Recently, Pudgy Penguins and Bonk meme coins have been fiercely competing for the leading position. Both digital currencies surpassed the $2 billion market capitalization mark, demonstrating their strong presence within the crypto market.

Investors are closely monitoring technical signals like the Average Directional Index (ADX) and Relative Strength Index (RSI) regarding the PENGU meme token. These indicators suggest an upward trend. In the last seven days, the value of PENGU has experienced significant fluctuations, but bears have been unable to maintain control above the vital support level at $0.032.

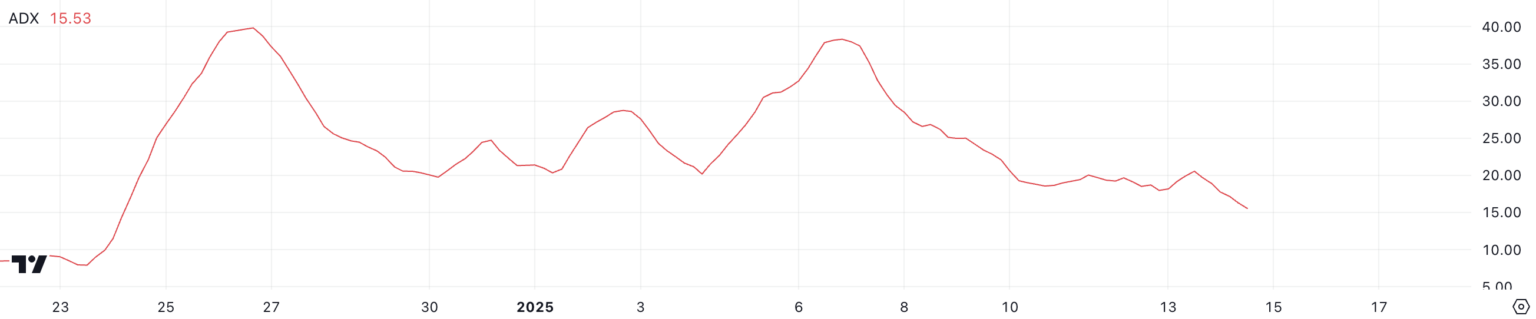

Over the past day, the PENGU ADX has decreased from 20.5 to 15.5, indicating a weakening trend. An ADX reading below 20 typically means there’s not much strong directional movement in the market, which can suggest either consolidation or uncertainty about future price action.

This dip occurs at a time when the PENGU price aims to create an upward trend, suggesting that despite the growing momentum, it doesn’t yet have sufficient power to firmly establish an uptrend.

Source: TradingView

The Average Directional Index (ADX), which ranges from 0 to 100, measures the strength of a market trend. A reading below 20 suggests a weak or non-existent trend, while values above 25 indicate a stronger, more established trend. PENGU’s current ADX of 15.5 indicates uncertainty about its price movement, implying that any efforts to create an uptrend may lack the necessary momentum.

If the PENGU ADX (Average Directional Movement Index) exceeds 25, it’s a sign of a bullish breakout driven by rising buying pressure. Before this happens, it’s expected that PENGU will continue in a period of sideways movement or consolidation.

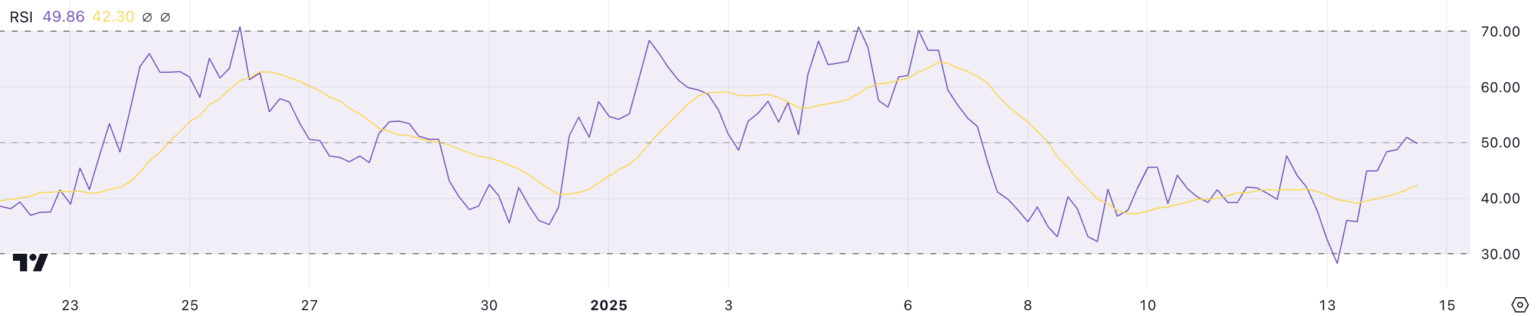

PENGU Price RSI Sees Quick Surge

Following a significant drop into an oversold market, the PENGU’s Relative Strength Index (RSI) noticeably spiked from 28.9 to 49.8 in just one day. This sudden increase suggests a rise in buying activity after extensive selling, moving the asset into a neutral zone.

The Relative Strength Index (RSI) measures how quickly and significantly a security’s price is changing, ranging from 0 to 100. A reading below 30 signals that the asset might be undervalued and could experience an upward trend, while a reading above 70 suggests it may be overvalued. At present, PENGU’s RSI stands at 49.8, indicating that the price is in a neutral zone with a slight inclination towards bullishness.

Source: TradingView

Currently, the price of PENGU is experiencing fluctuations, with a lower boundary around $0.031 and an upper limit at approximately $0.034.

Source: TradingView

If the upward trend continues to strengthen, it’s possible that the price of PENGU could surpass its current resistance at $0.034. This might lead to further tests around $0.04, with a potential reach of up to $0.0439.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-01-15 17:14