Over the past week, the Aave (AAVE) market experienced considerable setbacks, with its price dropping by approximately 17.07%. As per information from CoinMarketCap, this decline has occurred. However, in the last 24 hours, the DeFi token seems to have found some balance. Nonetheless, certain market signals point towards the possibility that the bearish trend might persist for a while longer.

AAVE Could Crash By 30% If Signal Holds

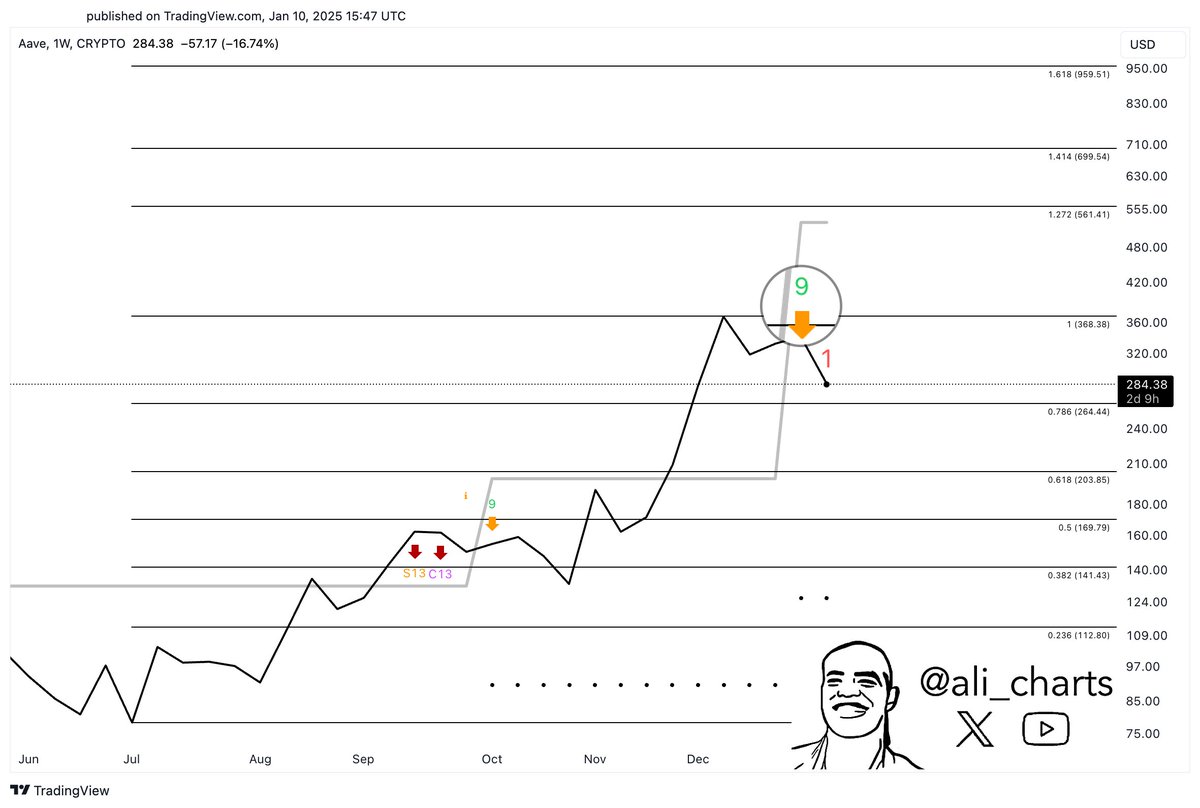

On a popular social media platform, crypto analyst Ali Martinez posted a bold forecast about AAVE. Based on his analysis using the TD Sequential indicator, he predicts a potential sell-off in the upcoming weeks for AAVE, hinting at a significant drop ahead.

In the realm of trading, a tool known as the TD Sequential, created by Tom DeMark, is employed to pinpoint possible shifts in trade prices. Essentially, it alerts traders when an asset’s price has moved too far in one direction and may soon undergo a change of direction.

According to Martinez’s prediction, if the TD Sequential sell signal remains strong, the price of AAVE might experience a substantial drop, potentially reaching approximately $264. If intense selling pressure continues, the L2 token could be at risk of falling even further to around $203, suggesting a potential 29.5% decrease from its current value.

It’s worth noting that this bearish forecast aligns with other signs. For instance, the Relative Strength Index (RSI) stands at 62.57, suggesting that AAVE has not yet reached the oversold territory and could potentially drop more over the next few weeks.

In addition, it’s worth noting that the asset’s 100-day average price is significantly lower than its current value, suggesting a potential bearish trend. It’s crucial to exercise caution when dealing with this market right now. Currently, AAVE stands at $290.04, representing a modest increase of 2.48% over the past day. However, the daily trading volume has decreased by approximately 48.99%, which could hint at a decrease in selling pressure.

Aave Set To Launch V4

Regardless of the persistent battle with prices, the Aave protocol has been witnessing progressive advancements. In fact, as per a recent report by NewsBTC, Aave achieved a record-breaking $35 billion in total net deposits, marking an all-time high value since 2021.

Beyond this development, the Decentralized Finance (DeFi) protocol is gearing up for its V4 network update, which promises to incorporate sophisticated risk management tools and unified liquidity resources, among other advantages. As per DeFi Pulse data, AAVE remains the second-largest DeFi platform with a Total Value Locked (TVL) of approximately $20.4 billion.

Among all the decentralized lending platforms, only one trails Lido Finance, which currently holds a total value locked (TVL) of approximately $31.60 billion.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- NVIDIA’s Jensen Huang shares details about the AI processors powering Switch 2

- Is There a MobLand Episode 11 Release Date & Time?

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-12 18:41