bitcoin‘s price surpasses the $97,000 milestone, while cardano recaptures the $1 mark. Bitcoin, with a daily volatility of 1.5%, boasts a market capitalization of $1.93 trillion and a 24-hour volume of $51.17 billion. Cardano, on the other hand, exhibits a 7.8% daily volatility and has a market cap of $37.40 billion, with a 24-hour volume of $1.43 billion, following a 9.82% increase in the past day.

This signifies a robust rebound following the ups and downs in the market. Given the positive momentum suggesting a potential market cap of around $37 billion, will Cardano persistently advance to reach the $1.50 price milestone?

Cardano Price Analysis

On a day-to-day price graph, we see a pattern of two successive candles indicating a bullish move. This bullish pattern suggests an increase in market optimism.

This represents a 5.40% increase in price and a daily rise of 5.82%. The positive trend persists, as it’s part of a series of lower highs, suggesting strong and ongoing upward movement.

As a crypto investor, I’m observing an optimistic surge in my Cardano holdings, which seems to be part of a constructive triangle formation. Plus, the recent rebound from the underlying trendline support is accompanied by a bullish divergence in the Relative Strength Index (RSI), suggesting potential upward momentum ahead.

This gap highlights the growing vigor in buying actions, as the upward momentum has exceeded the 23.60% Fibonacci level associated with the trend, which coincides with the $1 psychologically significant point.

ADA Price Targets

As the likelihood grows for a potential surge in the price of Cardano (similar to a triangle breaking out), Fibonacci levels based on current trends suggest possible price targets at approximately $1.38 and $1.554. If these prices are reached, it would signify substantial profits for Cardano investors. This increasing bullish sentiment towards Cardano’s price indicates a potential increase of around 50%.

Conversely, the significant resistance is provided by the 50 and 100 Exponential Moving Averages (EMA) at $0.936 and $0.814 respectively. These levels are crucial in halting any sudden declines as the bullish trend of Cardano continues to strengthen. Meanwhile, the technical analysis of derivatives suggests a favorable outlook.

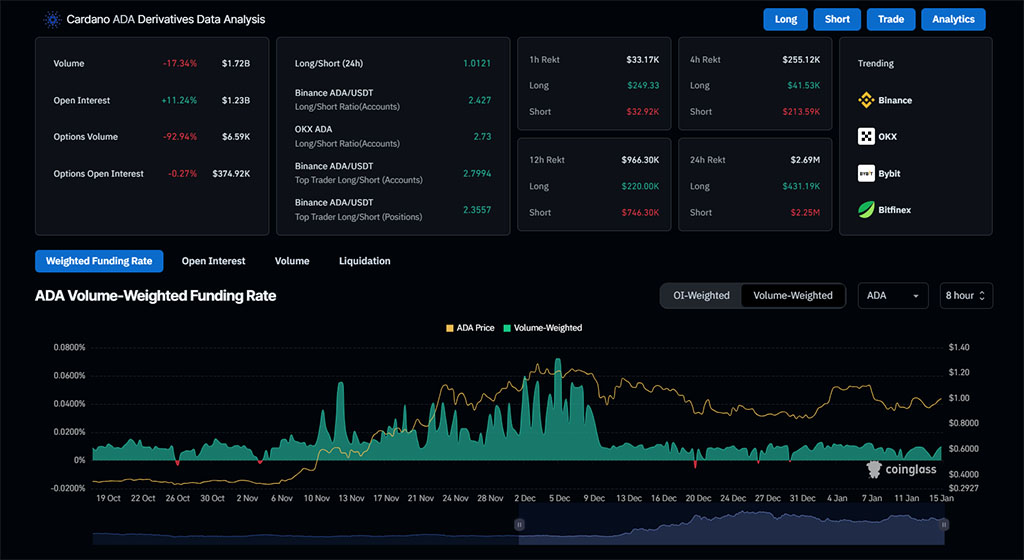

Cardano Derivatives Hint at an Extended Rally

The current value of outstanding contracts for Cardano stands at approximately $1.27 billion, marking a nearly 15% surge over the last day. This significant jump suggests an escalating interest in the market. Additionally, it’s worth noting that long positions have noticeably grown more prevalent than short ones, hinting at a positive sentiment among investors.

Over the last 24 hours, there’s been a noticeable trend as the short-to-long ratio stands at 1.027, suggesting a growing optimism among traders (bullish sentiment). Furthermore, the funding rate has surged to 0.0098%, recovering from its recent dip at 0.0020%. This pattern supports the bullish outlook.

Therefore, the increasing open positions, borrowing costs, and growing number of long positions relative to short ones suggest a potential increase in bullish activity for Cardano. This is consistent with the overall market upturn, indicating positivity among investors.

Whales Accumulate 100M ADA Tokens

In my latest analysis, I’ve noticed a significant growth in whale interest towards Cardano. Over the last two days, these prominent investors have amassed approximately 100 million ADA tokens, indicating a strong backing for this cryptocurrency.

Whales have bought 100 million #Cardano $ADA over the past 48 hours!

— Ali (@ali_charts) January 15, 2025

As a cryptocurrency investor, I can confidently say that this analysis sheds light on the current surge in Cardano’s value. Moreover, it boosts the prospects for further bullish momentum as the wider market starts to rebound.

Conclusion

Given increased whale presence, growing trading volume, and optimistic technical signals, Cardano presents promising prospects for additional growth. If the momentum persists, ADA may breach the $1.50 threshold soon, potentially providing investors with a nearly 50% profit margin. Keeping an eye on essential support levels and overall market dynamics is essential to maintain this upward trend.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-15 12:19