So, the Federal Market Open Committee (FOMC) decided to keep US Federal Rates at 4.25-4.5%, and suddenly, the world is all sunshine and rainbows 🌈. Global markets are up, and Bitcoin is strutting around like it owns the place. Over the past 24 hours, the total crypto market cap hit a whopping $3.5 trillion, with a price surge of nearly 3%. Not bad for a day’s work, eh?

With the broader market recovery, Bitcoin is back above the $105,000 mark, reclaiming its $2 trillion valuation. It’s up by 2.23% over the past 24 hours, and honestly, it’s giving off major “I’m about to break records” vibes. 🚀

Bitcoin Technical Analysis: Can BTC Break $105K for an Explosive Rally?

Bitcoin has been showing off with three consecutive bullish candles, bouncing back from $101,000 to the 24-hour high of $105,563. That’s a 4.15% recovery, and it’s making everyone sit up and take notice.

As Bitcoin bounces off from the $98,750 support, it’s challenging the 38.20% trend-based Fibonacci level at $105,372. With a current market price of $105,030, Bitcoin is facing some serious resistance. But if it closes above this Fibonacci level, we could be looking at a breakout of a rounding bottom pattern. That would mean price targets of $112,375 and $116,085. 🤑

On the flip side, the $100,000 psychological zone is a solid support, followed by the $98,750 level. So, fingers crossed, everyone!

Momentum & Trend Indicators

On the technical front, the Supertrend indicator is all like, “Hey, we’re in a bullish trend!” 📈 This increases the likelihood of a continued uptrend. The momentum indicator is also showing an uptick, supporting the ongoing uptrend. So, if the broader market conditions hold, Bitcoin could be on its way to a new all-time high. 🚀

Institutional Support Strengthens as Bitcoin ETFs Record Net Inflows

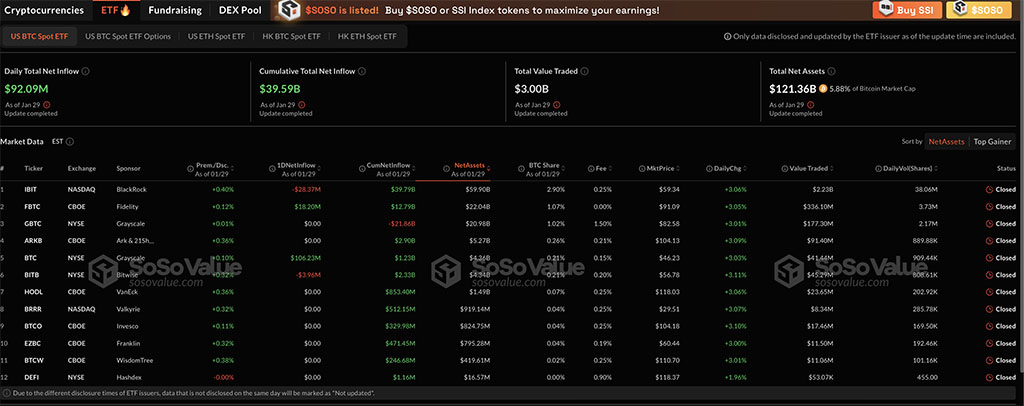

With the recent surge in the crypto market and the dovish push from the FOMC, institutional support for Bitcoin is on the rise. On January 29, the daily total net inflow stood at $92.09 million. Out of the 12 ETFs registered in the US market, only two maintained a positive flow. Grayscale bought $106.23 million worth of Bitcoin, and Fidelity purchased $18.20 million in BTC. 🤑

On the bearish front, however, BlackRock offloaded $28.37 million in the market. Furthermore, Bitwise’s Bitcoin ETF saw a net outflow of $3.96 million. But hey, the overall positive flow reflects a recovery in the ETFs market. So, glass half full, right? 🥂

Bitcoin Reserve Debate Gains Traction in the US

As institutional support rises, the discussion around a Bitcoin reserve in the US is intensifying. Adding to the debate, Cynthia Lummis, US Senator from Wyoming, has recently highlighted the growing need for a Bitcoin reserve. In a recent X post, she stated:

“If you are not first, you are last.”

She suggests that the Trump administration must take quick action to establish a strategic Bitcoin reserve. A potential move ahead can be seen as a step toward securing US financial dominance in the 21st century. 🇺🇸

Whale Activity Signals Market Repositioning

The Bitcoin landscape has witnessed massive shifts over the past 24 hours. Around 70 entities holding more than 1,000 BTC have either exited the network or redistributed their holdings. This was highlighted in a recent X post by Ali Martinez using Glassnode data.

Since mid-December, major players have been repositioning their portfolios, signaling a potential shift in market dynamics. While this could be seen as a risk-off positioning, it also suggests that big market players are adjusting to new trends. Despite the redistribution of BTC holdings, Bitcoin price could likely witness high-momentum moves in the coming times. 🐋

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-30 13:35