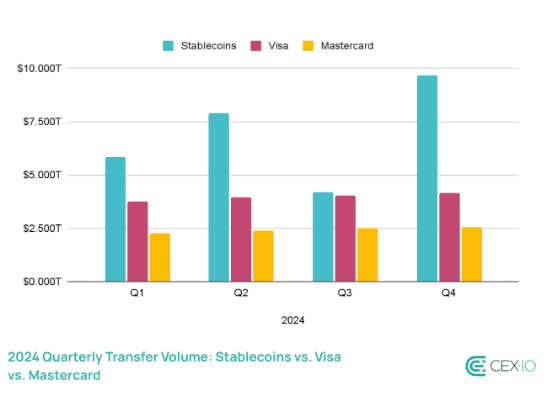

In a plot twist worthy of a sci-fi novel, stablecoins have officially stolen the financial show, outpacing Visa and Mastercard’s combined transfer volumes in 2024. According to crypto experts at CEX.io, stablecoin transfers soared to a mind-boggling $27.6 trillion, a 7.7% lead over the payment behemoths. 🚀

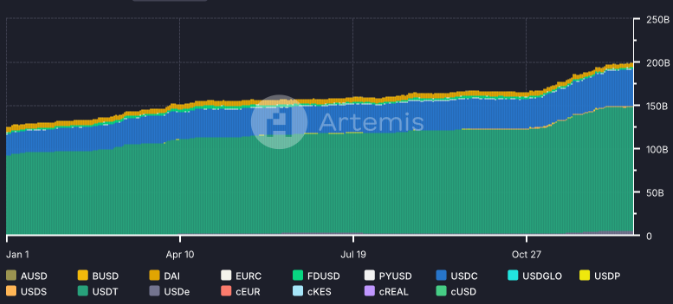

These digital coins are not just making waves; they’re creating a financial tsunami. The supply of stablecoins exploded like a supernova, growing by over 59% and reaching a peak of $200 billion in September. By the end of the year, they accounted for 1% of the total US dollar supply, up from a mere 0.63% at the start. 🌟

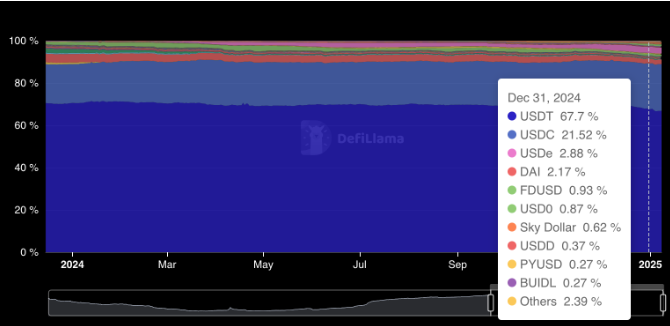

Tether’s USDT still leads the pack, but its market share slipped from 70.5% to 67.7%. Meanwhile, Circle’s USDC strengthened its position, rising from 18.4% to 21.5%, thanks to the magic of decentralized finance (DeFi). Ethena’s USDe made a splash, multiplying its supply 40 times and capturing a 2.88% market share, securing the bronze medal in the stablecoin Olympics. 🏅

Source: DeFiLlama

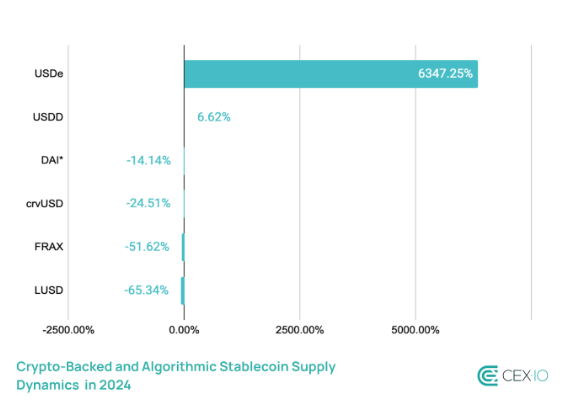

USDe’s Surged 6,300%, While Yield-Bearing Stablecoins Skyrocket 583% in 2024

Algorithmic and crypto-backed stablecoins went on a wild ride in 2024, with supply surging by 92%. USDe was the star of the show, recording a jaw-dropping 6,347.25% increase. By December, USDe had overtaken DAI, capturing 37% of the crypto-backed stablecoin market. 🚀

Source: CEX.io

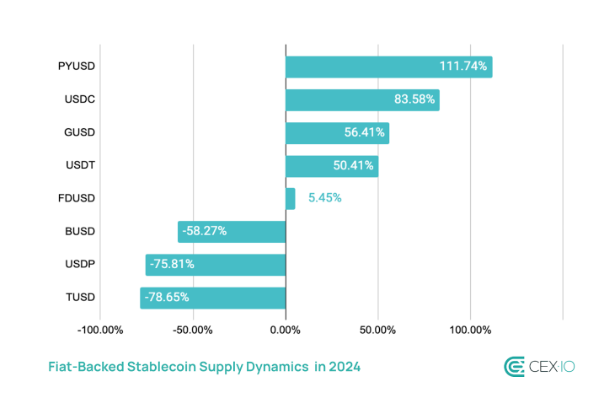

Fiat-backed stablecoins also had a growth spurt, expanding by 54.8%. However, their market dominance dipped from 93.62% to 92.2%. PayPal’s PYUSD was a key player in this sector’s growth, thanks to its Solana blockchain integration. On the flip side, TUSD took a nosedive, plummeting by 78% after Binance gave it the boot due to regulatory woes. 📉

Source: CEX.io

Yield-bearing stablecoins had an extraordinary year, with market capitalization soaring 583%. sUSDe led the charge with a staggering 5,800% rise. Tokenized US Treasuries followed suit, climbing 414% as USD0’s supply multiplied 39 times, reaching $1.7 billion. By year-end, USYC emerged as the largest holder of tokenized Treasuries. 💰

Ethereum & Tron’s Dominance Drops from 90% to 83%

Stablecoins remained heavily concentrated on Ethereum and Tron, which together hosted 83% of the market’s supply by the end of 2024. However, their dominance waned from 90% in January, signaling a shift towards more diverse networks. Ethereum’s market capitalization grew by

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-01-31 22:26