Right, so the whole crypto shebang, not counting that Bitcoin chappie

BTC

$97 406

24h volatility:

1.1%

Market cap:

$1.93 T

Vol. 24h:

$64.61 B

, has perked up to a jolly $1.23 trillion. And Ethereum

ETH

$2 759

24h volatility:

2.1%

Market cap:

$332.08 B

Vol. 24h:

$46.04 B

, bless its cotton socks, is teetering on the brink of what they call a ‘recovery rally’. Currently, it’s changing hands for $2,764, which, if you squint a bit, looks like a 0.99% improvement over the last day. Jolly good! 🧐

Even though the price seems to be having second thoughts about getting too excited, the general mood in the market is starting to resemble something vaguely optimistic. Could this be the moment Ethereum actually manages a proper, rip-roaring bull run? Let’s have a look-see, shall we? 🧐

Is Ethereum About to Leap Like a Salmon?

Looking at the daily chart, Ethereum has managed a 1.15% bounce after a rather uncouth 5% drop last night. Apparently, this is what the experts call a ‘V-shaped reversal’, attempting to reclaim the high ground of the broken resistance line of that ‘falling wedge’ thingy. Sounds painful. 🤕

And wouldn’t you know it, the Stochastic RSI indicator is waving its arms about, indicating a ‘positive crossover’ in what they term ‘oversold territory’. All of which, I gather, suggests a possible bullish recovery. One can only hope. 🙏

What’s more, this intraday rebound near the lower Bollinger band (whatever that is) gives the impression of a sliver of a chance of a jolly good recovery, as the bulls seem to be hunkering down near the $2,750 support level. Good show! ✊

Ethereum ETF Inflows: A Flood of Fortunes in 2025!

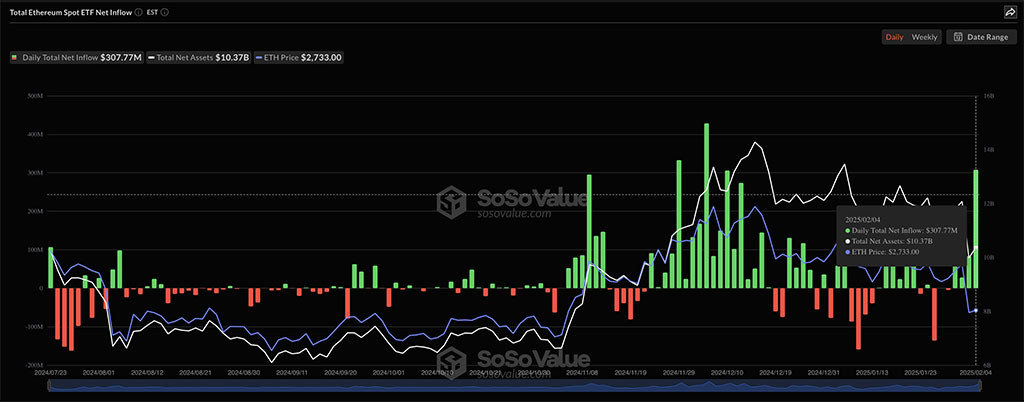

Amidst all this talk of potential bullishness, the big institutions are apparently rather keen on Ethereum’s spot ETFs, bless them. On February 4th, they threw in a net total of $307.77 million. Must be nice. 🙄

BlackRock, the big cheeses, grabbed the lion’s share with $276.16 million, followed by Fidelity with a modest $27.47 million. Bitwise, not to be outdone, chipped in with $4.14 million. The rest, apparently, sat on their hands. 😴

This, so they say, is the highest inflow of 2025 for Ethereum ETFs, indicating growing support for the biggest altcoin. Rather like supporting the largest cake at a village fete. 🍰

Speculation: The Lifeblood of Ethereum’s Bullishness!

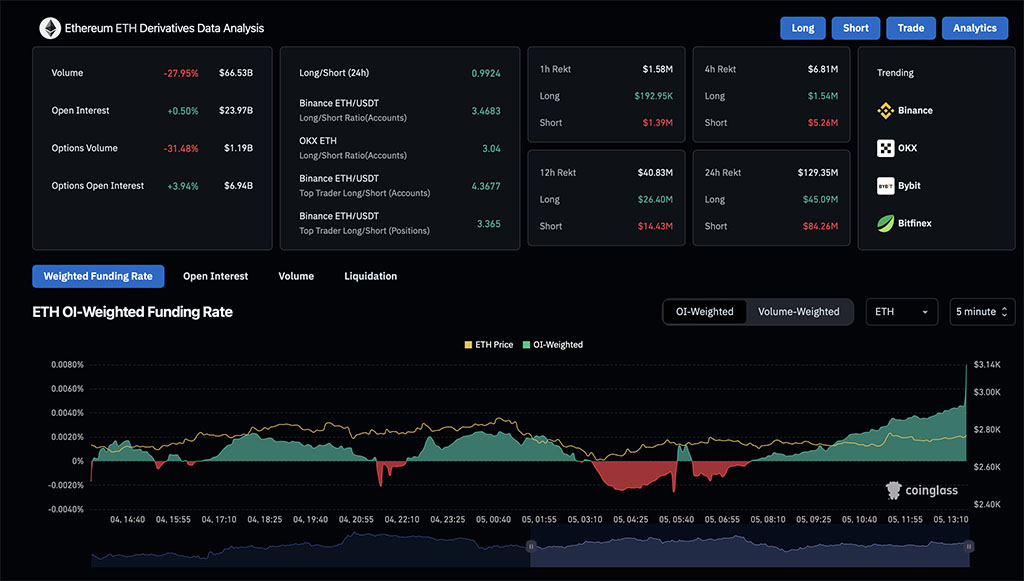

With the rising tide of inflows, the speculation market for Ethereum has gone positively bonkers. A 0.5% surge in open interest, reaching $23.97 billion, means the long-to-short ratio is finally balancing out. A sign, apparently, that the bullish chaps are back in force. 🎉

Furthermore, the funding rate has seen a rather dramatic recovery after that spot of market bother. Jumping from a dismal -0.0013% to a lofty 0.0080%, the bulls are positively thrilled to hang onto their long positions, willingly paying extra for the privilege. One almost admires their optimism. Almost. 😉

Hence, the chatter about Ethereum kicking off a bullish spree has increased significantly. One might even say, it’s reaching fever pitch. 🤒

ETH Price Targets: Giddy Up!

Based on this here price action analysis, a reversal rally will likely joust with the $3,000 mark. This critical zone, now acting as a support-turned-resistance, stands as a formidable wall in Ethereum’s path. 🧱

A breakthrough here, so it’s suggested, will signal a proper bullish recovery, potentially soaring above the $4,000 level. On the flip side, the vital supports sit at $2,500 and $2,400. So there you have it. Off you go and make your millions! 💸

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-02-05 13:02