Ethereum Spot ETFs have been making waves in the financial world, leaving even the most seasoned investors scratching their heads. In a surprising turn of events, these ETFs managed to rake in double the amount of net inflows compared to their Bitcoin counterparts in the first week of February 2025, all while Ethereum’s price was on a downward spiral!

Ethereum Spot ETFs: The More You Look, The Less You Understand!

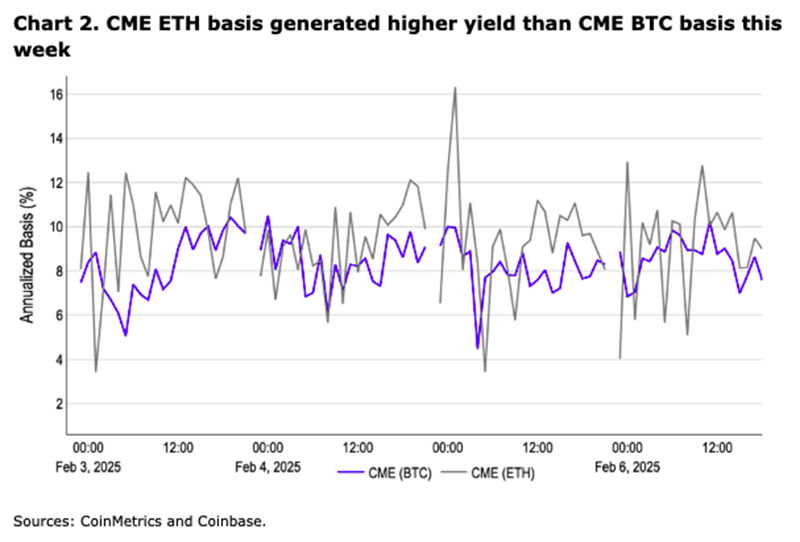

Despite Ethereum’s price taking a tumble, the Ethereum Spot ETFs experienced a whopping $420 million in net inflows! This was in stark contrast to the Bitcoin Spot ETFs, which only managed to pull in $203 million during the same period. According to Coinbase analysts, this unexpected turn of events can be attributed to a sudden surge in interest in ETH as a preferred asset for CME basis trading over Bitcoin.

For those not in the know, CME basis trading is a popular strategy where market participants go long on an asset in the spot market and short in the future market, hoping to profit from the difference in market prices. And, as it turns out, the CME ETH basis trade produced a higher gain (16%) compared to Bitcoin (10%) over the last week, sparking increased institutional interest in the Spot ETFs.

Of the reported net inflows in the Ethereum ETF market, BlackRock’s ETHA remains the darling of investors, with total net deposits of $286.81 million. Fidelity’s FETH comes in a close second, with aggregate investments of $97.28 million. Grayscale’s ETHE, Bitwise’s ETHW, and 21 Shares’ CETH also managed to record modest net inflows between $4 million – $18 million. However, Invesco’s QETH, Franklin Templeton’s EZET, and VanEck’s ETHV all recorded zero net flows.

ETH Price: A Wild Ride Indeed!

At the time of writing, Ethereum is trading at $2,681, following a 1.46% rise in the last 24 hours. However, daily trading volume is down by 45.15% and is now valued at $16 billion. According to its daily trading chart, the Ethereum Relative Strength Index currently stands at 34.03 and is heading in an upward direction, suggesting strong potential for a price reversal following last week’s price crash. Market bulls will face stiff resistance in the $3400 price zone, and pushing past this could allow for a return to the local market peak of $4,000.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Who Is Al Roker’s Wife? Deborah Roberts’ Job & Relationship History

- One Piece Chapter 1140 Release Date, Time & Where to Read the Manga

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2025-02-09 20:48