Oh, what a spectacle, dear reader! 🎟️ In the grand theater of blockchain, Solana (SOL) emerged as the belle of the ball, dazzling us with a performance that would make even the most seasoned impresario blush. 🙈

When Solana Met DeFi: A Love Story For The Ages 💘

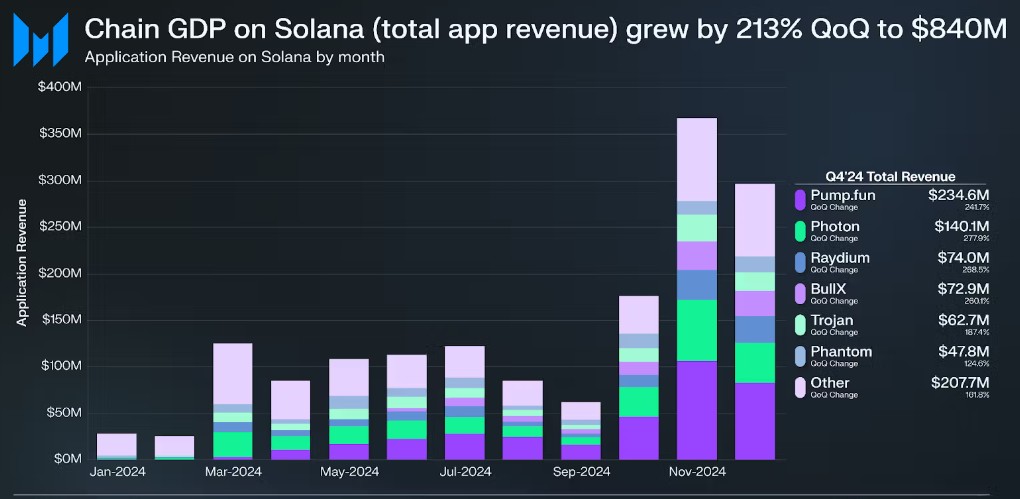

Imagine, if you will, a growth so audacious it could only be described as the blockchain equivalent of the Great Leap Forward. Chain GDP, a measure of total app revenue on Solana’s network, leaped like a salmon in mating season, soaring from $268 million in Q3 to a staggering $840 million in Q4. 🐟💰 November, the month when turkeys dream of freedom, proved to be Solana’s golden goose, laying an egg worth $367 million. 🦆✨

Driving this revenue tsunami were the dynamic duo of Pump.fun and Photon, whose growth percentages would make a math professor blush. Pump.fun, the mischievous one, saw its revenue balloon by 242% to $235 million, while Photon, the quiet genius, exploded with a 278% increase, netting a cool $140 million. 🤑

And what fueled this frenzy? Why, none other than the twin specters of memecoin speculation and AI cryptocurrency launches, a perfect storm of digital whimsy and technological wizardry. 🌀💻

Solana’s DeFi total value locked (TVL) grew like a weed in the garden of financial innovation, reaching $8.6 billion, and thus, our dear Solana ascended to the throne as the second-largest DeFi network, dethroning the once-mighty Tron. 🏆

Stablecoins, those stalwart sentinels of the crypto world, witnessed their market cap swell by 36% to $5.1 billion, placing Solana firmly in the top five stablecoin markets. USDC, the undisputed king, saw its market cap expand by 53% to $3.9 billion, cementing its dominance with a whopping 75% market share. 🎖️

A Tale Of Stakes And NFTs: When Crypto Meets Art 🎨🎲

The liquid staking rate, a measure of how much SOL was being put to work, climbed higher than a mountain goat on a sugar high, reaching 11.2%. This indicated that a whopping 66% of the eligible SOL supply was staked, a testament to the ecosystem’s yield-bearing potential. 🐐📈

The NFT market, that playground of digital art aficionados, saw a slight uptick in activity, with average daily volume increasing by 7% to $2.7 million. Tensor, the star pupil, achieved $103 million in volume, up by 14%, while Magic Eden, the prodigal son, experienced a 28% decline to $68 million. 🎨📉

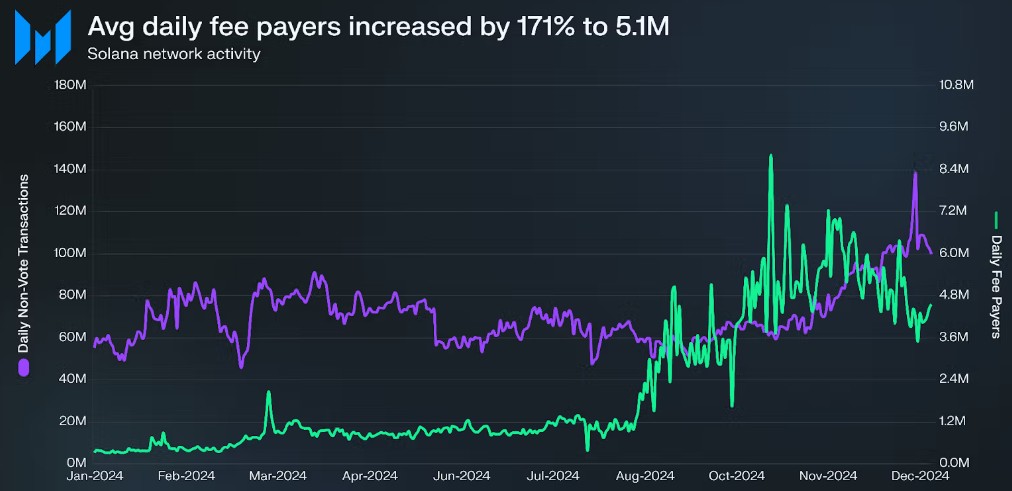

Network activity metrics, those harbingers of user engagement, reflected a bustling bazaar of activity, with average daily fee payers multiplying like rabbits, growing by 171% to 5.1 million. New fee payers, the newcomers to this vibrant scene, surged by 189% to 3.8 million. 🐇📈

But alas, the average transaction fee, that pesky little detail, increased by 122% to $0.05, a small price to pay for the thrill of participating in a network pulsating with speculative energy. 💸⚡

As we close the curtain on this epic tale, let us remember that despite a few stumbles, such as the 5% decrease in staked SOL, attributed partly to the FTX estate unlocking its tokens, Solana’s market cap soared by 27% to $91 billion, peaking at a majestic $120 billion in November. 🌄💰

And so, dear reader, as we bid farewell to this quarter of triumphs and tribulations, know that Solana’s journey is far from over. With a current trading price of $199, down 22% over the last two weeks amidst macroeconomic headwinds, the future remains as uncertain as it is promising. 🌪️🌈

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-02-06 10:38