According to JPMorgan’s predictions, ETPs tied to XRP and Solana (SOL) could potentially draw in more than $15 billion in new investments. This projection is based on the trends observed in Bitcoin (BTC) and Ethereum (ETH) adoption. The growth in assets accumulated by these ETPs supports this forecast, indicating a significant increase in interest.

Here are some key statistics for your reference:

– Bitcoin (BTC): $96,306, 24h volatility: 6.0%, Market cap: $1.91 T, 24h volume: $70.53 B

– Ethereum (ETH): $3,206, 24h volatility: 4.5%, Market cap: $387.65 B, 24h volume: $36.07 B

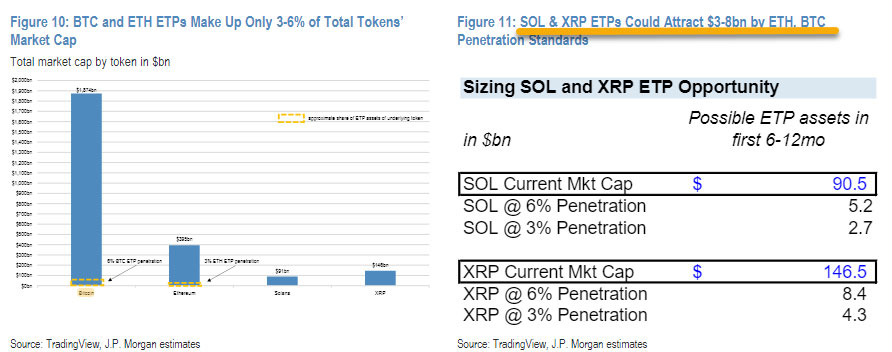

Matthew Sigel, who leads digital asset research at VanEck, pointed out that Bitcoin ETPs (Exchange-Traded Products) gathered a massive $108 billion in assets during their first year, which equates to around 6% of Bitcoin’s total market cap of $1.8 trillion. Likewise, Ethereum ETPs managed to secure a 3% penetration rate within six months, accumulating $12 billion in assets. Using these growth indicators as a benchmark, it is estimated that XRP could potentially attract between $4 billion and $8 billion, while Solana might garner around $3 billion to $6 billion.

CoinShares reports significant funds under their management for Solana and Ripple Exchange-Traded Products (ETPs). Specifically, the assets linked to Solana total about $1.6 billion, while those associated with Ripple handle around $910 million. It’s worth mentioning that both Solana and Ripple ETPs experienced increased investments in 2024, with inflows of approximately $438 million for Solana products and $69 million for Ripple-related ETPs.

SEC Rejects Solana ETFs: Ripple Faces Legal Hurdles

Progress is being impeded by regulatory hurdles, even though there are positive signs in the market. For example, the US Securities and Exchange Commission (SEC) has recently turned down proposals for exchange-traded funds (ETFs) linked to Solana. Ripple Labs is also involved in a legal battle about whether XRP should be classified as a security rather than a currency.

According to Bloomberg analysts James Seyffart and Eric Balchunas, it’s predicted that Exchange-Traded Funds (ETFs) tied to Litecoin (LTC) and Hedera (HBAR) have a higher likelihood of getting the green light. As of now, Litecoin is priced at $99.29 with a 24h volatility of 5.0%, boasting a market cap of $7.51 billion and a 24h trading volume of $556.55 million. Similarly, Hedera stands at $0.28 with an 8.2% 24h volatility, a market cap of $10.88 billion, and a 24h trading volume of $441.55 million.

As an analyst, I find the chances of an XRP or Solana-based ETF approval in the short term to be rather slim. Yet, there’s a glimmer of hope with potential regulatory changes under a new administration. Some experts like Seyffart and Balchunas have even suggested that a Trump administration might take a more favorable stance towards ETF approvals.

As a researcher, I’ve noticed that despite some regulatory hurdles, the market sentiment towards certain cryptocurrencies has proven surprisingly robust. For instance, following JPMorgan’s forecast, Solana’s price surged by approximately 5.40%, reaching $188, and there was an impressive over 150% jump in trading volume over a 24-hour period. In a similar vein, Ripple (XRP) experienced a rise of more than 7%, reaching $2.60. This increase was accompanied by a 50% boost in trading volume within the same timeframe.

BlackRock’s Dominance in Crypto ETFs

Exchange-traded funds (ETFs) connected to Bitcoin and Ethereum have played a substantial role in shaping the market. Notably, BlackRock has spearheaded this trend with an impressive $37.6 billion in investments flowing into their Bitcoin ETF and another $3.6 billion in Ethereum ETF. The historical pattern indicates a robust appetite for regulated cryptocurrency products. To date, Bitcoin ETFs have accumulated a total of $35.9 billion, while Ethereum ETFs have gathered approximately $2.4 billion.

Nonetheless, the trip hasn’t been free from bumps in the road. For instance, on January 13, Bitcoin ETFs experienced a withdrawal of approximately $284.1 million, while Ethereum ETFs saw a loss of around $39.4 million. This trend signifies three consecutive days with negative inflows, reflecting the market’s volatile nature and the fine line between hopefulness and caution.

Matthew Sigel expressed on social media that potential XRP and SOL ETFs could be “groundbreaking,” reflecting a widespread belief in the significant influence these financial products might have. Despite the lingering doubts about regulatory clearance, the broader aspiration for simple and regulated crypto investment options is sustaining enthusiasm within the market.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-14 15:20