In a recent cinematic spectacle of crypto analysis, the illustrious asif.eth, a sage of the digital coinage realm, has proclaimed that Dogecoin, that whimsical canine currency, is languishing in a state of grievous undervaluation. With a flourish of his analytical wand, he suggests that the coin’s tumultuous correction may have reached its denouement, a narrative spun through the intricate tapestry of Elliott Wave theory, particularly the enigmatic ABC corrective pattern. 🌀

Has Dogecoin Finished Its ABC Correction? 🤔

Our analyst, with the flair of a literary protagonist, recounts the tale of Dogecoin’s meteoric rise, followed by the inevitable descent into the abyss of corrections. “First came the A, then the B—a higher high, a higher low, and finally, the C correction,” he muses, as if narrating a tragicomedy of market misadventures.

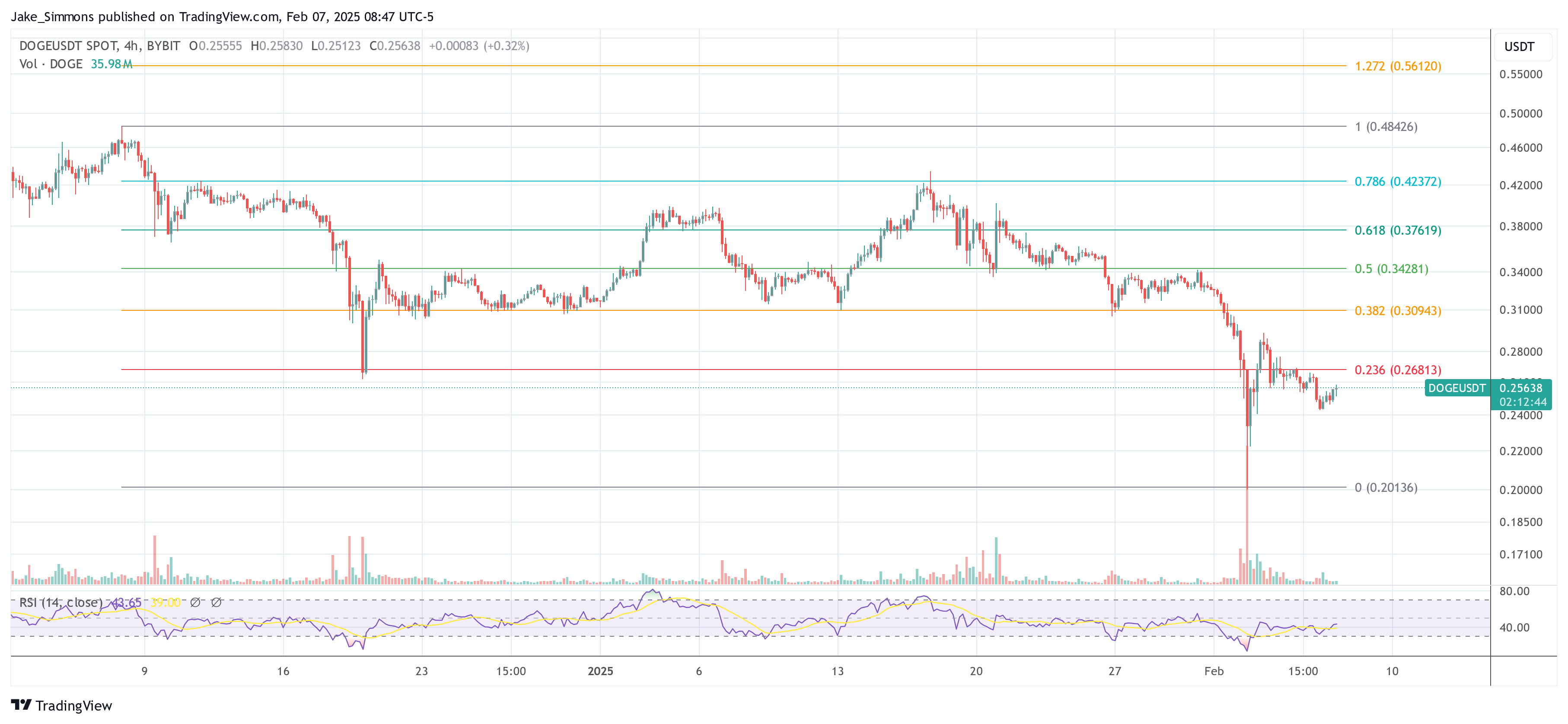

He posits that this final “C wave” has perhaps ushered the token back into a sacred support zone, where the RSI languishes in the oversold territory—a veritable siren call for buyers. Yet, with a wink, he admits the potential for miscounting these waves, as if he were a juggler in a circus of numbers, maintaining that the structure hints at a grand corrective phase nearing its curtain call.

The analyst identifies a price range, a veritable treasure map, stretching from $0.24 to $0.18, which he dubs a “very, very good” spot for accumulating Dogecoin. This zone, he claims, has transformed from a “huge supply” to a “huge demand” area, akin to a bustling marketplace where traders haggle over the last remaining tokens.

However, he warns of the ominous $0.16 threshold, below which he would abandon ship faster than a sailor spotting a storm. “If you break below $0.16, sell that token!” he exclaims, as if issuing a battle cry against the tides of market sentiment. Holding onto an altcoin below such a critical support, he argues, is like clinging to a sinking ship—foolhardy and fraught with peril.

To bolster his case, he invokes the mystical Fib golden pocket, a Fibonacci retracement that aligns with the aforementioned demand region. This confluence, he argues, is a beacon of hope, suggesting that the market views this band as pivotal for Dogecoin’s long-term narrative. “It aligns perfectly with our top supply zone,” he declares, as if unveiling a hidden treasure.

Despite the waning “hype” surrounding Dogecoin, he interprets this as a silver lining, suggesting that the lack of frenzied selling could foster a sense of stability. “No one is selling Dogecoin like hyper aggressively,” he quips, hinting at a calm before the storm, where traders might soon realize the coin has hit rock bottom in its ABC saga.

In his closing remarks, he emphasizes the importance of vigilance. The $0.24–$0.18 corridor is a prime accumulation zone, while $0.16 serves as a clear stop-loss. The price action around these thresholds will determine if the ABC correction is truly at an end. “Dogecoin is looking very, very good and very, very discounted,” he concludes, urging potential buyers to consider the risk-to-reward ratio at a time when many are dismissing the meme coin era as a relic of the past.

As of the latest update, DOGE is trading at a tantalizing $0.25, a price that might just be the beginning of a new chapter in this canine crypto tale.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2025-02-08 03:41