Since reaching its record high of $108,135, Bitcoin‘s price has shown relative stability but has struggled to maintain a value over six figures for extended periods. For instance, it only managed to stay above $100,000 for a single day before dropping below $92,000 in the recent week.

Discussions are arising due to Bitcoin’s slow price fluctuations, with some questioning if a peak has been reached and the bull market has ended. Yet, recent analysis of its underlying activity indicates that there may be potential for more price increases in the flagship cryptocurrency.

What’s The Current Bitcoin Short-Term Holders Cost Basis?

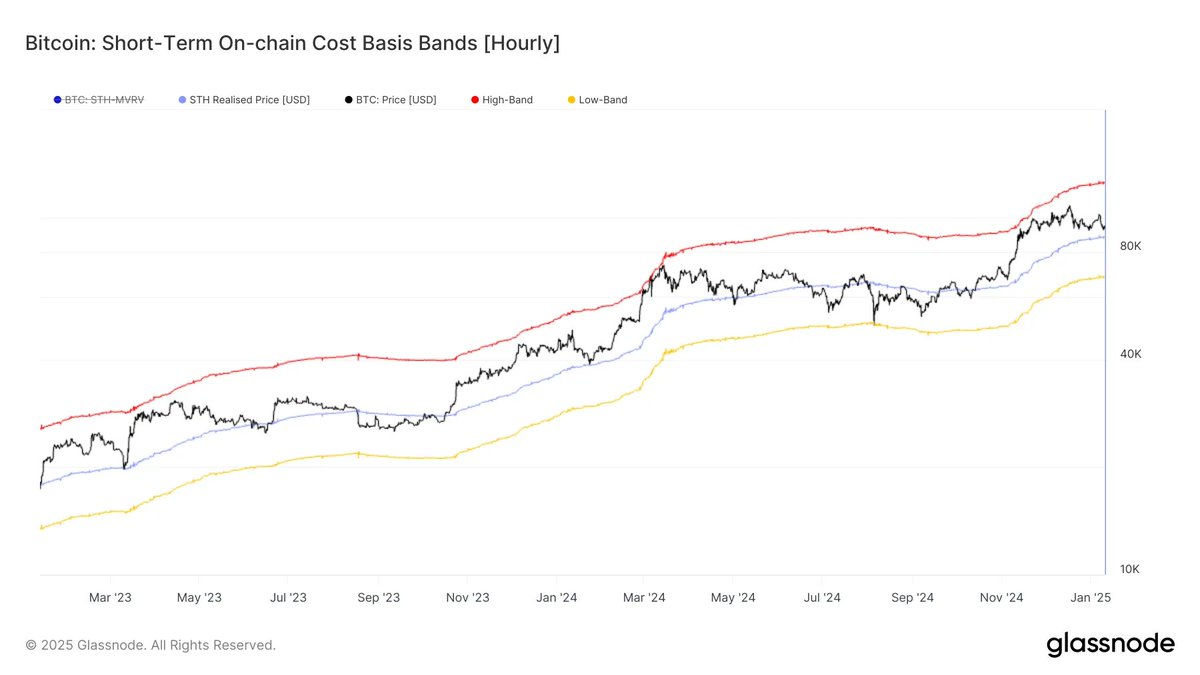

According to a recent update from Glassnode on their X platform, it seems that the Bitcoin bull run may still have some life left in it. This assumption is derived from an analysis of the Bitcoin price’s behavior relative to the average purchase price for short-term holders (STH).

The STH cost-basis indicator monitors the typical buying price of short-term investors (those who own Bitcoin for fewer than 155 days). This figure acts as a significant reference point for BTC investors and may provide a technical benchmark for examining prices, particularly during periods of upward market trends.

Normally, Bitcoin’s price tends to hover above its Simple Moving Average (STH) cost basis during bull markets, suggesting strong buying interest and a positive attitude among short-term traders. On the other hand, when the Bitcoin price drops below this mark, which is common in bear markets, it indicates that new investors are experiencing losses, potentially leading to heavy selling pressure.

Based on Glassnode’s data, Bitcoin’s price is approximately 7% higher than the average purchase price for short-term holders, which is currently about $88,135. This suggests that short-term holders might not be in a hurry to sell their Bitcoin, as its price is still slightly above the amount they initially paid for it.

If Bitcoin’s price stays above its support level (STH cost basis), it suggests that the existing bullish market trend might persist. Conversely, if the price drops below $88,000, this could be an indication of a potential shift from a bull to a bear market, where the overall trend may reverse.

Currently, Bitcoin’s price hovers slightly over $94,000, showing minimal growth of less than 1% within the past day. However, as per CoinGecko’s data, Bitcoin has experienced a decline of over 3% in the last week.

Is A Market Rebound Imminent?

Over the last seven days, the cryptocurrency market has struggled significantly, causing the values of major currencies to plummet by more than 10%. Not surprisingly, numerous crypto investors have expressed a desire to sell their holdings across different social networking sites.

In contrast, an upturn in investor opinion boosts the chances of a market rebound since price movements often go against the general trend. For example, Santiment, a firm specializing in on-chain analysis, pointed out that during the Q4 rally of 2024, higher prices were observed following an increase in bearish sentiments.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2025-01-11 15:41