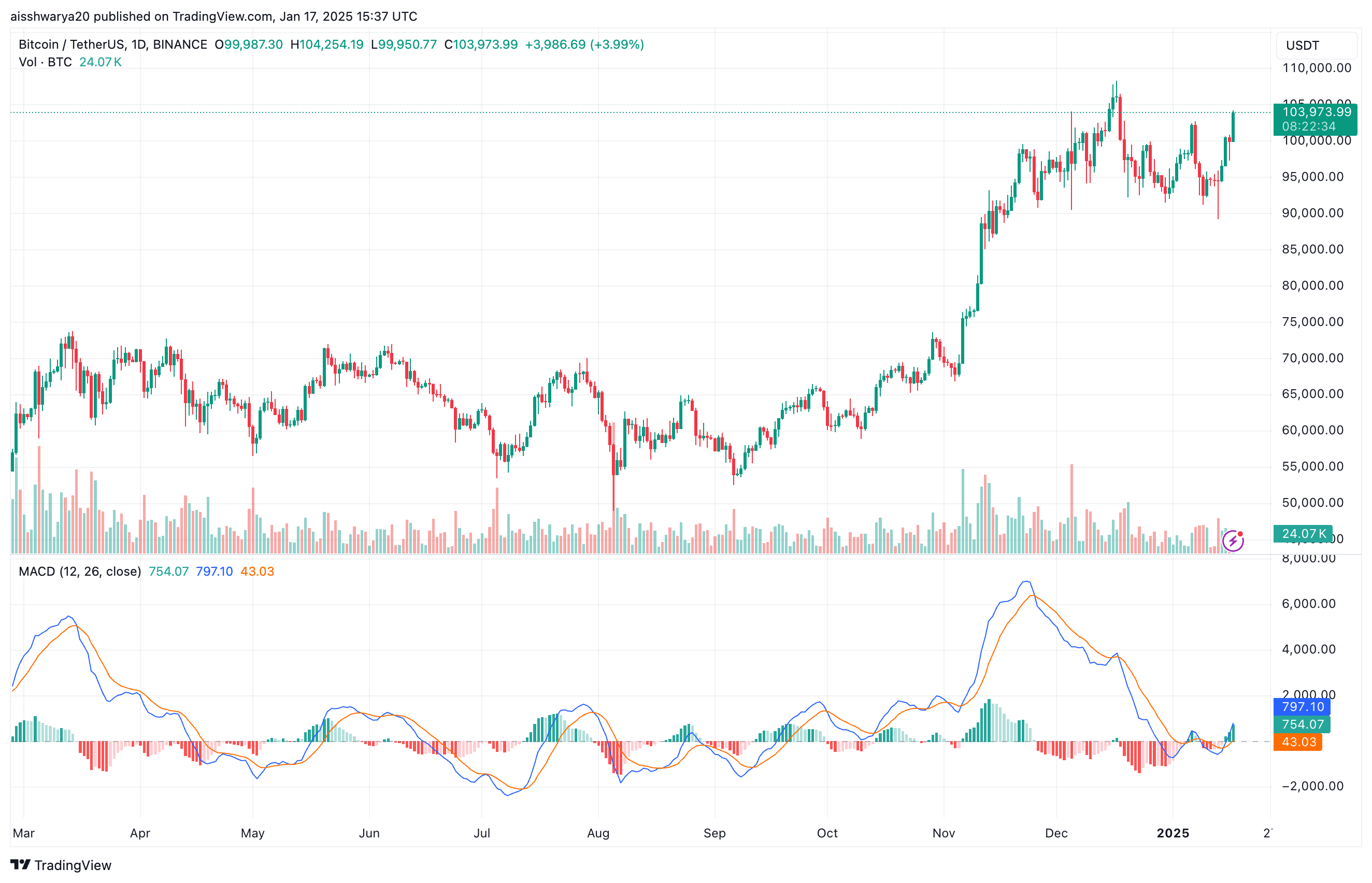

From my perspective as an analyst, it’s clear that Bitcoin (BTC) has once more breached the $100,000 threshold, inching towards a potential new peak. Many crypto analysts foresee the leading cryptocurrency reaching around $150,000 during this market cycle. Yet, some experts contend that this projection seems rather conservative given Bitcoin’s increasing adoption and the shifting market landscape.

$150,000 Target Too Low For Bitcoin

Crypto trader Alex Becker recently expressed his views about Bitcoin’s price trend on platform X. He stated that while most people predict Bitcoin reaching $150,000 in this cycle, Becker feels that this target is both underestimated and insufficient.

Becker contended that if Bitcoin’s market value reached $150,000, it would be just one-sixth the size of gold’s, indicating ample potential for further expansion. He considered the notion of Bitcoin reaching only one-sixth of gold’s market capitalization as overly modest or unrealistic.

Currently as I type, the total market value of Bitcoin amounts to an impressive $2.06 trillion. However, gold holds a substantially larger market value estimated at around $18.5 trillion.

In contrast to previous market trends, this trader observes that Bitcoin’s behavior during the present cycle differs significantly. The leading cryptocurrency appears well-positioned to capitalize on advantageous regulations under President Trump’s administration, coupled with growing adoption by businesses and nations as a form of value storage.

As a analyst, I project that based on these influential factors, Bitcoin (BTC) has the potential to reach a peak value anywhere between $250,000 and $400,000. This perspective is consistent with that of crypto analyst Will Clemente.

In his latest update on platform X, Clemente pointed out that should a country decide to hold Bitcoin as part of its strategic reserves, it might initiate a chain reaction, potentially leading other nations to do the same. He further explained this idea.

If a country decides to hold Bitcoin as a strategic reserve asset, it can be seen as a natural and patriotic act for citizens to consistently invest in this asset. In a broader perspective, this principle could apply to any nation across the globe that aims to preserve its monetary value using this game-theoretic approach.

BTC Supply Crunch Nearing?

With an increasing number of companies incorporating Bitcoin into their financial holdings and buzz surrounding the possibility of a U.S. strategic Bitcoin reserve, there could be mounting demand for Bitcoin, potentially squeezing its available supply.

Recently, crypto expert Miles Deutscher noted in a post on X-platform that the amount of Bitcoins held on cryptocurrency exchanges has dropped to its lowest level in seven years. Typically, when there’s less Bitcoin supply on these platforms, it tends to trigger significant, rapid price surges for the digital asset.

Predictions indicate that Bitcoin might hit approximately $200,000 around the summer season of 2025. Currently, Bitcoin is exchanging hands at $103,973, marking a 5.7% increase over the last day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-18 05:10