The mood on the cryptocurrency market has been better at times. However, many investors may have expected a different outcome with the New Year rally. It was widely heard that a great future awaited the cryptocurrency market under Donald Trump. Now, Trump is about to take office and the price is plummeting. Does this mean the 2025 rally has been cancelled and the bull run has ended already, or could Bitcoin soon start climbing again?

90.000 Dollar Marke unterschritten

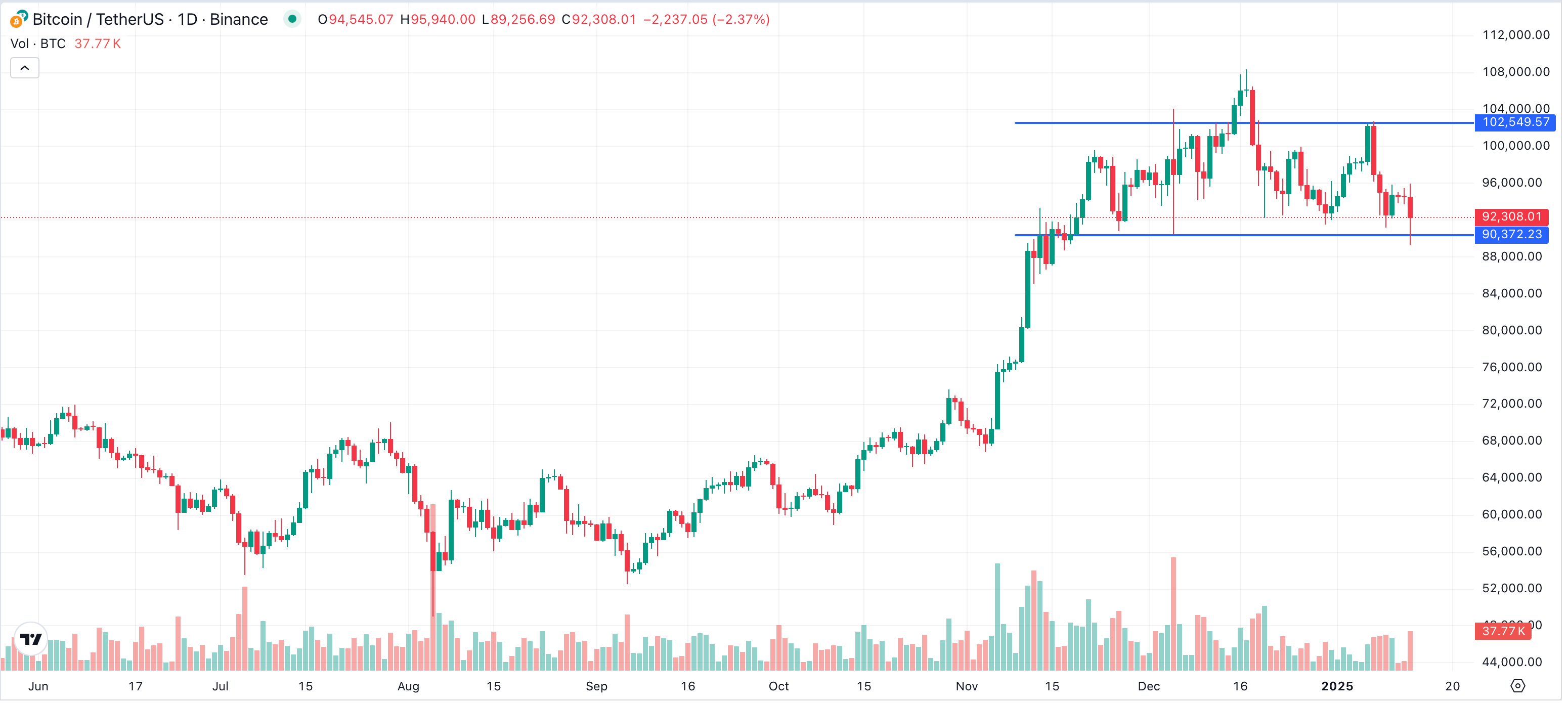

For months now, the price of Bitcoin has been moving within a wide range downward. The lower end of this downtrend has been marked by 90,000 USD, while the upper end typically closed at around 102,000 USD. However, there was an exception when it breached the all-time high of 108,000 USD. Currently, the world’s largest cryptocurrency is again moving near the lower end of this range.

(Bitcoin Kursentwicklung – Quelle: Tradingview)

Today, the price briefly dipped below $90,000, but this only served to further confirm the strong support at that level as the price quickly rose back up to $93,000 within a few minutes. Many investors seized the opportunity for a good buy. However, it is increasingly likely that this value will be sustainably breached with each new test of the $90,000 mark.

Parallelen zu 2021

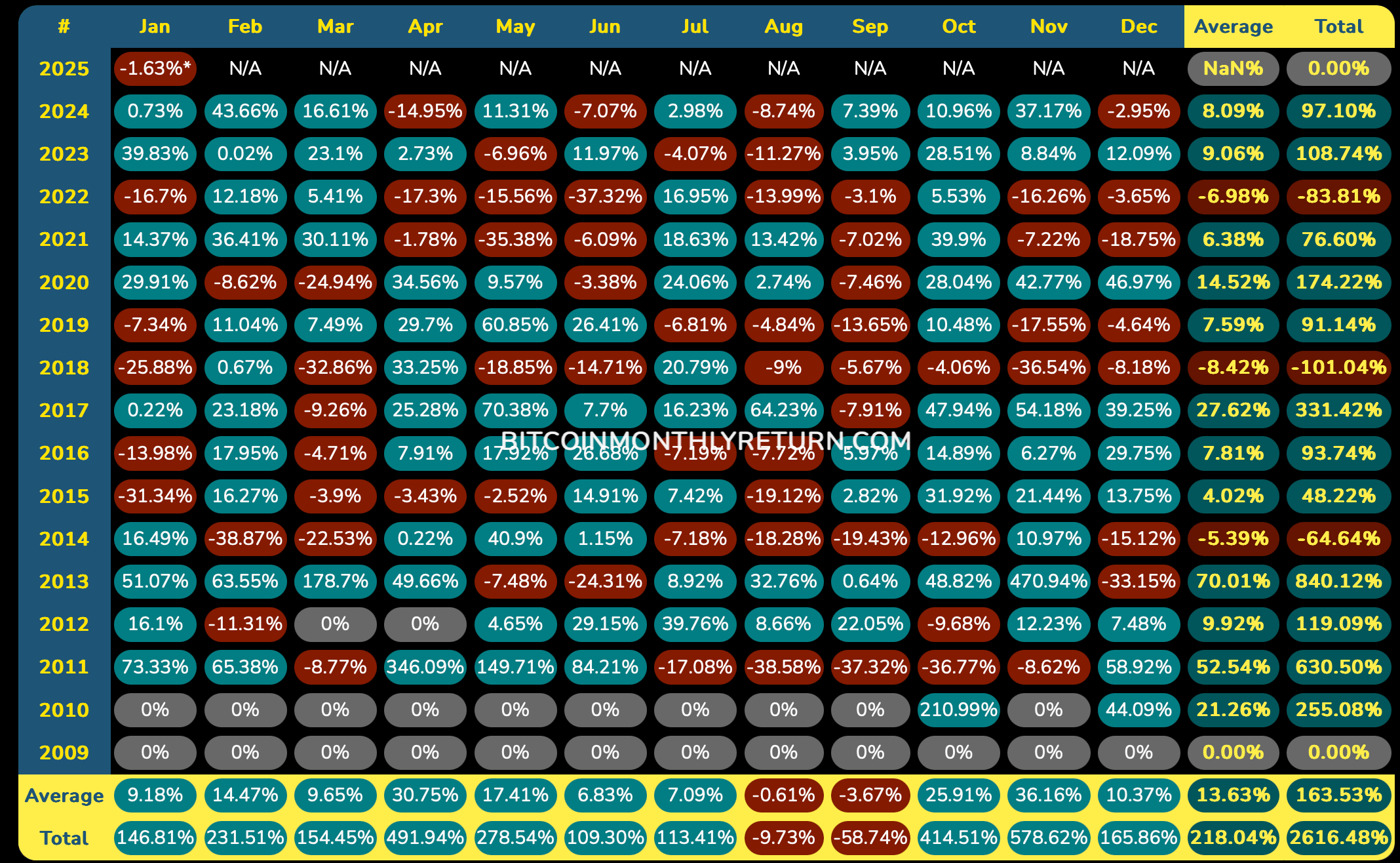

Many analysts look back at historical data to develop a sense of future price movements, particularly for Bitcoin. In 2021, the price of Bitcoin saw an extreme surge following a halving event in the previous year. Now, four years later, another halving has occurred and there is still expectation for further price increases. However, current trends suggest a correction, which was also the case back then.

(Monatliche Gewinne und Verluste bei Bitcoin – Quelle: Bitcoin Monthly Return)

2021 saw a significant increase in the Bitcoin price during the early days of the new year compared to its rise this year. Just like before, there was a correction afterwards. However, the Bitcoin price dropped less than 13% in January 2021 when considering its overall value. Given that the trend after every halving year has been upward, the chances for another such surge remain good.

Die nächsten Tage sind entscheidend

To break free from the sideways movement of the past few months, we need another push. This could potentially come from the upcoming US inflation data. On Tuesday, 14th January, the U.S. Producer Price Index will be published, followed by the Consumer Price Index on Wednesday.

If inflation turns out to be lower than expected, Bitcoin’s price could potentially surge towards $100,000. Conversely, a higher inflation rate might even cause the $90,000 mark to be breached. Investors should therefore closely monitor the release of these data in the coming days. On the other hand, the sentiment seems more favorable for the new Wall Street Pepe ($WEPE).

Jetzt mehr über Wall Street Pepe erfahren.

Wall Street Pepe steuert auf 50 Millionen Dollar zu

Over the next few days, Bitcoin’s fate remains uncertain, but the mood for the new Wall Street Pepe is hard to beat. The meme coin is currently available for pre-sale and is already heading towards the $50 million market cap. Already exceeding expectations, this new coin is already surpassing all predictions. Recently, an extremely successful ICO at Pepe Unchained ($PEPU) followed by a surge over $600 million occurred. Analysts now expect similar price movements for $WEPE.

($WEPE Initial Coin Offering – Quelle: Wall Street Pepe Website)

During the presale phase, investors benefit as the $WEPE price is repeatedly increased. Since the starting price on cryptocurrency exchanges is higher than the current presale price, this already results in an initial profit for early buyers. The extremely high demand during the presale suggests that it could potentially go much higher after that.

Jetzt rechtzeitig eisnteigen und $WEPE im Presale kaufen.

Caution: Investing involves speculation and carries risk to your capital. This website is not suitable for use in legal systems that prohibit the described trading or investments. It should only be used by individuals who are legally permitted to do so. Your investment may not offer protection under the investor-protection laws of your country or residence. Therefore, please conduct your own due diligence. This website is provided to you free of charge, but we may receive commissions from the companies featured on this site.

* Investing involves a risk and can lose your money.

* This website should only be used in countries where the described trading or investments are legal.

* The laws protecting investors might not apply to your country or place of residence.

* Make sure you understand all the risks before investing.

* This website is free, but we may earn commissions from the companies listed here.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- Presence Digital, 4K, Blu-ray, & DVD Release Dates Set for Lucy Liu Horror Movie

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Roxanne Perez Addresses Cora Jade Tension Ahead of WWE NXT Vengeance Day 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- New Malayalam OTT releases this week: Unni Mukundan’s Marco, Govind Padmasurya’s Manorajyam and more

- Kingdom Come Deliverance 2: How To Clean Your Horse

2025-01-13 23:46