After reaching a notable height of $100K, Bitcoin saw an increase in selling activity, causing some unease among investors who had initially been optimistic. Unfortunately, this new high couldn’t be maintained, leading to a quick dip down to around $92,500 within just three days. This sudden drop has revived discussions about the market’s resilience and whether Bitcoin can keep its positive trend going.

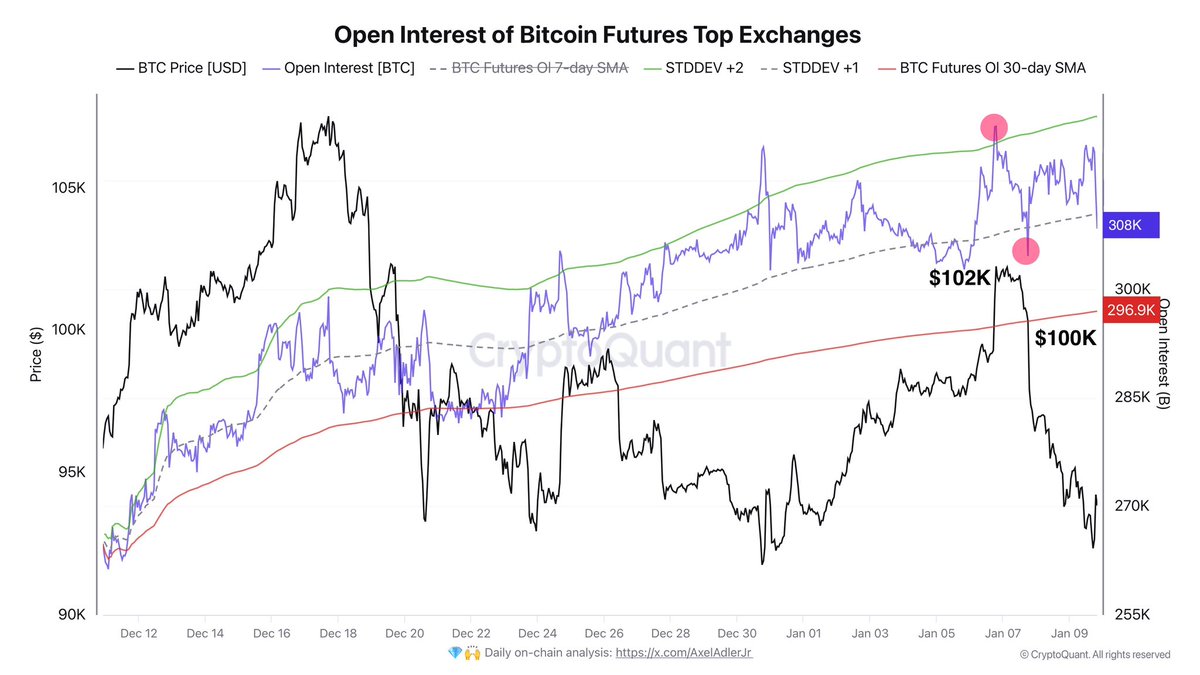

Axel Adler, a well-known CryptoQuant analyst, provided crucial observations about the recent market trends. He disclosed that the most significant reduction in debt occurred between January 6th and 7th, during which Bitcoin’s value dipped from around $102,000 to $100,000 as a result of liquidations. This surge of compulsory selling caused prices to drop even lower, enabling bears to regain dominance and drive Bitcoin’s price down further to approximately $92,500.

Under the present market scenario, investors are uncertain about Bitcoin’s future actions. Will it recover and gain strength for another surge, or will its downward trend continue, causing a more significant downturn? Given the mixed feelings in the market, ranging from fear to optimistic caution, everyone is closely watching Bitcoin as it maneuvers through this crucial period.

Bitcoin Regains Ground After Aggressive Sell-Off

Even though Bitcoin suffered a steep decline, pushing it down to $92,000, it has shown signs of recovery by finding crucial support at that significant point. In the recent past, BTC has surpassed this barrier, rising to $95,000, giving optimistic investors a spark of hope. The fact that Bitcoin has held and rebounded from this support level indicates potential strength, but there are still uncertainties that need to be addressed.

According to Axel Adler, a well-known analyst from CryptoQuant, he provided valuable information about X regarding the current market trends. He pointed out that the most significant deleveraging took place between January 6 and 7, as Bitcoin’s price plummeted from $102K to $100K due to a surge of liquidations. This liquidation episode eliminated overextended positions, paving the way for bearish actions. Taking advantage of the disorder, bears initiated short trades, contributing to the further decline in Bitcoin’s price to $92K.

Although Bitcoin has recently shown signs of recovery, Adler cautions that a 9K BTC decrease in open interest doesn’t necessarily mean the market pressure is subsiding. As a result, it’s difficult to predict Bitcoin’s next move. Investors are keeping a close eye on how the price behaves over the coming days to gauge the market’s direction.

A move back up to $95K is seen as a good indication, yet Bitcoin needs to regain stronger positions to solidify a bullish trend and bring stability to the market. For now, traders stay vigilant since there’s still a possibility of increased volatility ahead.

BTC Holds Key Level: Bulls Eye Higher Ground

Currently, the value of Bitcoin is approximately $95,000. It’s currently holding above a crucial support point and is only 2% below its four-hour moving average at around $96,200. The four-hour 200 EMA (Exponential Moving Average) serves as an important benchmark, with Bitcoin being just a small distance away. Meanwhile, the 200 MA (Moving Average), another significant indicator, is located about 3% further up. This proximity of Bitcoin to these technical levels makes its current position crucial for determining short-term market trends and potential bullish rebounds. These technical indicators are vital for evaluating immediate market momentum and possible bullish recovery.

To continue its upward trajectory, the $95,000 mark needs to be maintained as a strong base. Overpowering this level and eventually the $98,000 and $100,000 levels is essential. These price points act as significant barriers that, if broken, could potentially initiate a powerful rise, potentially leading Bitcoin back towards its previous record highs.

If Bitcoin (BTC) doesn’t maintain its value above $95K, it might invite stronger bearish trends, possibly pushing BTC into a more prolonged period of consolidation or even testing areas with lower demand. On the other hand, if BTC manages to maintain its current levels and gather momentum, it could rebuild investor trust and set the stage for a continuous upward trend.

Observers in the Bitcoin world are keeping a close eye on key points, hoping to predict its future action. If it manages to surge beyond the $100,000 barrier, it might spark renewed optimism and provide a clearer path for the market’s movement.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-10 23:10