Currently, the overall crypto market value surpassed $3.5 trillion due to a 2.42% surge within the day, and Bitcoin (BTC) has breached the $102,170 mark with a 2.13% increase. The upward trend in Bitcoin seems to be strengthening further.

Is it possible that the current surge could lead to a record peak in stock prices prior to Donald Trump’s inauguration as the next U.S. President?

Bitcoin Analysis Reveals Channel Breakout

On a 4-hour scale, Bitcoin’s price movement indicates a bullish escape from a descending channel pattern. Over the last four days, Bitcoin’s price has climbed by approximately 15%, rising from $89,164 to its current value of $102,063.

With the bullish momentum growing more robust, the intersection of the 50 and 200 Exponential Moving Averages (EMA) – often known as a golden crossover – presents an attractive buying opportunity. Moreover, the Relative Strength Index (RSI) line on the 4-hour chart has ventured into the overbought region, further bolstering the optimistic outlook.

The behavior of BTC’s price suggests a potential reversal at a rounded bottom, with resistance at approximately $102,514. If this level is breached, it could lead to an attempt to surpass the previous peak around $108,000. By employing Fibonacci ratios, the projected upper price limit for Bitcoin would be about $111,573, which corresponds to the 1.272 Fibonacci level.

On the negative side, the important support is currently at $100,874. The breakout rally from the descending channel pattern suggests a potential reversal to an uptrend, indicating a very optimistic Bitcoin market. This increase in bullish sentiment makes it more likely than ever before that new record highs will be reached.

Institutional Support Drives Bitcoin Momentum

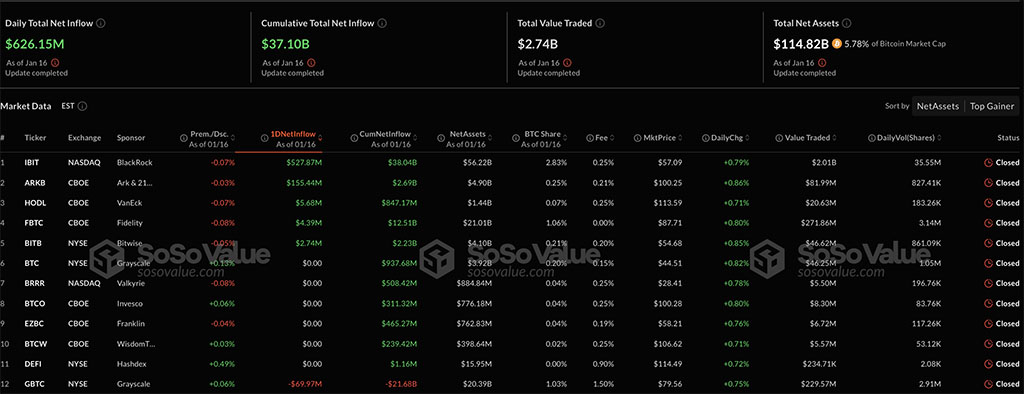

With Bitcoin’s price steadily rising, there’s been a significant resurgence in institutional backing. On January 16 alone, the daily net purchase of U.S.-based Bitcoin ETFs amounted to approximately $626.15 million.

As a researcher, I’m noting that it was BlackRock’s IBIT ETF that spearheaded the recent surge in investments, raking in an impressive inflow of approximately $527.87 million. ARK and 21Shares were close behind, collectively contributing a significant influx of around $115.44 million to the market.

During this period, many ETFs experienced either growth or stability in their investments. However, Grayscale Bitcoin Trust saw a decrease of approximately $69.97 million in its holdings. Interestingly, the last two days have been favorable for Bitcoin ETFs, leading to an influx of around $1.4 billion. This suggests a steadily optimistic trend for Bitcoin ETFs.

On-Chain Metrics Signal Optimism

Recently, crypto expert Ali Martinez emphasized shifting tendencies within the Bitcoin trading market. As Bitcoin surpassed $100,000, long-term investors have developed a sense of greed.

As an analyst, I’ve observed that the long-term holder Net Unrealized Profit/Loss (NUPL) indicator has moved into the ‘euphoric’ zone. This could indicate a bullish sentiment among Bitcoin holders who have held their coins for a significant period. However, it’s crucial to exercise caution as market volatility might lead to potential corrections in Bitcoin.

According to the UTXO realized price distribution indicator, the $97,000 level plays a pivotal role as a strong support. If it manages to hold, the overall upward trend in the market is likely to continue, even though there might be minor reversals in the short term.

Derivatives Market Reflects Bullish Speculation

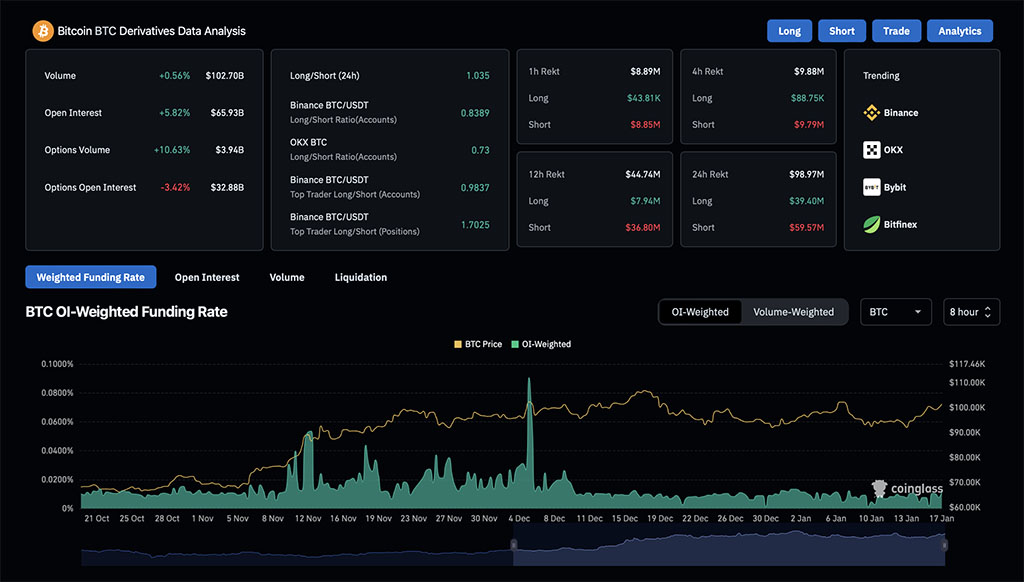

In simpler terms, the overall financial world expects Bitcoin’s upward momentum to persist. A significant jump of 5.82% in Bitcoin’s open interest, now standing at approximately $65.93 billion, points towards growing interest and speculation. Furthermore, the volume of options trading increased by 10.60%, reaching a total of $4 billion.

Over the last 24 hours, the balance between long and short trades has slightly tilted towards more bullish positions, with a ratio of approximately 1.035. Yet, the leading traders on Binance have taken a different approach, as their long-to-short ratios are below 1, hinting at fewer bullish positions among them.

Looking at the proportion of position sizes, it soars to approximately 1.7025, suggesting a strong bullish sentiment. Moreover, the funding rate has surged to 0.0117, indicating that traders are confident in maintaining long positions. Consequently, the data from derivatives highlights a high level of optimism among traders, reinforcing the overall bullish outlook for Bitcoin.

Essentially, Bitcoin’s upward trend and substantial backing from institutions suggest it could reach even greater heights, potentially hitting around $111,573 as its next milestone.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2025-01-17 14:22