As Bitcoin (BTC) surpasses $102K, the Decentralized Finance (DeFi) sector is experiencing a resurgence. The increase in bullish sentiment in the crypto market is mirrored by the Crypto Fear and Greed Index, which now stands at 57, suggesting rising market optimism. This positive trend has led to a significant increase in the total market capitalization of DeFi tokens, currently valued at approximately $160 billion.

In the past week, Chainlink, one of the leading DeFi tokens, has seen an increase of approximately 18.71%. This growth has brought its market cap up to around $15.43 billion. With the token trying to exceed the significant resistance level at $25, traders who follow price movements are expecting a potential surge toward $31.

Chainlink’s 35% Price Surge Breaks Key Levels

Looking at today’s data, it appears that the Chainlink (LINK) price has experienced four successive bullish candles. This upward trend started after the appearance of a long-legged Doji candle on January 13th. Fortunately, the price rejection at the lower end prevented a bearish close below the 100 Exponential Moving Average (EMA), allowing buyers to regain control.

For the past four days, Chainlink has experienced an impressive 35% price jump, breaking through the $24 barrier previously acting as resistance. Furthermore, it has skillfully navigated around a potential bearish situation where the 20- and 50-EMA lines might have crossed over, which could have indicated a downward trend.

As a researcher, I am observing a notable development in Chainlink’s price action. The price has surged beyond the 23.60% Fibonacci retracement level at approximately $23.84, indicating a bullish breakout. This event concludes a double-bottom pattern that has been forming on the daily chart, suggesting a potentially positive outlook for Chainlink. Furthermore, the Relative Strength Index (RSI) line is steadily climbing, underscoring the persistent bullish momentum in this cryptocurrency.

If the upward trend persists, Fibonacci ratios indicate a possible future price peak around 61.80% or approximately $31.13, followed by another potential high at $38.42. On the flip side, the key support level can still be found near the 50-Exponential Moving Average (EMA) line, which is roughly at $21.35.

Whale Accumulation Signals Strong Bullish Momentum for Chainlink

With Chainlink prices climbing and optimistic predictions, more investors are stockpiling LINK tokens. As reported in a recent post by Onchain Lens, one whale withdrew 142,448 LINK tokens at an average cost of approximately $23.74, equating to roughly $3.38 million.

This positive market entrance reinforces the idea that large investors are fueling this upward trend, suggesting that Chainlink could experience significant growth during the next major cryptocurrency spike.

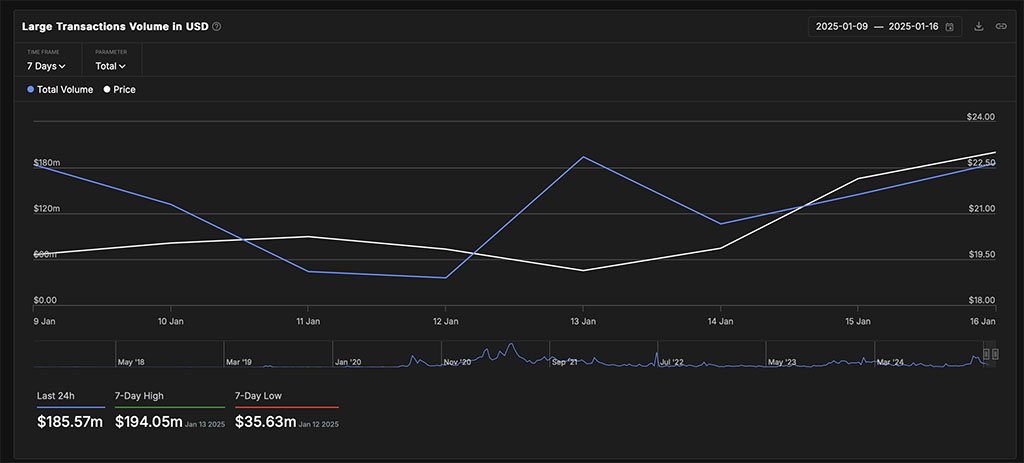

On-Chain Metrics Reflect Growing Chainlink Network

Data recorded on the blockchain indicates a substantial surge in larger transactions across the Chainlink network. The value of these transactions has climbed from a 7-day minimum of $35.63 million, now standing at an impressive $185.57 million.

Just as we’ve seen a significant increase, the active addresses on the Chainlink network have climbed steeply. This surge took them from 4,180 to 5,330 during the same timeframe.

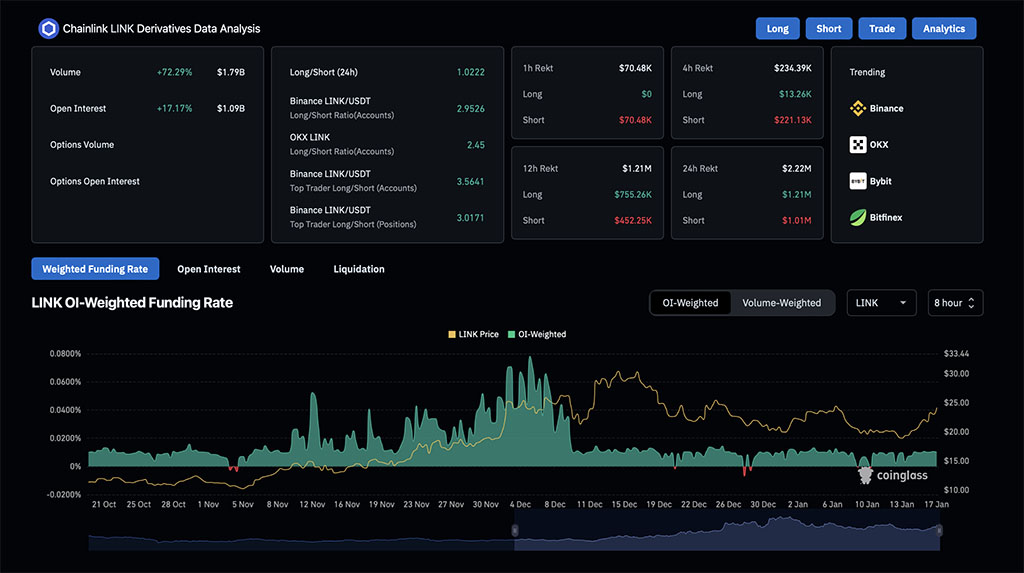

Derivatives Data Highlights Growing Bullish Speculation

For more than four consecutive days, Chainlink’s price trend remains bullish, sparking heightened activity in the derivatives market. The value of its DeFi token’s open interest has climbed by approximately 17.17% within the past day, now standing at $1.09 billion.

Additionally, the funding rate remains close to 0.010%, indicating that traders are fairly optimistic about maintaining long positions. Moreover, the long-to-short ratio of experienced traders on Binance indicates a robust bullish sentiment, as there are nearly three times more bullish positions than bearish ones.

To sum up, the trend in derivatives suggests a rise in optimistic betting on Chainlink, making it more probable that we’ll see continued price increases.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-17 15:03