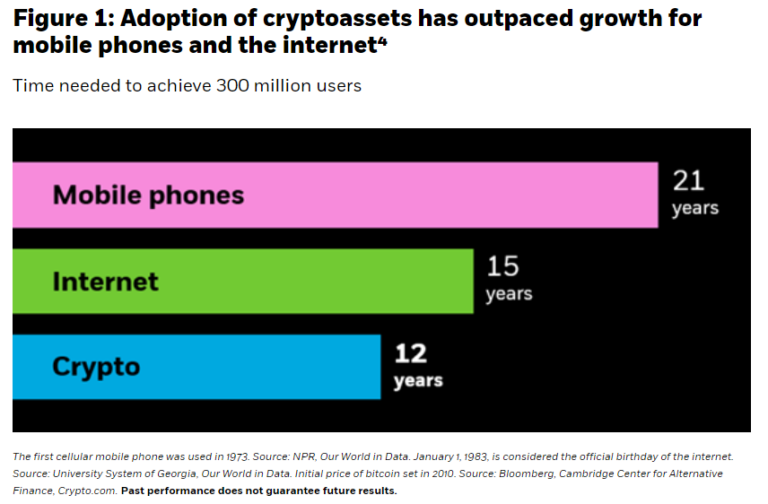

Remarkably, the use of cryptocurrencies has surpassed the early adoption pace of both mobile phones and the internet, as revealed in BlackRock’s latest report dated January 13. Mobile phones required 21 years and the internet needed 15 years to amass 300 million users. In contrast, cryptocurrencies managed to reach this milestone in a mere 12 years. This rapid growth underscores the worldwide curiosity and enthusiasm towards decentralized finance and blockchain technology innovations.

Source: BlackRock

The surge in cryptocurrencies is largely due to their borderless accessibility and increasing versatility, a factor that is significantly altering conventional financial structures, according to BlackRock’s report. Furthermore, Bernstein anticipates widespread crypto adoption by 2025, as suggested by CoinSpeaker’s report.

Bitcoin leads the charge in this emerging trend, being the cryptocurrency with the broadest global adoption. Its market value is rapidly approaching USD $2 trillion, causing it to be seen as a possible worldwide substitute for traditional money. As worries about inflation, political unrest, and dwindling confidence in government-issued currencies increase, both institutional and individual investors are increasingly looking towards Bitcoin, the digital titan.

Bitcoin’s Breakneck Adoption — What’s Driving It?

The report indicates that Bitcoin’s popularity has surpassed many groundbreaking technologies, driven by various contributing factors leading to its rapid growth. Younger, tech-savvy individuals tend to favor Bitcoin more than older generations. Additionally, global concerns such as inflation and financial instability have increased Bitcoin’s attractiveness as a decentralized asset.

In a recent report, Jay Jacobs, U.S. Head of Thematics and Alternative ETFs at BlackRock, noted that members of younger generations are often referred to as “digital natives.” This label suggests they are more likely to lean towards adopting Bitcoin compared to GenX and Baby Boomer generations.

As a crypto investor, I’ve witnessed firsthand how the ongoing digital revolution in our economy is shaping the landscape. The advancements in digital asset infrastructure are breaking down barriers and making it easier than ever to join the game. This accessibility is not only attracting more people to Bitcoin but also paving the path for its seamless integration into traditional financial systems, marking a significant milestone in its journey towards mainstream acceptance.

However, even with widespread excitement, there are still obstacles to be addressed. Traditionally, investing in Bitcoin was not straightforward due to hurdles like setting up specialized accounts, encountering high transaction fees, and dealing with security concerns. The absence of a smooth process has discouraged numerous potential investors, creating an opportunity for innovation to fill the void.

BlackRock’s IBIT Simplifies Bitcoin Access

The iShares Bitcoin ETF (IBIT) offered by BlackRock acts as a modern investment option, making it easier for people to invest in bitcoin. This ETF allows digital assets to be held within traditional brokerage accounts, thereby reducing complexity when investing. In essence, IBIT operates similarly to a stock and provides an uncomplicated entry point for investors, whether they have taxable or tax-advantaged investment accounts.

The ETF named IBIT offers access to the Bitcoin market, functioning similarly to a stock. This means it can be bought or sold through conventional brokerage services alongside traditional investments such as stocks, bonds, and other ETFs. These transactions can occur within both taxable and tax-free savings accounts like TFSA,” the report stated.

Using an ETF like IBIT simplifies investment in Bitcoin, eliminating the need for intricate tasks such as opening accounts on cryptocurrency exchanges or managing personal digital wallets. This streamlined approach significantly minimizes the risks and expenses typically involved in direct Bitcoin investments. Backed by industry giant BlackRock, the world’s largest asset manager, and utilizing Coinbase Prime technology, IBIT offers a secure and premium-quality investment solution.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-01-14 00:57