have failed to stir the soul of this once-mighty beast. 🙄

On the monthly chart, our beloved Ethereum has suffered a rather embarrassing 17% decline. But, fret not, my dear friends! The analysts, those prophets of the digital age, continue to whisper of a glorious future, a time when Ethereum will reign supreme. 🔮

The digital seers at CryptoQuant, those keepers of the cryptic codes, have revealed a fascinating insight into the heart of Ethereum. Their “realized price” metric, an indicator of the average price at which all ETH was last transacted, currently sits at a rather uninspiring $2,263. This level was achieved on February 3, following a market correction that would make even the most seasoned investor blush. 😳

These “realized price bands,” like the celestial rings around Saturn, offer a glimpse into Ethereum’s potential support and resistance levels. The upper band, a beacon of hope, lies 2.3 standard deviations above the realized price, while the lower band, a cautionary tale, lies 0.5 standard deviations below. According to the soothsayers, Ethereum’s market cycle tops and bottoms often occur near these celestial markers. 💫

Source: CryptoQuant

The Ethereum Foundation: A Patron of the Arts? 🎭

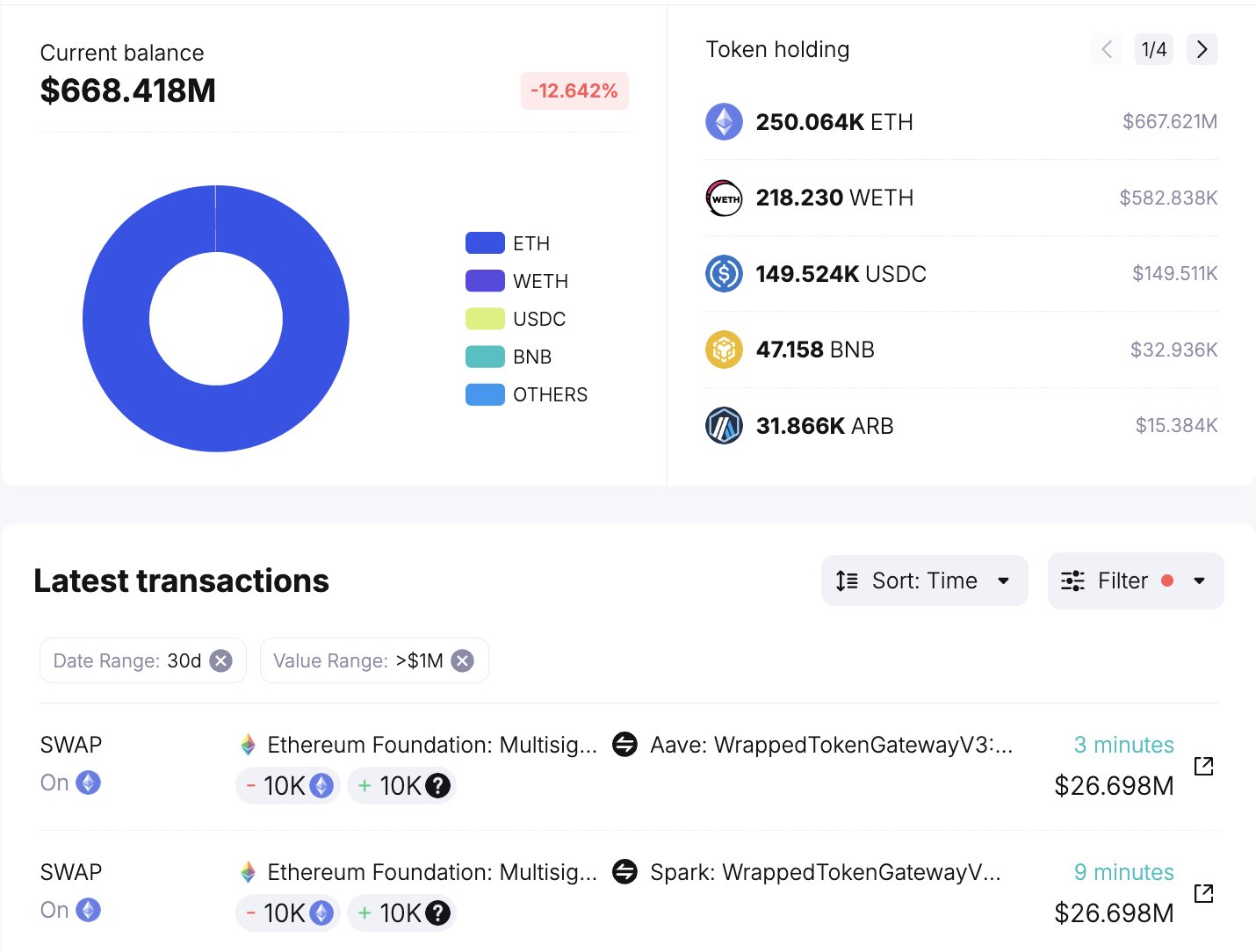

In a move that has even the most cynical observers scratching their heads, the Ethereum Foundation, that enigmatic guardian of the digital realm, has taken a rather unexpected detour into the world of DeFi. They have showered two rather prominent DeFi projects, Spark and Aave, with a rather generous gift: 10,000 ETH each, a sum worth a princely $26.7 million. 💰

Source: Spot On Chain

This rather surprising act of philanthropy, this patronizing of the arts, is a testament to the foundation’s commitment to the growth and adoption of DeFi. Spark, a project focused on enhancing blockchain-based financial services, and Aave, a leader in decentralized lending, are both prominent players in the DeFi arena. 👑

21Shares: A Staked ETF to Rule Them All? 👑

The Chicago Board Options Exchange, that bastion of the financial world, has filed on behalf of 21Shares to list a staked Ethereum ETF. This, dear reader, is a rather significant event. The 19b-4 filing, a document that would make even the most seasoned lawyer weep, requests staking privileges for the Ethereum holdings of all US ETF issuers. 📜

James Seyyfart, that wise sage of Bloomberg ETF strategists, has declared: “This, I believe, is the first ETF to file with the SEC and request the ability to permit staking. The final deadline for this filing will be somewhere around the end of October”. 🤔

This innovative product, a true marvel of the digital age, will offer a “point-and-click” staking feature, a testament to the simplicity of our times. ETH, once the realm

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- POPCAT PREDICTION. POPCAT cryptocurrency

2025-02-13 13:32