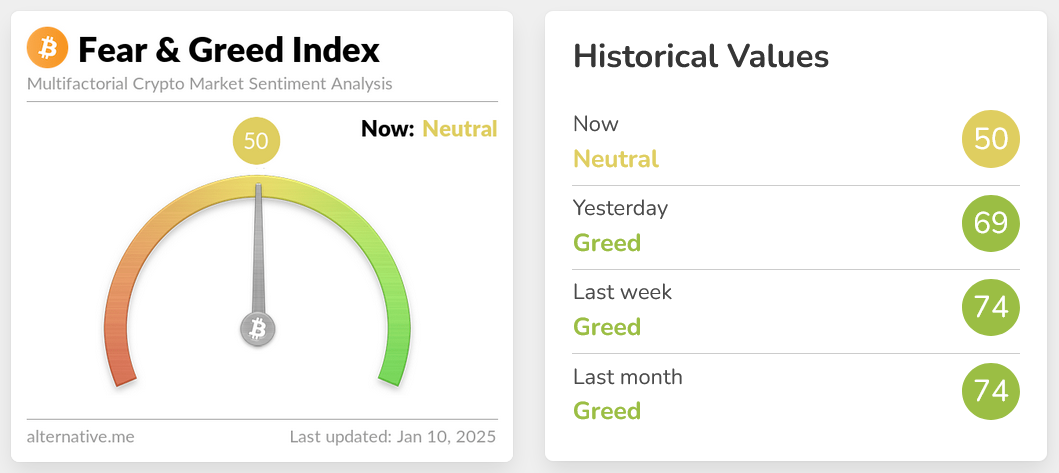

In the face of persistent selling, Bitcoin‘s price dipped to $91,380 levels earlier today, marking a further correction. This significant decline caused the Crypto Fear and Greed Index to plummet by 19 points in a single day, moving towards the ‘fear’ zone and reaching its lowest point since October 14. The index gauges overall market sentiment.

The index experienced a steep drop to 50 out of 100, which represents one of its largest daily decreases in years. This has moved the market feeling from “Extreme Greed” and “Greed” states, where it had been for three months, into the “Neutral” zone.

Source: Alternative.me

On November 22nd, the Crypto Fear and Greed Index peaked at 94 out of 100, reflecting robust market enthusiasm following Donald Trump’s election as President. Additionally, there is growing conjecture about a potential US Bitcoin reserve strategy in 2025.

The demand for buying Bitcoin remains low due to recent reports showing that the U.S. government offloaded approximately 69,000 Bitcoins, valued at around $6.7 billion. Some market experts predict that larger economic trends will persist in influencing the price fluctuations of Bitcoin over the coming period.

I, as an analyst, am observing that the anticipation of a tightening monetary policy by the US Federal Reserve in 2025 seems to be a significant factor contributing to the current market downturn. Furthermore, the surge in Treasury yields and the strengthening U.S. dollar have played a role in keeping Bitcoin’s value largely below the $100,000 threshold over the past few weeks.

On Friday this week, the Bureau of Labor Statistics (BLS) will unveil the employment figures for the U.S. in December 2024, specifically the Nonfarm Payrolls data. This information is highly anticipated by investors as it offers fresh perspectives on the condition of the American job market, given the ongoing debates about inflation and the future direction of monetary policy during Trump’s presidency.

Bitcoin and Altcoins Together Will Go Up

Regarding the present volatility in the cryptocurrency market, seasoned Wall Street investor and economic expert Raoul Pal continues to express a positive outlook towards Bitcoin and the broader altcoin sector as we move forward.

According to Real Vision’s co-founder and CEO, Raoul Pal, we’ve stepped into the “Banana Zone” in the crypto market. This phase indicates a robust rally is underway, and Pal suggests it could culminate in a “Banana Singularity,” a time period marked by simultaneous, significant price increases across various markets, where virtually everything experiences an upward trend.

Yes, we are still in the Banana Zone… 🍌🍌🍌

Last year saw the explosive launch of Banana Zone Phase 1. Since then, it has entered a period similar to the consolidation experienced in 2016/17 following Phase 1. However, this isn’t expected to last much longer…

Next up Banana Zone Phase 2 – The “Banana Singularity” (Alts szn) when everything goes up…

— Raoul Pal (@RaoulGMI) January 10, 2025

The major investor commented that the initial stage of the bull market began when a breakout occurred in November 2024, following Donald Trump’s election win. Since then, we have experienced a period of consolidation, much like what happened in 2016/17. Here are three areas identified by Raoul Pal as “Banana Zones,” which suggest that the Bitcoin price and overall crypto market will increase.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-10 14:21