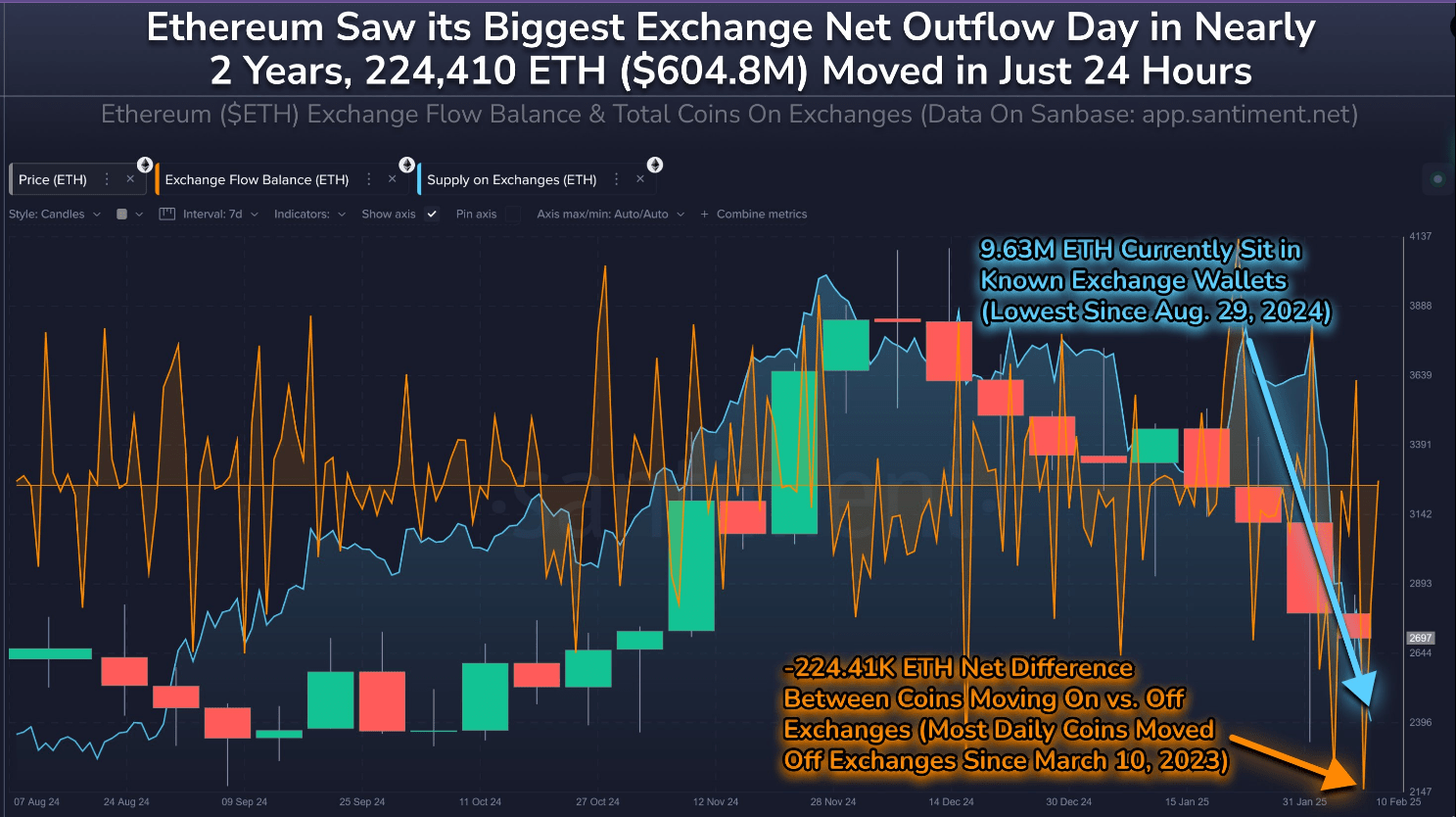

So, get this: over 224,410 Ethereum tokens just vanished from exchanges in the last 48 hours. Poof! 💨 It’s like a magic trick, but instead of a rabbit, we’ve got a massive wave of withdrawals shaking up the whole cryptocurrency scene. According to some fancy data from Santiment, this is the biggest net outflow we’ve seen in almost two years. I mean, who knew Ethereum could pull off such a disappearing act?

Now, analysts and market watchers are scratching their heads, trying to figure out what this means for the second-largest cryptocurrency in the world. Spoiler alert: nobody really knows! 🤷♂️

The Raw Numbers Behind The Movement

Let’s talk numbers, shall we? When you look at the market value, the scale of these withdrawals is downright jaw-dropping. We’re talking billions of dollars’ worth of Ethereum just waltzing off exchanges like it’s no big deal. I mean, who needs that kind of cash flow, right?

There was a historic milestone of ~224,410 ETH moving away from exchanges in the 24 hours between February 8th and 9th. This was the most amount of net coins moving off of known exchange wallets in a single day in 23 months. Can you believe it?

Though more of a long-term metric, this is a…

— Santiment (@santimentfeed) February 11, 2025

Now, conventional wisdom says that when people start yanking their coins off exchanges, it usually means something big is about to happen. Lower supply? Higher prices? Sounds great in theory! But in the unpredictable world of crypto, it’s like trying to predict the weather in L.A.—good luck with that!

Why Investors Are Playing The Long Game

So, what’s the deal with these withdrawal trends? It looks like the big players are in it for the long haul. They’re not just day trading; they’re moving their Ethereum off exchanges like they’re preparing for a marathon, not a sprint. 🏃♂️💨

This kind of behavior is like a smart investment strategy—sacrificing short-term gains for potential long-term glory. Experts say these sudden shifts often mean that the big fish are feeling pretty optimistic about the future. Or maybe they just really like their cold storage. Who knows?

With billions of ETH now tucked away in cold storage and private wallets, it seems like the big players are quietly gearing up for something big. Or maybe they just want to keep their coins safe from the prying eyes of the internet. Can’t blame them!

Market Dynamics And The Bitcoin Factor

And let’s not forget about Bitcoin! The state of the Bitcoin market is still a huge player in Ethereum’s game. It’s like a buddy cop movie where Bitcoin is the grizzled veteran and Ethereum is the eager rookie trying to keep up. Bitcoin’s price swings still dictate the mood of the entire crypto economy. Talk about pressure!

Analysts are keeping a close eye on some key resistance levels, just waiting for the moment when a Bitcoin breakout could send Ethereum soaring. It’s like waiting for the other shoe to drop, but in a much more exciting way!

Technical Evaluation Indicates A Possible Breakout

As the dust settles on this record-breaking 224,410 ETH transfer, the crypto community is on the edge of their seats. This isn’t just a record; it’s a game-changer for the conversation around Ethereum’s market dynamics. Buckle up, folks! 🚀

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-02-13 00:06