The Bitcoin price action saga continues, folks! It’s still hovering above the $100k mark, but the past 24 hours have been a bit of a snooze fest – a 2.5% decline, to be exact. But don’t get too comfy, because it’s time to talk about the juicy stuff!

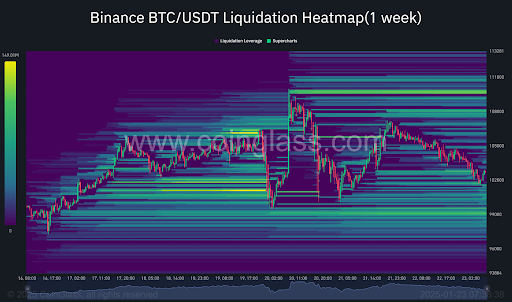

Crypto analyst-extraordinaire Kevin (Kev_Capital_TA) has been pouring over the numbers and has identified a sweet spot between $96,000 and $111,000. He calls this the most pivotal zone on Bitcoin’s liquidation heatmap. The dude knows his stuff, and this range just might be where the magic happens – or not, depending on how you look at it.

Liquidity heatmaps are like the crystal ball of crypto – they show where buy and sell orders accumulate, often flashing “Caution: Price Action Ahead!” signals. The presence of significant liquidity in this range means that the market might just get juiced up and send prices swingin’ once Bitcoin reaches these levels. Just be prepared for some…erm… “rearranging of furniture” for those newbie investors.

The largest liquidity cluster lies near $109,700, just cozily above Bitcoin’s all-time high of $108,786, which was set only three days ago. You know, just give or take a few thousand bucks. That’s like the crypto equivalent of ordering a latte with room for cream – almost there, but not quite.

Time to Break On Through to the Other Side

Kevin also points out that Bitcoin’s had its share of prolonged sideways trading, making even the most seasoned investors go a little…well, sideways themselves. Eight months of going-nowhere trading must’ve been a real pickle for those poor souls, followed by a brief but exciting price surge, only to go back to zero (just kidding, but still). Now, we’re at a three-month mark of low volatility. Yeah, exciting stuff.

Breaking above the upper end of the liquidation zone at $110,000 would be the first step towards repeating that glorious bullish momentum. But, and this is a big but, going below the lower end of the zone presents its own set of risks – thinner orders mean less resistance to a potential price breakdown. Just like when you’re trying to politely decline an invitation to a party but end up staying till 5 am, only to be regretting it the next morning. Or so I’ve been told.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-23 22:34